Union Pacific Corporation (NYSE: UNP) reported a 4% increase in earnings for the second quarter of 2019 helped by lower operating expenses. The bottom line exceeded analysts’ expectations while the top line missed consensus estimates.

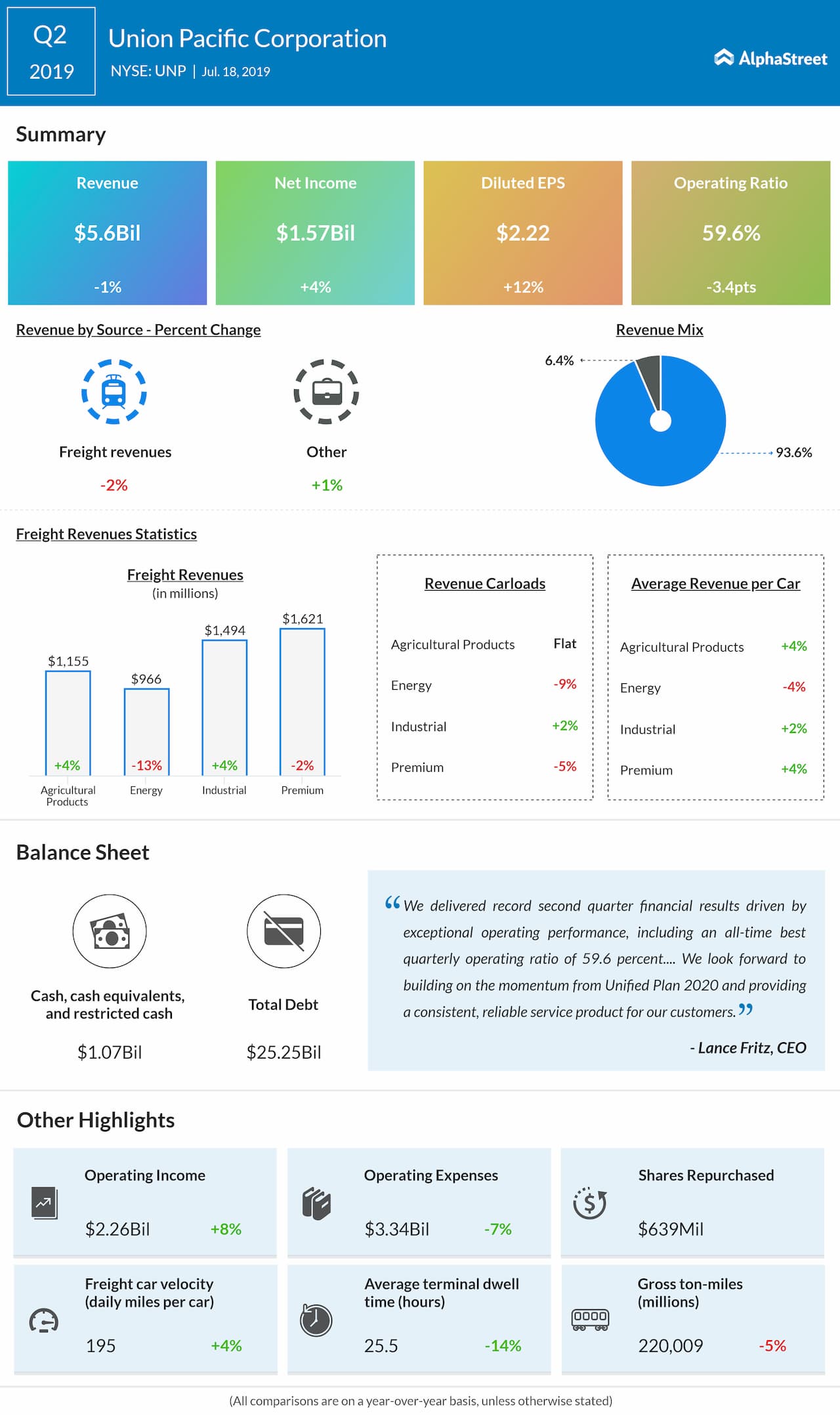

Net income increased by 4% to $1.57 billion or $2.22 per share. Operating revenue declined by 1% to $5.6 billion.

The business volume, as measured by total revenue carloads, decreased by 4%. The growth in industrial volumes were more than offset by flat agricultural products shipments as well as declines in energy and premium.

Freight revenue decreased by 2% year-over-year, as core pricing gains were offset by lower volumes. Agricultural products increased by 4% and industrial grew by 4%, while premium declined by 2% and energy fell by 13%.

The $2.21 per gallon average quarterly diesel fuel price in the second quarter was 4% lower than the previous year quarter. Quarterly freight car velocity was 195 daily miles per car, a 4% improvement compared to the year-ago period.

Looking ahead into the full year 2019, the company expects capital expenditures of about $3.2 billion. Operating ratio is still expected to be at a sub-61% in 2019. In the second half of 2019, volumes are anticipated to be down around 2%.

Also read: Kansas City Southern Q2 earnings preview

The company looks forward to building on the momentum from Unified Plan 2020. Union Pacific remained focused on driving increased shareholder returns by appropriately investing capital in the railroad and returning excess cash to its shareholders.

In rivals, Kansas City Southern (NYSE: KSU) is scheduled to report its earnings results for the second quarter of 2019 on Friday before the market opens. Analysts expect Kansas City Southern’s earnings to jump by 4.50% to $1.61 per share and revenue will rise by 3.50% to $706.23 million for the second quarter.

Shares of Union Pacific ended Wednesday’s regular session 6.05% at $164.55 on the NYSE. Following the earnings release, the stock advanced over 3% in the premarket session.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.