Verizon Communications (VZ) is scheduled to post its fourth-quarter 2018 earnings before trading hours on Tuesday, Jan. 29.

The Street expects earnings of $1.09 a share on revenue of $34.34 billion for the three-month period.

Verizon looks to be on the right path, since reports suggests that the company has added at least 1.2 million new retail postpaid accounts on the quarter, that too with a churn rate of 0.82%. This indicates that customers are staying with the company.

It was also during the reported quarter that the telecom giant launched its new offering — the world’s first commercial 5G broadband internet service, in some markets. The Verizon 5G Home was first offered to some parts of Houston, Indianapolis, Los Angeles, and Sacramento.

By the looks of it, wireless would put Verizon back in the good graces of the market. We’ll look out for these metrics in the earnings report.

THE FAILED OATH-TAKING

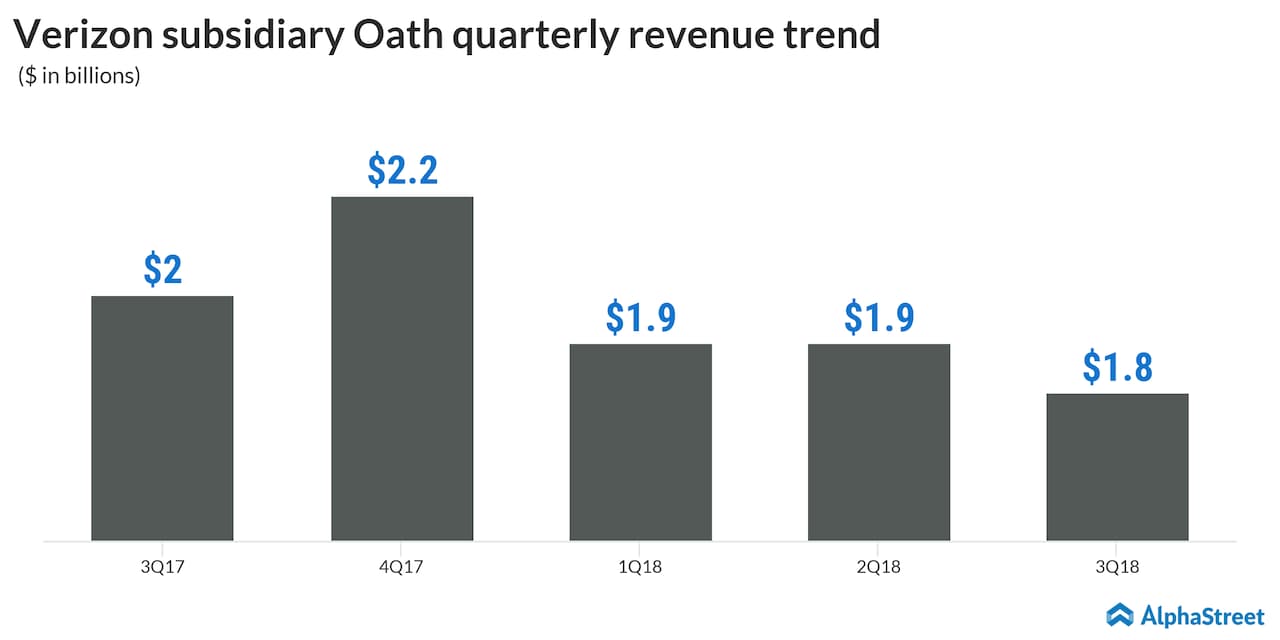

Two year ago, Verizon acquired Yahoo and AOL amid hopes of it revolutionising both these properties. However, nothing spectacular happened, with Verizon reportedly writing off $4.6 billion from its Yahoo-AOL acquisitions, after having paid more than $9 billion for both companies. Oath — the combined entity of tehse two firms — saw its revenue slow down sequentially over the past couple of quarters.

Given the estimates that it is not going to get any better for Oath, it is more likely that the division would fail to reach its target of $10 billion in revenue by 2020. Verizon originally formed Oath to take on Alphabet’s (GOOGL) Google and Facebook (FB) in the online advertising space — something it clearly failed to achieve.

After CEO Hans Vestberg took over as top dog, the first major change was the reorganization of Verizon’s business into three segments — Consumer, Business and Verizon Media Group/Oath. This looks like Verizon realigning its focus on expanding its 5G network, which is a good move. If Oath doesn;t catch up, Verizon might even consider discarding it.

It was only last month that Verizon announced that about 10,400 employees accepted to leave the company as part of its voluntary separation program.

REVISITING THE PREVIOUS QUARTER

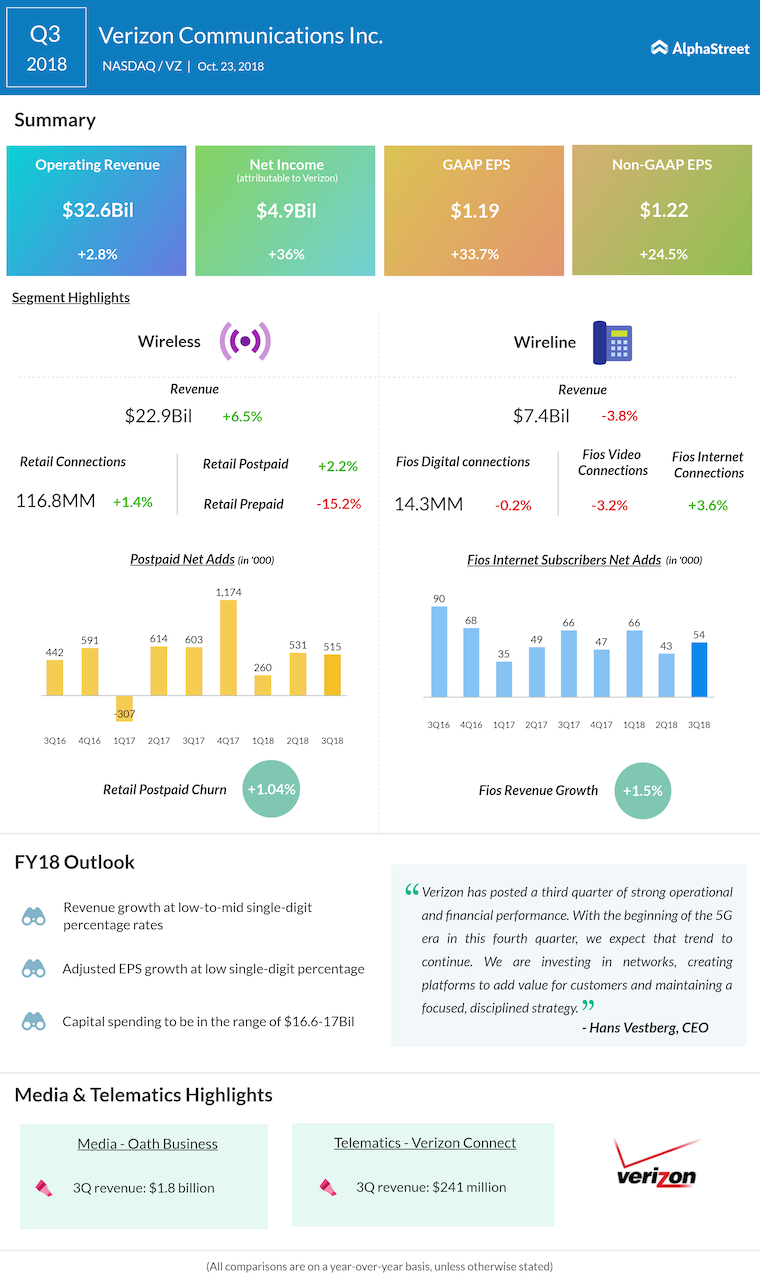

Looking at the previosuly reported third quarter, the telecom giant saw its results surpassing estimates on higher revenues and strong subscriber growth. Soon after the results were out, Verizon’s stock shot up. Total operating revenues grew 2.8% on adding 515,000 more registered retail postpaid wireless subscribers during the three-month period.

Back then, Verizon also hinted that it expects FY 2018 consolidated revenue growth at low-to-mid single-digit percentage rates. Adjusted earnings is touted to rise in low single-digit percentage. Capital spending is expected to be between $16.6 billion to $17.0 billion.