Growth drivers

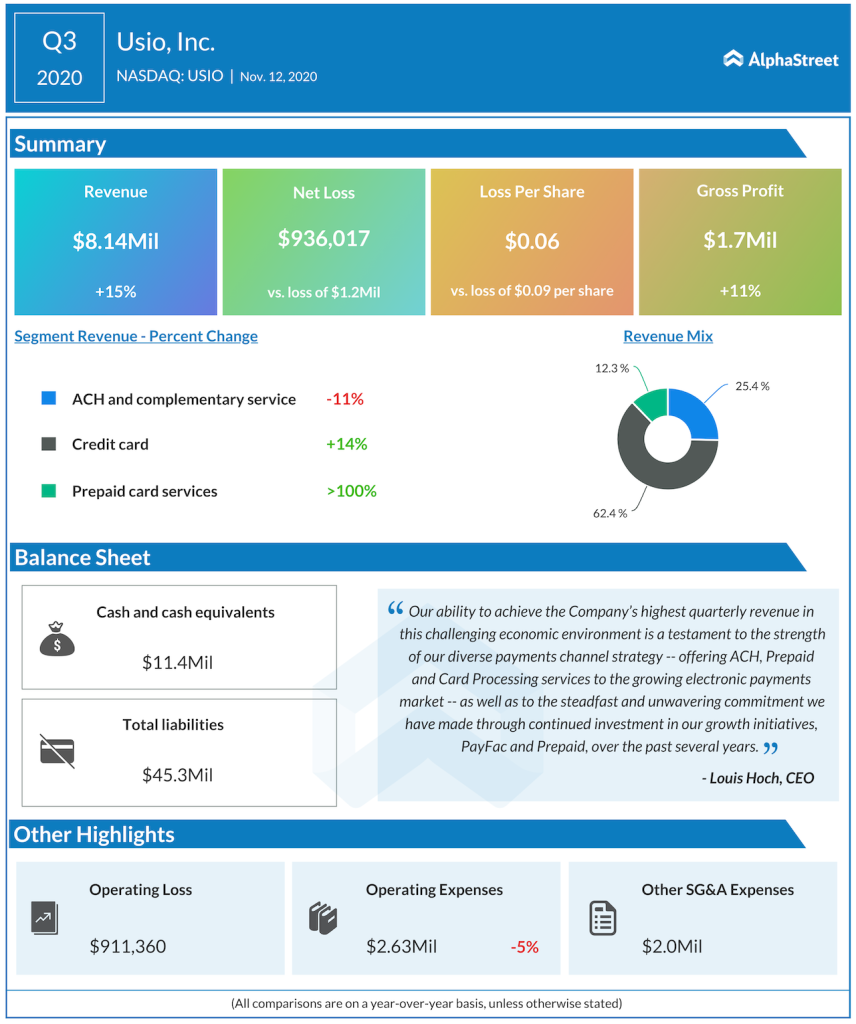

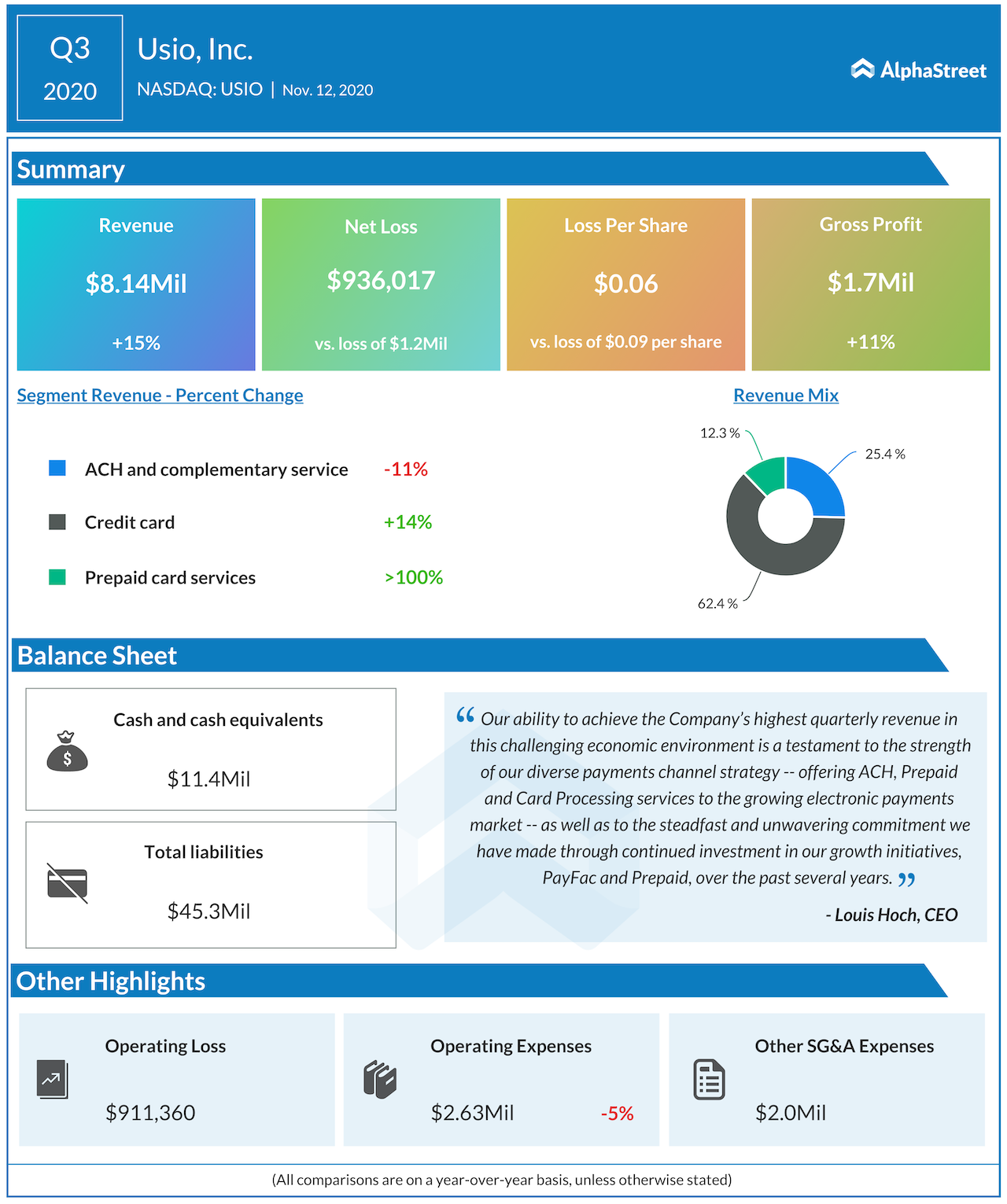

The company, which operates through three segments – ACH, credit card and prepaid card services – posted 15% growth in revenues in the most recent quarter, while cutting down losses to 6 cents per share, from 9 cents per share a year ago. The strong results were directly linked to prepaid and credit card processing services, while partly being dragged by the weakness in the consumer loans division in the ACH segment.

In an interview with AlphaStreet, Usio CEO Louis Hoch said it’s card segments are witnessing robust growth and will soon eclipse the ACH business. The growth engine transition was a discernible factor in the Q3 financials, where credit card transactions processed shot up over 80%. Meanwhile, five of the 10 largest US cities choosing Usio’s prepaid services for the disbursement of monetary assistance provided a fillip to the firm’s growth ambitions in Q3.

“We are definitely scaling. We are trying to get to $50 million in sales as quick as we can. The industry understands we have innovative products and wants to see if we can scale.”

ADVERTISEMENT

Hoch asserted that ACH will continue to be a key component to its business, which is also the most profitable unit. The executive said a transition of focus to the card business could slightly dent the margins, even though it would mostly depend on the sales mix.

COVID impact

According to Hoch, the management’s deliberate decision to stay out of restaurants, hotels, rental car agencies and other big retail firms helped them stay insulated to massive volatilities witnessed during the pandemic period. Meanwhile, consumer lending was affected due to high unemployability, leading to erosion of creditworthiness, affecting ACH.

He added that the recovery in the ACH unit has already started taking shape.

Clients

The CEO said one of the best attributes about the company is that it hardly loses clients.

“We spend our days selling to software vendors, from where we get access to hundreds and thousands of customers downstream. And we share revenue with these software vendors, and help them integrate into their software offering using our great tech stack.”

ADVERTISEMENT

The San Antonio-based firm was known as Payment Data Systems Inc. till mid last year, when it was rechristened to Usio. Usio competes with numerous large and small players including Stripe, First Data Merchant Services Corporation and WorldPay. The company, which has a market cap of around $40 million, has a 12-month average price target of $3.67, which is at a 134% upside from Friday’s trading price.

Interested to know more about Usio? Read their latest earnings call transcript here.

_____