Once again, Uber’s profitability in the quarter is expected to be hurt by the mounting cost pressure. Uber’s revenue has been growing steadily QoverQ. However, this revenue growth was offset by the increase in costs. Early last week, The New York Times reported that Uber fired around 400 employees from its marketing team to cut down costs and streamline its operations.

Uber’s global headcount stood at 22,263 employees as of December 31, 2018, consisting of 11,860 employees in operations and support, 5,459 employees in research and development, 2,993 employees in general and administrative, and 1,951 employees in sales and marketing. Out of the 22,263 total employees, 11,488 were located outside the United States.

As of March 31, 2019, the company had 24,494 global employees, of whom 12,767 were located outside the United States.

Total costs and expenses in 1Q increased to $4.13 billion from $3.06 billion in the prior-year quarter. Total long-term debt at the end of March 31, 2019, increased to $6.94 billion from $6.87 billion at the end of December 31, 2018.

The increasing excess driver incentives is a headwind for Uber that will likely to continue in the second quarter also. In the first quarter of 2019, the excess driver incentives increased to $303 million from $129 million in the first quarter of 2018.

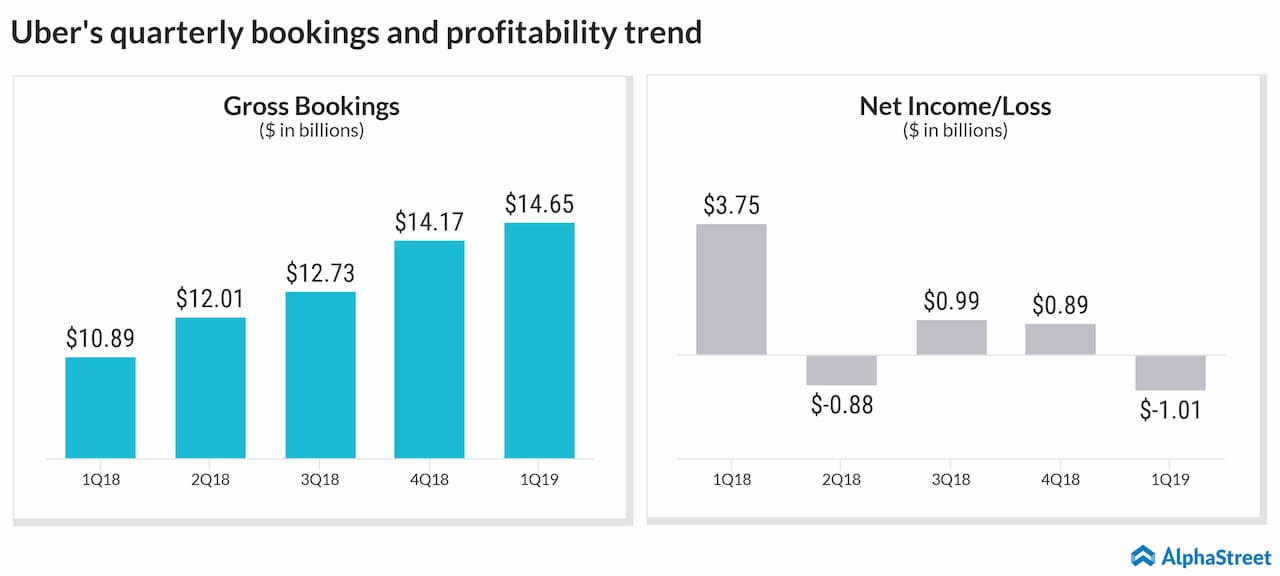

For the first quarter of 2019, Uber’s loss was wider than the expectations, while revenue exceeded the Street’s estimates. The company reported a loss of $1.01 billion or $2.26 per share on revenue of $3.10 billion. Gross bookings increased 34% year-over-year to $14.65 billion. Monthly active platform consumers surged by 33% to 93 million and trips soared 36% to 1.55 billion.

Core Platform’s (consists of Ridesharing and Uber Eats segments) revenue rose 16%, while Other Bets (consists of Uber Freight and New Mobility segments) revenue rallied 263% for the last reported quarter.

Geographically, the US and Canada, as well as EMEA regions, registered a strong revenue growth of 26% in the March quarter. While Asia-Pacific increased by 6%, Latin America decreased by 13%.

Uber’s rival Lyft (NASDAQ: LYFT) will be reporting its second quarter earnings results tomorrow after the market close. Analysts expect the company to report a loss of $1.41 per share on revenue of $808.31 million for the second quarter.

Uber has been trading in a range of $36.08 to $47.08 since it became public. Shares of Uber closed down 3.34% at $39.05 yesterday and opened in the positive territory today.