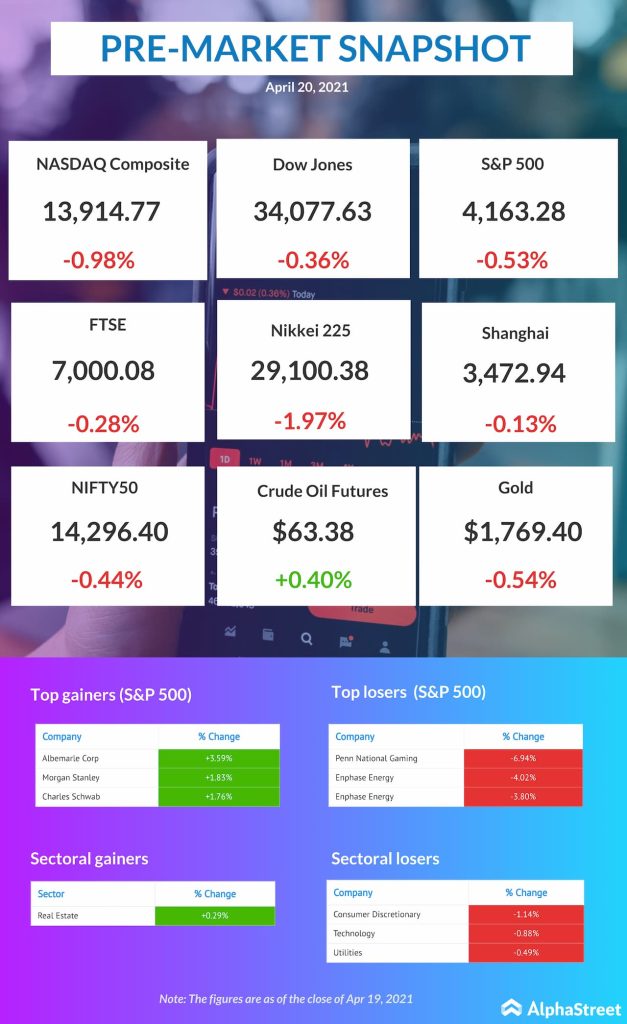

US pre-market news: Dow Jones, NASDAQ, S&P updates for Apr.20, 2021

Wall Street is seen opening lower on Tuesday, the second day of losses after a series of record highs. Earnings from big tech companies and consumer-oriented firms are upcoming and a lot would depend on their performance. The yield on the benchmark 10-year Treasury was last traded around 1.60%, after falling as low as 1.53% […]

“Wall Street is seen opening lower on Tuesday, the second day of losses after a series of record highs. Earnings from big tech companies and consumer-oriented firms are upcoming and a lot would depend on their performance. The yield on the benchmark 10-year Treasury was last traded around 1.60%, after falling as low as 1.53% […]

· April 20, 2021

Wall Street is seen opening lower on Tuesday, the second day of losses after a series of record highs. Earnings from big tech companies and consumer-oriented firms are upcoming and a lot would depend on their performance. The yield on the benchmark 10-year Treasury was last traded around 1.60%, after falling as low as 1.53% last week.