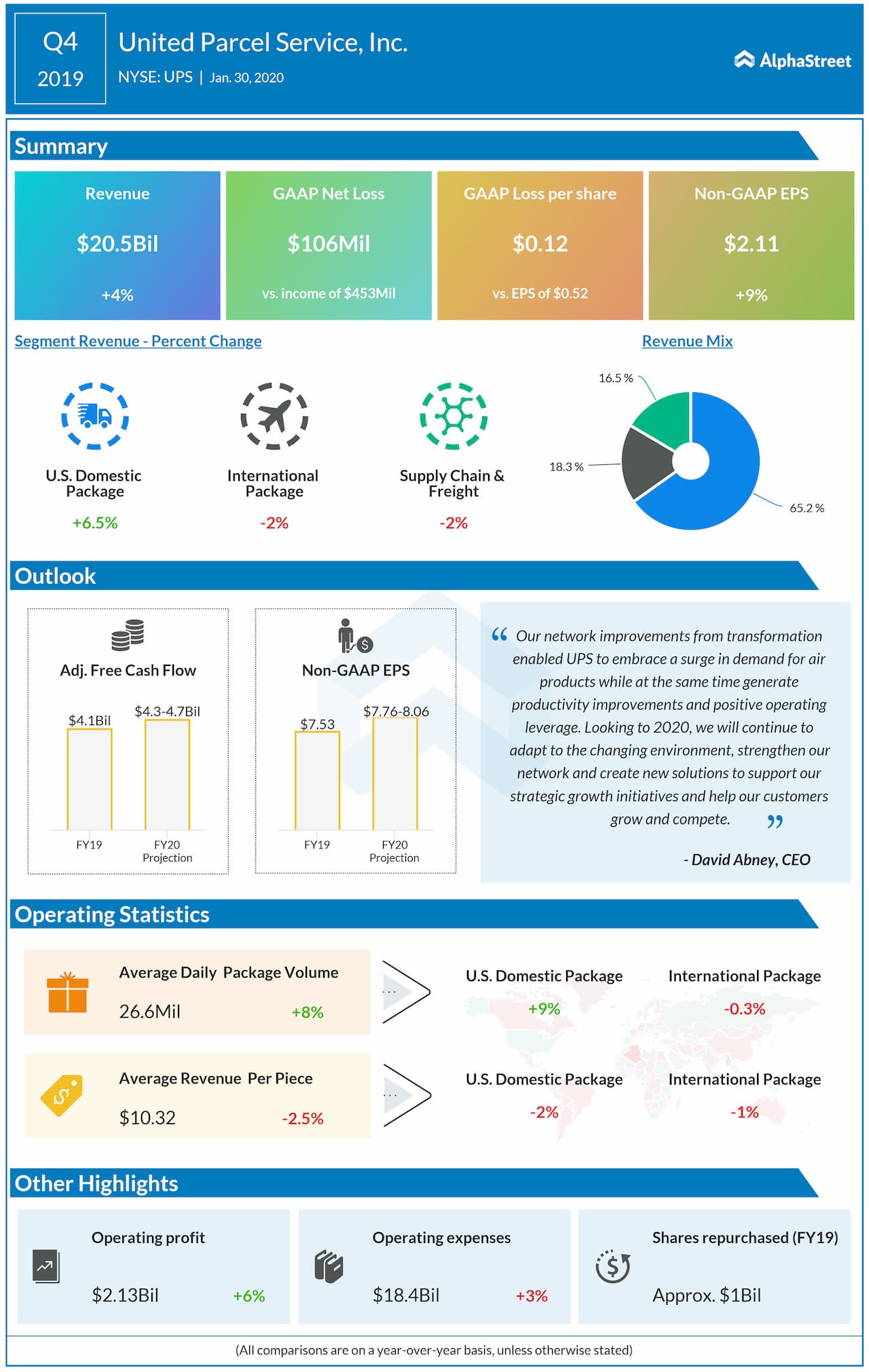

On a GAAP basis, the company reported a net loss of $106

million, or $0.12 per share, compared to a net income of $453 million, or $0.52

per share, in the prior-year period. The results included mark-to-market

pension charges, transformation charges and legal expenses related to the New

York cigarette case. Excluding the aforementioned charges, earnings grew 8.8%

to $2.11 per share, in line with forecasts.

During the quarter, average daily volume levels exceeded 26.6 million packages, up 7.5%, driven by high demand for air services in the US.

Also read: Altria Q4 2019 Earnings Snapshot

In the US Domestic segment, revenues increased 6.5% to $13.4

billion, with growth across all products. Total volume across all products grew

around 9%. Unit costs decreased 2.1%.

Revenues in the International segment amounted to $3.7

billion. Export volume dipped slightly as gains on intra-Europe, intra-Asia and US export trade lanes did not fully offset the

declines into and out of the UK and on the Asia-US lane.

In the Supply Chain and Freight segment, revenues totaled $3.3 billion, with growth in Logistics, Marken and UPS Freight.

Adjusted EPS is expected to come in a range of $7.76 to $8.06 for fiscal year 2020. Capital expenditures are estimated to be around $6.7 billion.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.