Headwinds

While stressing its strategy of diversifying revenue streams, United Airlines executives warned that operations would be affected by geopolitical tensions including the unrest in the Middle East, though the issues are mostly transitory. The company looks headed for a weak fourth quarter when margins will likely be hit by higher fuel expenses and labor costs. However, the impact will be reduced by stable capacity growth and improvements in utilization to some extent.

At the same time, capacity is being impacted by delays in aircraft delivery, which also adds to the cost pressure. The company expects Q4 earnings to be around $1.80 per share with an average fuel price of approximately $3.28, which includes the impact of potential flight cancellations to Israel’s capital Tel Aviv. The guidance is below the analysts’ forecast.

The impact of cancellations on United would be bigger since it operates more flights to Israel than any other US-based company. Recently, other players including American Airlines and Delta Airlines stopped flying to Israel in the wake of the violent conflict.

Strong Q3

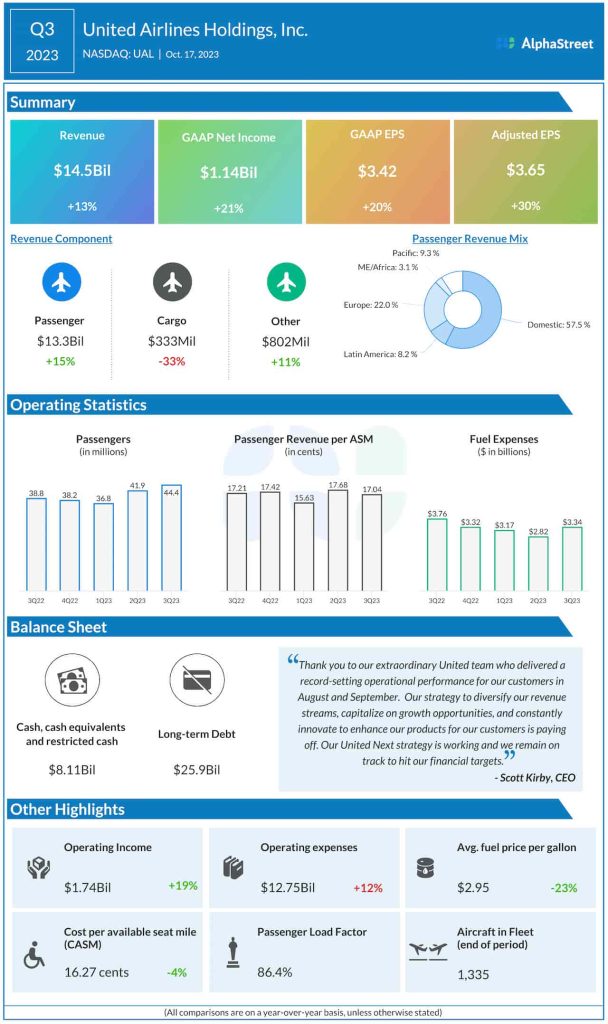

United Airlines posted an adjusted profit of $3.65 per share for the September quarter, which is up from $2.81 per share it reported a year earlier and above analysts’ consensus estimates. Unadjusted net income was $1.14 billion or $3.42 per share in Q3, compared to $942 million or $2.86 per share in Q3 2022. The bottom line topped expectations regularly ever since the company emerged from a losing streak more than a year ago.

From United’s Q3 2023 earnings call:

“We believe we have a lot of runway ahead of us with United Next in our diverse revenue streams, along with our ability to catch up on gauge and connectivity positioning United well. We expect that the current stress in segments of the industry is also going to lead to structural changes that lay the foundation for an even better future for United, our employees, our customers, and our shareholders. With that, I’ll turn it over to Brett.”

High Demand

Driving the earnings growth, third-quarter operating revenue rose to $14.48 billion from $12.88 billion last year and exceeded expectations. At $13.3 billion, passenger revenue was up 15%. While passenger traffic continued to grow, fuel prices moved up in Q3 after easing consistently in recent quarters.

Shares of United Airlines closed the last session lower but traded slightly higher on Thursday afternoon. It has lost 36% in the last three months.