Stock

From United Parcel Service’s Q4 2023 earnings call:

“In 2024, the small package market in the U.S., excluding Amazon, is expected to grow by less than 1%. And projected market growth rates for the rest of our business segments suggest some improvement but not until the latter part of the year. In building our 2024 financial targets, we anchored the low end of our guidance on market growth and, for the high end of our guidance, included growth we should experience if we capture market share.”

Deal with Workers

Recently, UPS workers ratified an agreement they reached with management last year on a new five-year contract that covers more than 300,000 full- and part-time employees in the U.S. The deal avoided a potential strike by the Teamsters union which has been demanding higher wages and better working conditions for some time.

After a difficult 2023, the company is currently working to regain business lost due to muted shipping demand and labor issues. Delivery of medical supplies remains a focus area since it could yield higher profits. As part of its efforts to streamline the business and boost margins, UPS executives recently revealed plans to lay off around 12,000 workers.

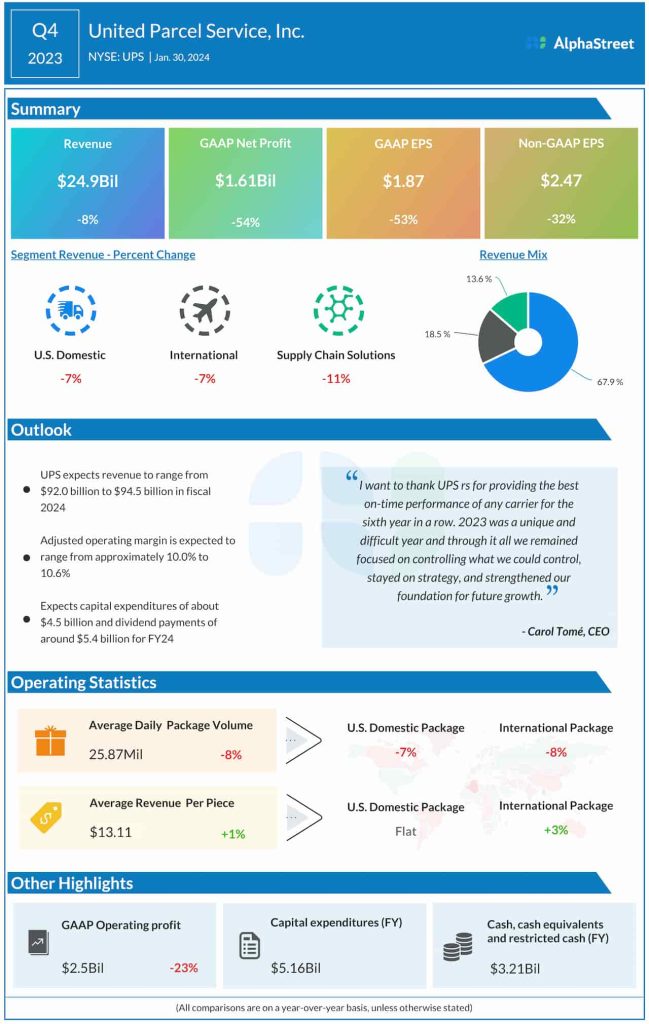

In the December quarter, adjusted earnings dropped by double digits to $2.47 per share, reflecting an 8% decrease in revenues to about $25 billion. But the bottom line exceeded estimates, marking the third beat in a row. Revenues from US Domestic and International cargo services, which together account for about 86% of the total, decreased by 7% each but topped expectations. Net income, including special items, was $1.61 billion or $1.87 per share, compared to $3.45 billion or $3.96 per share in the same period of 2022.

Outlook

In an indication that in the near term the downtrend might continue, market watchers predict a decline in net profit and revenue for the first quarter. Meanwhile, the UPS leadership is optimistic about full-year results and predicts revenues of $92-94.5 billion for fiscal 2024, which is slightly higher than last year’s number.

After maintaining an uptrend for more than a month, UPS changed course this week and slipped below $150. Regaining a part of the lost momentum, the stock traded higher in the early hours of Wednesday.