Revenue

Earnings

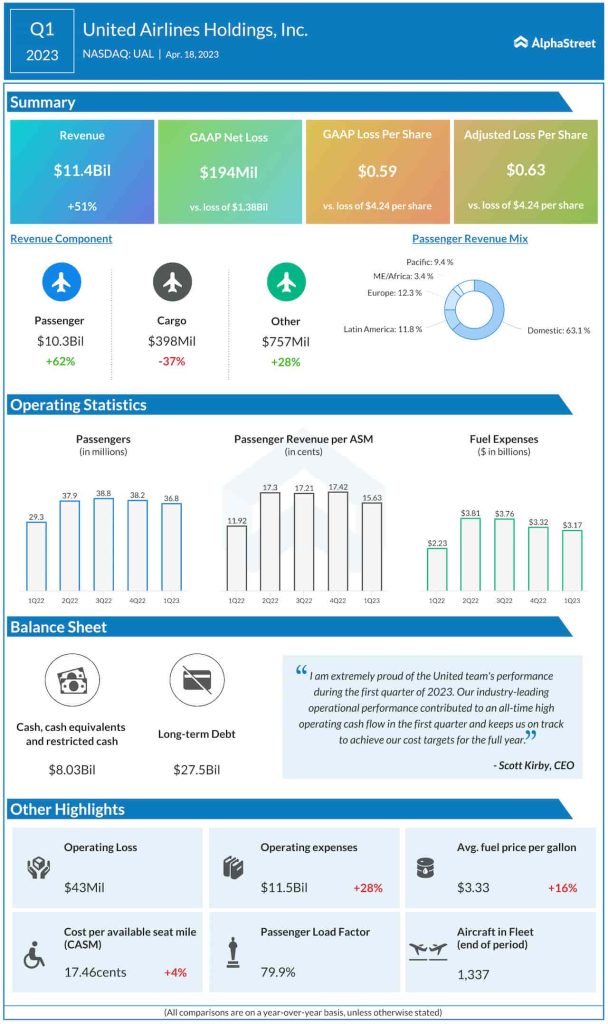

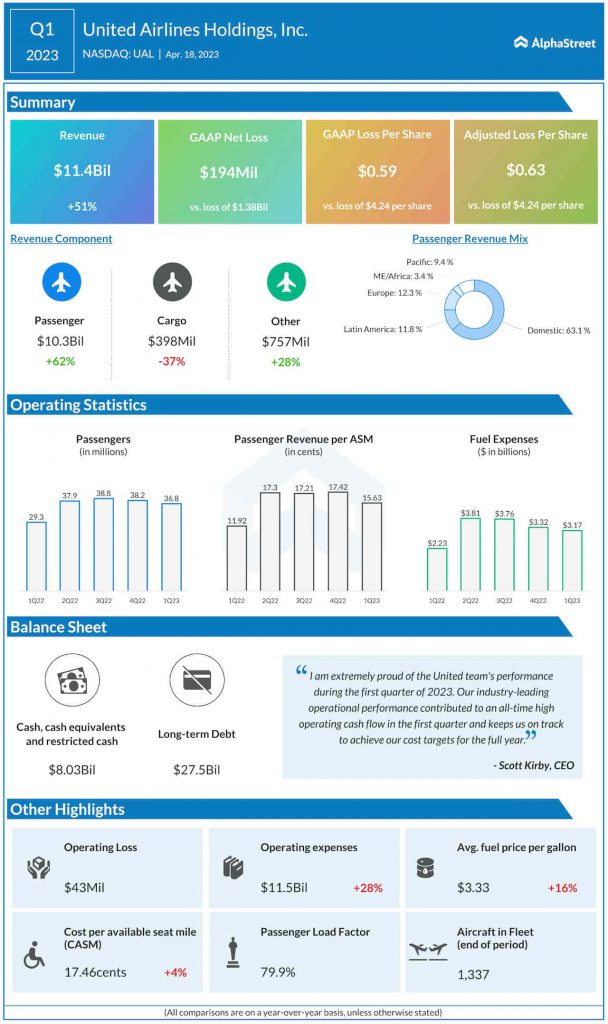

United has guided for adjusted EPS of $3.50-4.00 for Q2 2023. Analysts are projecting EPS of $4.03, which compares to EPS of $1.43 reported in the year-ago quarter. In Q1, the company reported an adjusted loss of $0.63.

Points to note

United is seeing strong demand for air travel with particular strength in leisure travel. Business travel is also gaining momentum, especially in global long-haul markets. International demand seems to be gaining traction over domestic. The trends for second-quarter revenue and bookings appear to be strong.

In Q1 2023, passenger revenues were up 62% YoY while cargo revenue was down 37%. Total revenue per available seat mile (TRASM) was up 22.5% while passenger revenue per available seat mile (PRASM) was up 31.1%. Passenger load factor was 79.9%.

In Q1, capacity was up 23.4% YoY. In Q2, capacity is expected to be up approx. 18.5%. In Q1, CASM-ex was down 0.1% versus the year-ago period. For Q2, CASM-ex is expected to be flat to up 2%.