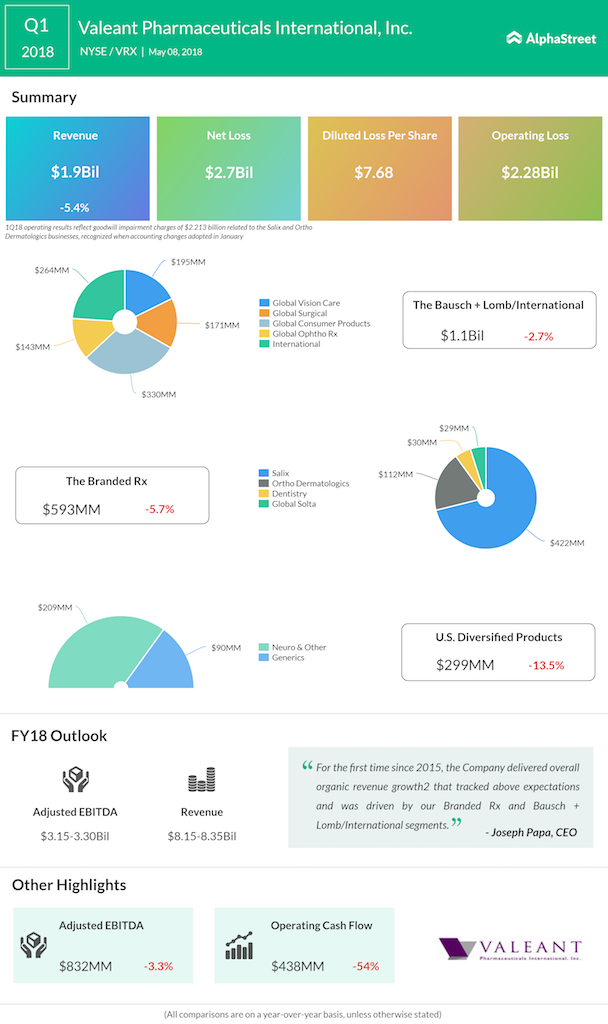

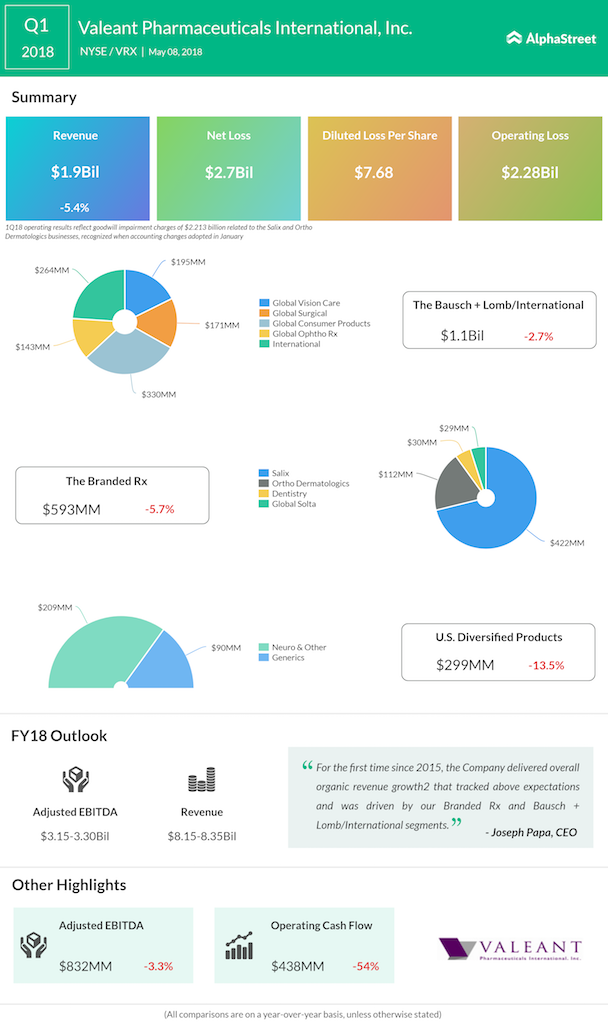

Bausch + Lomb/International segment revenues dropped 3% to $1.10 billion during the first quarter of 2018 compared to last year, while Branded Rx segment revenues were down 6% to $593 million. In the US Diversified Products segment, revenues fell 14% to $299 million, primarily due to decreases from the loss of exclusivity for a basket of products and by the impact of the 2017 divestitures.

Revenues grew 15% in the Global Vision Care business and 40% in the Salix business during the quarter. The company said launches are underway for an additional two of its Significant Seven products, which include VYZULTA, a glaucoma medication and LUMIFY, an OTC eye drop for the treatment of eye redness.

The US FDA approved PLENVU, a bowel cleansing preparation for colonoscopies, which is expected to be available in the third quarter of 2018. The FDA also accepted New Drug Applications for ALTRENO™3, an acne treatment in lotion form and BRYHALI™3, a topical treatment for plaque psoriasis.

Valeant raised its guidance for the full year of 2018 and now expects revenues of $8.15 billion to $8.35 billion and adjusted EBITDA of $3.15 billion to $3.30 billion.

Valeant also announced that it was changing its name to Bausch Health Companies Inc. effective July 2018. As part of the name change, the company will roll out a new corporate brand identity in July 2018, which will include a new website, and will trade under a new ticker symbol, BHC. Until then, Valeant will continue to trade under its present symbol, VRX.

As the company’s businesses and subsidiaries have strong brand equity, all entities that have separate established brands will continue to operate under the corporate umbrella using their existing names.