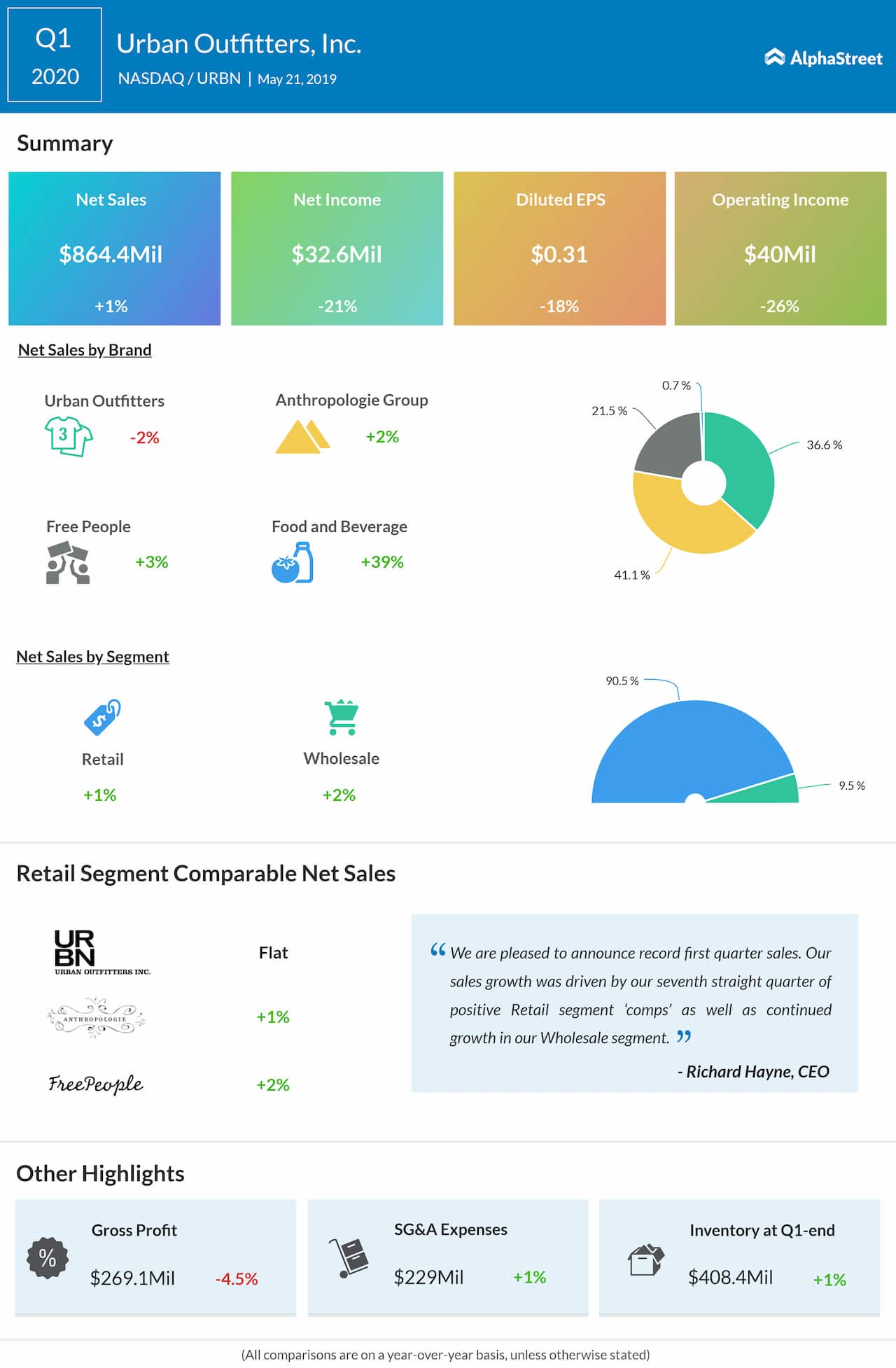

Comparable retail sales moved up 2% at the Free People brand, 1% at Anthropologie Group and were flat at Urban Outfitters. Net sales at the wholesale segment advanced 2% during the three-month period.

Meanwhile, net income dropped to $32.6 million or $0.31 per share from $41.3 million or $0.38 per share in the first quarter of 2019. The bottom-line, however, came in above the estimates.

Comparable retail segment net sales grew 1% during the three-month period, supported by double-digit growth in online sales

Richard Hayne, chief executive officer of Urban Outfitters, said, “We are pleased to announce record first-quarter sales. Our sales growth was driven by our seventh straight quarter of positive Retail segment ‘comps’ as well as continued growth in our Wholesale segment.”

The retail segment of the Pennsylvania-based apparel maker, which owns popular brands like Urban Outfitters, Anthropologie and Free People, accounts for about 90% of the total sales. Considering the rapid expansion of the digital channel, supported by strong user growth and favorable exchange rates, the management continues to make significant investments to ramp up the online platform.

During the first quarter, Urban Outfitters repurchased and subsequently retired 2.4 million shares for about $71 million under its stock buyback program. The company also opened four new retail locations and closed three units during the period.

In the fourth quarter, earnings more than doubled to $0.80 per share and exceeded estimates, supported by a 4% increase in net sales to $1.13 billion. All the business segments and brands registered growth.

The company’s stock has underperformed the S&P 500 this year, falling 19% so far. After losing 37% in the past twelve months, the stock closed Tuesday’s session slightly higher.