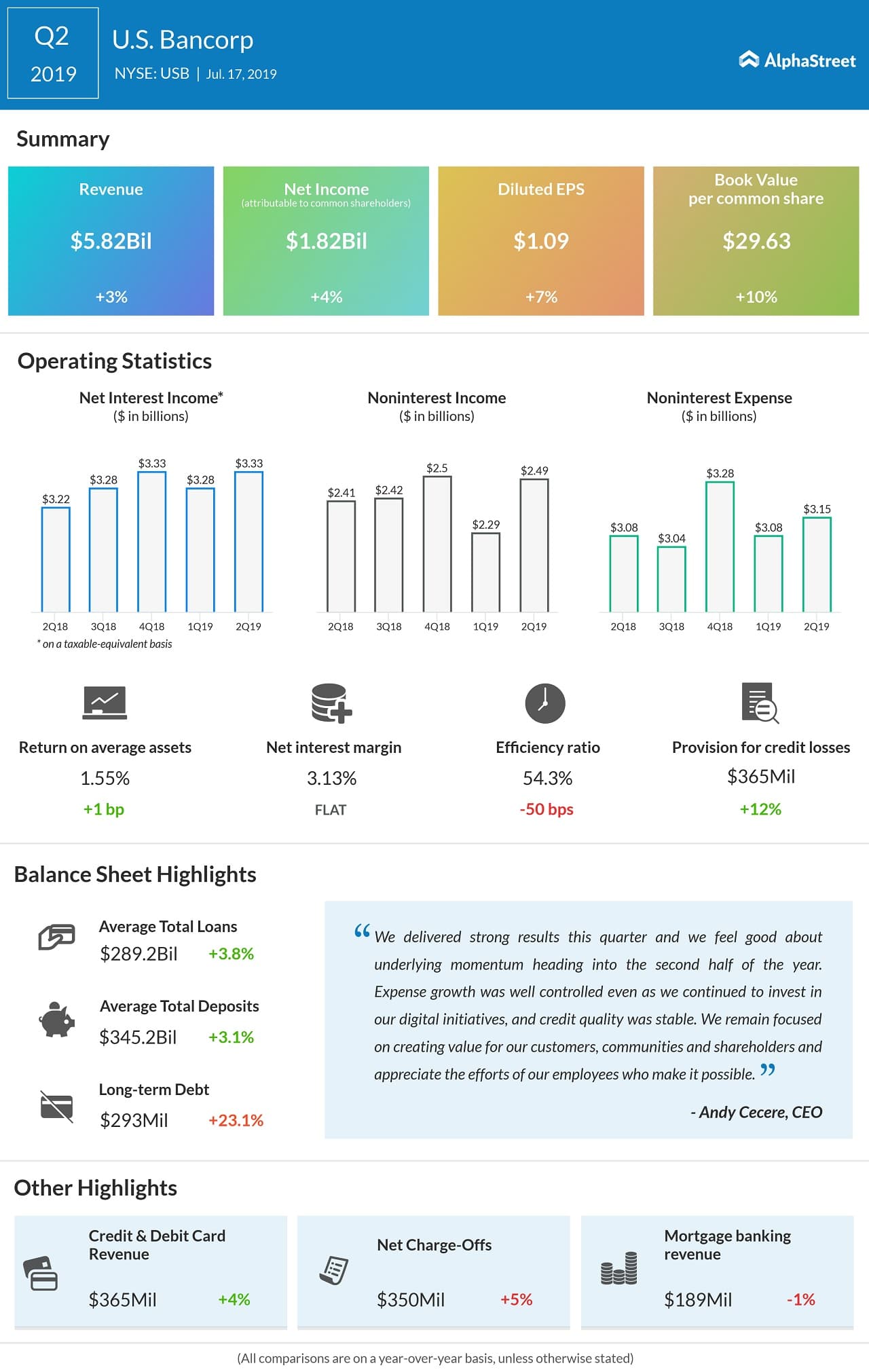

Net income grew 7% to 1.09 per share, beating the Street consensus by 2 cents. The increase in net income was driven revenue growth during the quarter, but was partially offset by noninterest expense growth of 2.2%.

Strong loan and deposit growth during the quarter, which benefited from heightened consumer confidence, drove Net Interest Income (NII) in Q2. NII improved 3.4% to $3.33 billion, as average total loans grew 3.8% year-over-year.

READ: JPMorgan Chase beats in Q2 on tax benefit

ADVERTISEMENT

Total commercial loans grew 5%, residential mortgages jumped 9.9%, credit card loans improved 7.6%, and total other retail loans edged up 2.7% in Q2.

“We delivered strong results this quarter and we feel good about underlying momentum heading into the second half of the year. In the second quarter, we delivered a return on tangible common equity of 19.2% and returned 79% of our earnings through dividends and share buybacks, said CEO Andy Cecere.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.