Broader macro pressures affecting high-growth software and SaaS stocks — specifically labor cost inflation and interest rate sensitivity — remain secondary to refining crack spreads for Valero. However, the company noted that rising G&A expenses, which reached $1.0 billion for the year, reflect the impact of these broader economic trends on industrial operations.

Valero Energy Corporation (VLO) Adjusted EPS of $3.82 Beats Estimates on Record Throughput

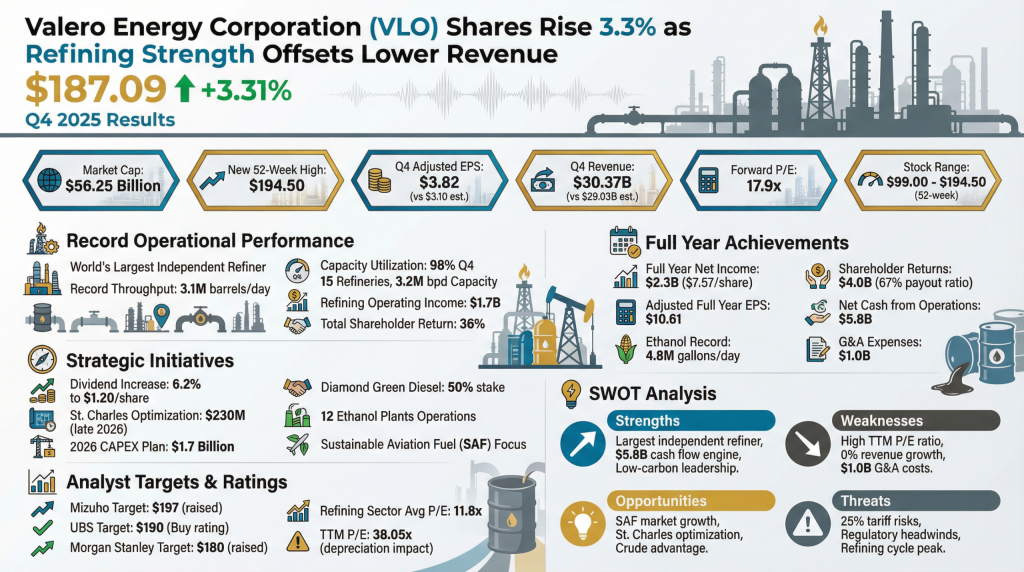

Valero Energy Corporation (VLO) reported fourth-quarter 2025 adjusted net income of $1.2 billion, or $3.82 per share, beating the Zacks consensus estimate of $3.10. Revenue for the quarter was $30.37 billion, slightly above the $29.03 billion forecast but down from $30.76 billion in the prior-year period. The beat was driven by the refining segment, which […]

“Valero Energy Corporation (VLO) reported fourth-quarter 2025 adjusted net income of $1.2 billion, or $3.82 per share, beating the Zacks consensus estimate of $3.10. Revenue for the quarter was $30.37 billion, slightly above the $29.03 billion forecast but down from $30.76 billion in the prior-year period. The beat was driven by the refining segment, which […]

· January 29, 2026

Valero Energy Corporation (VLO) reported fourth-quarter 2025 adjusted net income of $1.2 billion, or $3.82 per share, beating the Zacks consensus estimate of $3.10. Revenue for the quarter was $30.37 billion, slightly above the $29.03 billion forecast but down from $30.76 billion in the prior-year period. The beat was driven by the refining segment, which reported operating income of $1.7 billion on record throughput volumes of 3.1 million barrels per day.

For the full year 2025, net income was $2.3 billion, or $7.57 per share. On an adjusted basis, full-year earnings reached $10.61 per share. The company’s ethanol segment also set a production record of 4.8 million gallons per day. Valero returned $4.0 billion to shareholders in 2025, representing a payout ratio of 67% of adjusted net cash from operations.