Branch closures continued in the first quarter. Total branches at the end of the first quarter stood at 480 compared to 500 at the end of last quarter. As expected, most of the closures (17 branches) were in Canada. The company ended the first quarter with 32 distribution centers.

Grainger is upbeat about the full-year results due to the improving volumes and strong demand for its products, besides the ongoing transformation efforts in the Canadian business.

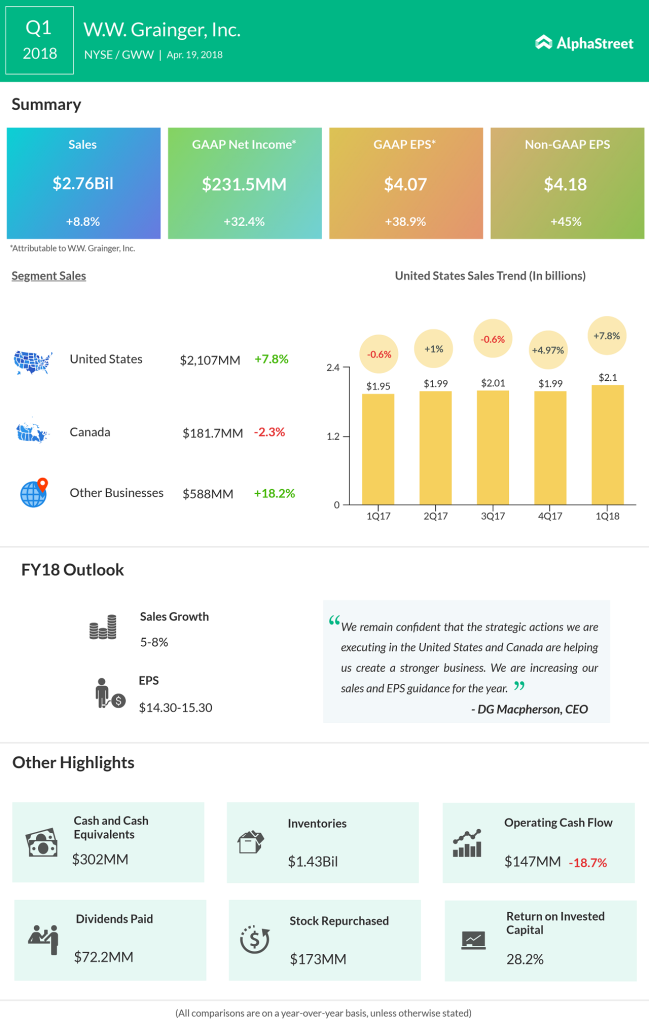

The company has raised its sales and earnings forecast for 2018. It now expects sales growth of 5% to 8%, compared to 3% to 7% reported last quarter. Earnings are predicted to be between $14.30 and $15.30 per share vs $12.95 to $14.15 reported in the fourth quarter.

Grainger’s price reduction strategy to tackle competition from Amazon and its peers seem to be bearing fruit. On top of that, the company has reported volume growth due to strong demand in the Industrial sector for the past two quarters. Grainger’s share price has increased 29% in 2018, exceeding the 16% growth recorded by the US Industrial Index.