Weak Q4

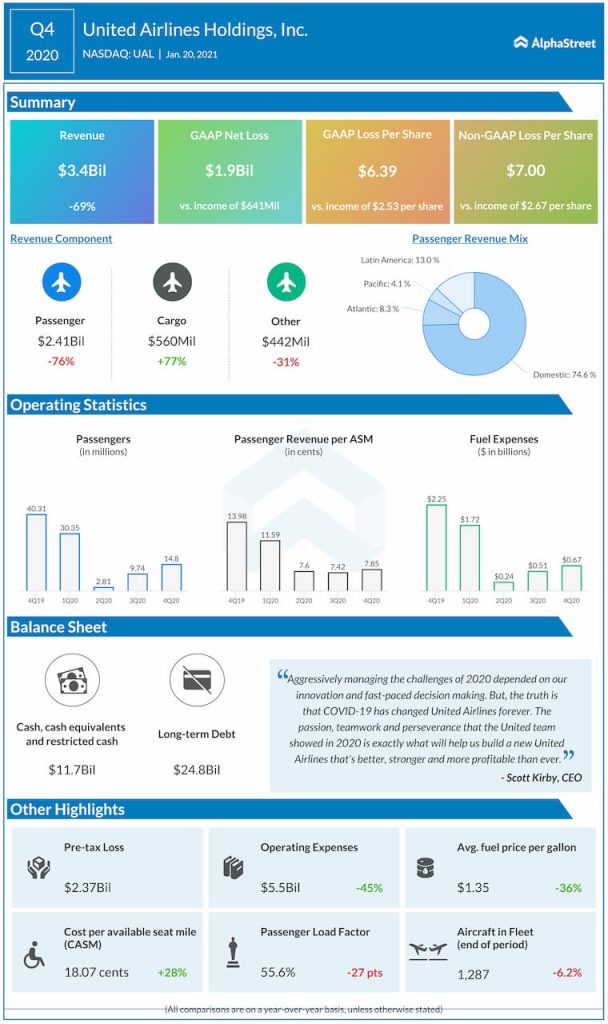

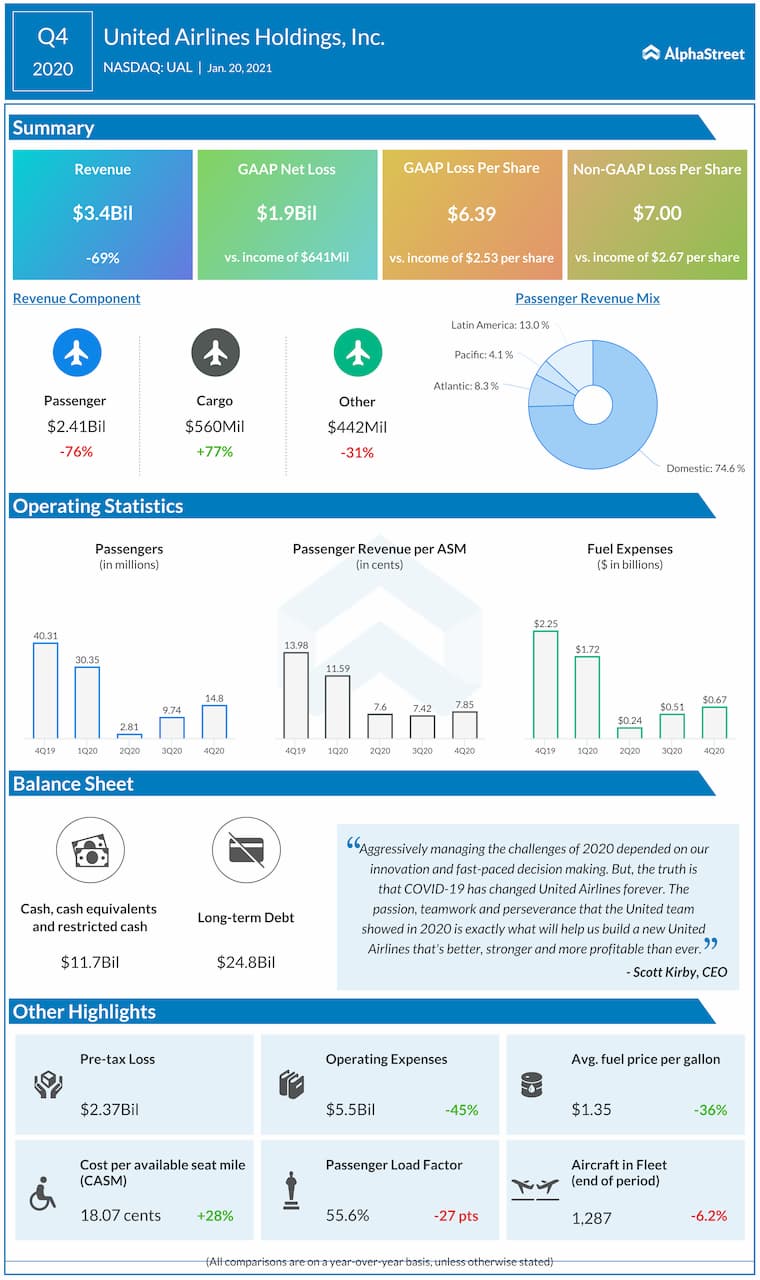

Total revenue fell 69% year-over-year to $3.4 billion during the fourth quarter of 2020. GAAP net loss amounted to nearly $2 billion, or $6.39 per share. Adjusted net loss totaled $7.00 per share compared to EPS of $2.67 last year. Traffic declined 71% while capacity fell 57%. Passenger load factor dropped 27 points to 55.6%.

Travel trends

During the fourth quarter, United reduced capacity versus its initial guidance as demand remained at lower-than-expected levels. Although travel trends picked up during the Christmas period compared to Thanksgiving, they were still much lower than 2019 levels.

Total passenger revenue was down 76% in Q4 while cargo revenues increased 77%. Domestic passenger revenue fell 72% while international passenger revenues plunged 83%. Within international, Pacific saw the highest drop at 91% followed by Atlantic at 88%. Latin America fell 65%.

United has seen some momentum in leisure and VFR travel and anticipates leisure travel to pick up over the coming months fueled by pent-up demand as vaccines are rolled out. The demand for business travel is expected to take more time to recover and the company believes it will be 18-24 months before it sees a pickup. Based on this assumption, the company expects business travel to remain down in 2022.

United believes business executives are less likely to travel for internal meetings in the medium term but there could be pent-up demand for travel related to getting production back on line or employee travel related to remote work.

In terms of demand recovery, United expects international demand to surpass capacity. The company anticipates traditional major markets in Europe and Asia to recover in 2022 but emerging international markets are expected to be strong in the near term. In other words, international travel is expected to recover faster than domestic travel as domestic demand is likely to lag capacity.

Outlook

For the first quarter of 2021, total operating revenue is expected to be down 65-70% versus the first quarter of 2019 while capacity is expected to be down at least 51%. Although the company does not expect to see a meaningful improvement in Q1 versus Q4 at present, trends could pick up based on vaccine availability. United believes that once vaccines are widely rolled out and restrictions are eased, demand could significantly improve and this could take place in the second half of 2021.

Click here to read the full transcript of United Airlines Q4 2020 earnings conference call