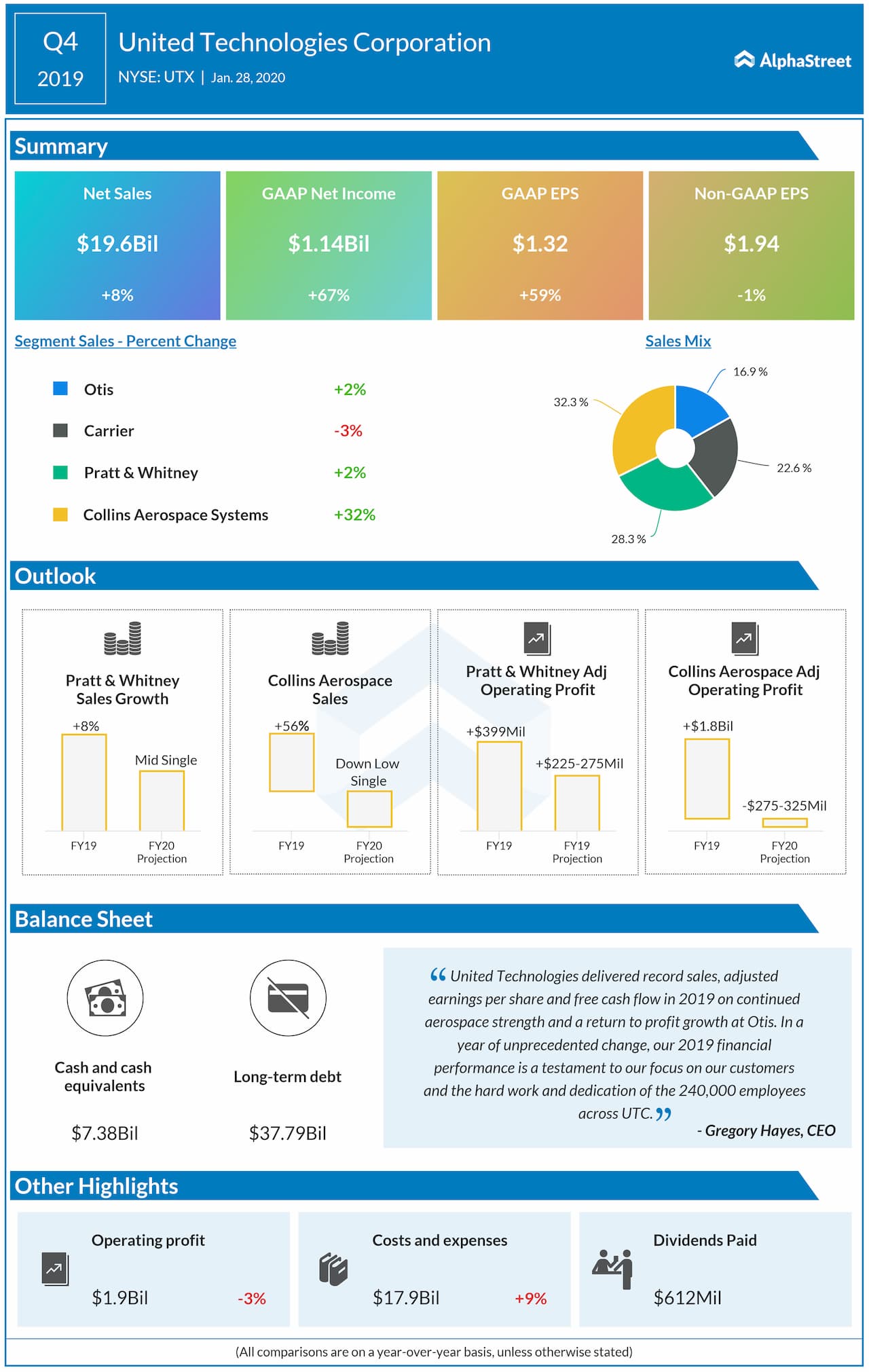

Net sales rose by 8% to $19.6 billion. This includes 1 point of organic sales growth and 8 points of net acquisition benefit, offsetting 1 point of foreign exchange headwind.

Analysts had expected earnings of $1.84 per share on revenue of $19.38 billion for the fourth quarter.

Looking ahead into the full year 2020, the company expects Pratt & Whitney sales to be up in the mid-single-digit range versus 2019 and Pratt & Whitney adjusted operating profit growth of $225-275 million. Given the upcoming portfolio actions, the outlook for sales, adjusted EPS and free cash flow for Raytheon Technologies will be provided after the merger closes.

Collins Aerospace sales are expected to be down in the low-single-digit range versus 2019, including an estimated 5 point headwind resulting from the suspension of 737 MAX production, lower ADS-B mandate sales and the expected impact of divestitures associated with the Raytheon merger. Collins Aerospace adjusted operating profit is predicted to be down $275-325 million.

For the fourth quarter, Collins Aerospace’s commercial aftermarket sales were up 42% and up 9% organically. On a pro forma basis, Collins Aerospace commercial aftermarket sales were up 11% including Rockwell Collins. Pratt & Whitney’s commercial aftermarket sales were flat, following 11% growth in 2018. Equipment orders at Carrier were down 4% organically. Otis new equipment orders were up 3% at constant currency in the quarter and flat on a rolling twelve-month basis.

Collins Aerospace continued to deliver strong performance and achieved approximately $300 million in cost synergies during 2019, remaining on track to deliver at least $600 million in cost synergies by year four.

Otis completed one of the largest and most complex modernization projects to date at the Empire State Building, including the installation of a custom-made Gen2 glass elevator. Carrier continued its commitment to innovation, launching more than 100 new products for the fifth year in a row.