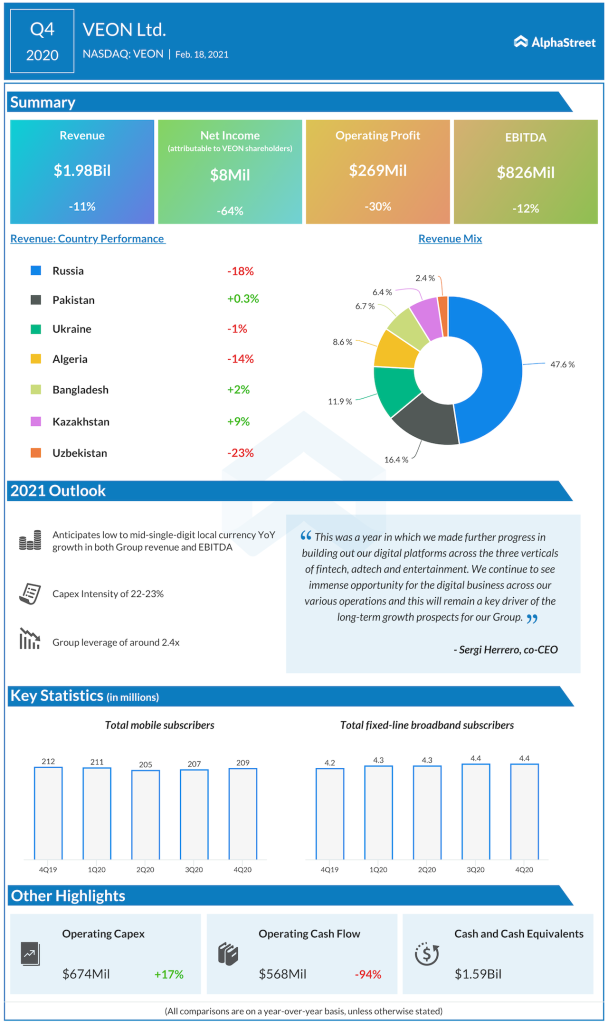

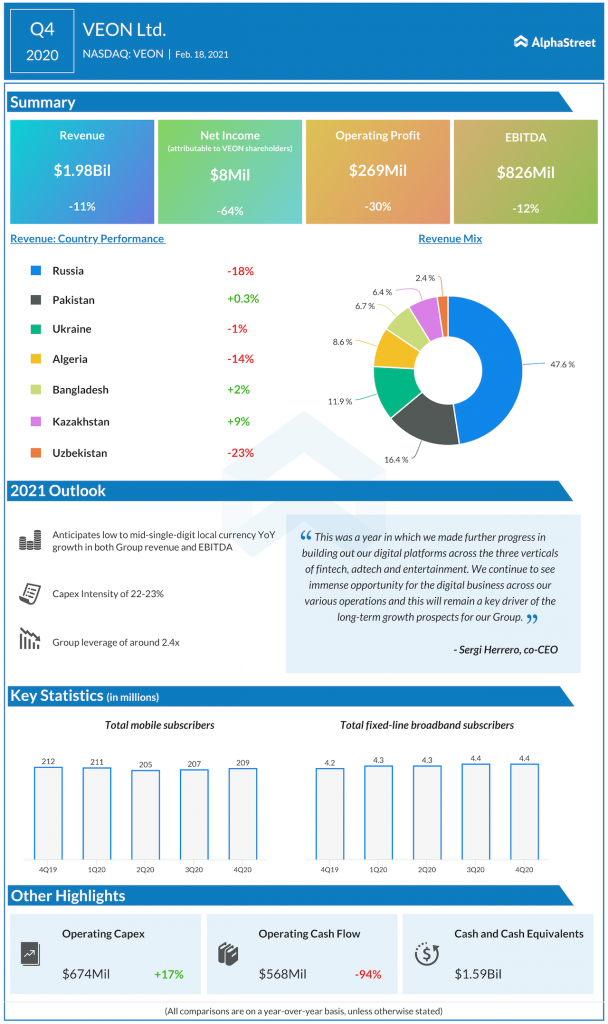

At the end of fiscal 2020, the company had 213.5 million subscribers, as well as a total 4G user base of 80 million. The company also last week reported strong earnings results in the face of the pandemic, suggesting it could be on the verge of a turnaround.

A huge market in Russia

Russia contributes about half of VEON’s business and makes up one of its key markets. In an interview with AlphaStreet, VEON co-CEO and former Facebook executive Sergi Herrero said 4G penetration in the country continues to be less than 60%, offering space for further growth.

In December last year, the company announced that it has completed coverage of all Moscow metro stations with 4G in an effort to reach out to more customers.

“In 2020, we focused on solving the fundamentals, specifically the Moscow Metro. In Moscow, if you don’t cover a metro it means that you don’t cover anything. Our effort was to bring a good 4G network that is at least at par with the best player in the area,” the CEO said.

He added that the company is currently in the process of expanding its revenue channels outside of traditional operations through partnerships and joint ventures. Interestingly, VEON has established joint ventures with Alfa Bank, one of Russia’s largest private commercial banks on the fintech side, as well as with X5 Retail Group, a popular consumer goods brand on the retail side.

For more insights on VEON, read the latest earnings call transcript

Full ecosystem approach

In some of its markets, VEON is emulating the larger telecom firms’ approach of expanding into complementary services through content platform Beeline TV, fintech unit JazzCash, self-care application MyBeeline and others. In Q4, Beeline TV’s monthly active users increased 33% to 2.7 million, while that for JazzCash improved 67% to 12.2 million monthly active users.

Herrero said the company would pursue a full-ecosystem approach in regions where it enjoys a leadership position including Pakistan, Ukraine and Bangladesh. Meanwhile, in the other markets including Russia, it would depend on strategic partnerships and joint ventures to drive subscriber growth.

“A year ago, we had zero merchants on our JazzCash platform. And within the past 12 months, we became the biggest merchant acquirer of Pakistan. Today, we have more than 100,000 registered merchants. And we do that by applying technology,” Herrero added.

VEON stock has declined 22% in the trailing one year while increasing 15% in the last 6 months. Currently, it trades at less than $2 per share. Founded in 1992, the company is headquartered in Amsterdam, Netherlands.

____