Shares of Verizon Communications Inc. (NYSE: VZ) were up 2.2% on Wednesday despite a mixed earnings report from the company. While profits beat estimates, revenue fell short. However, growth in subscribers, rising 5G adoption and a raised outlook for the full year impressed the Street. The company is confident that the momentum in 5G will help it conclude the year on a strong note.

Quarterly performance

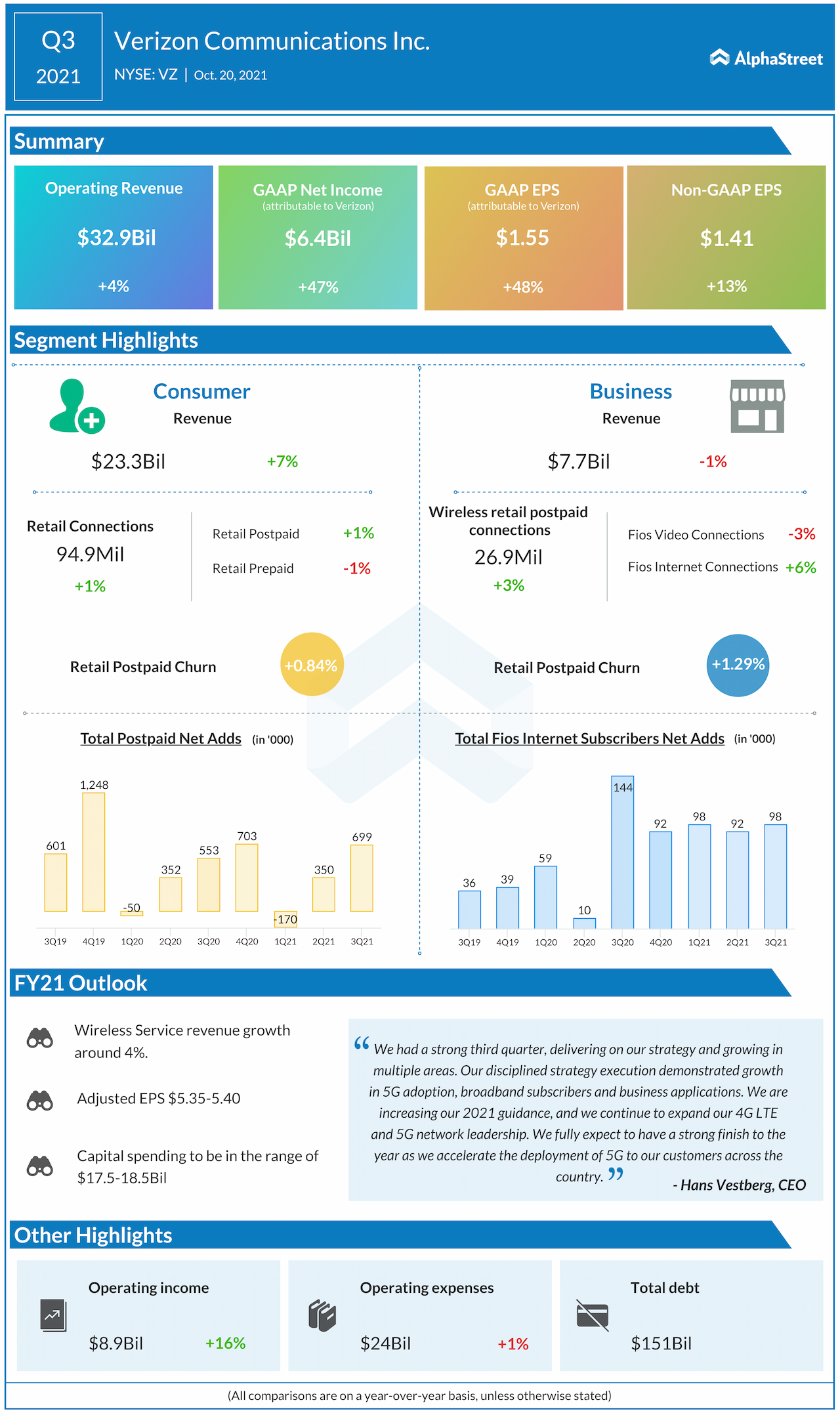

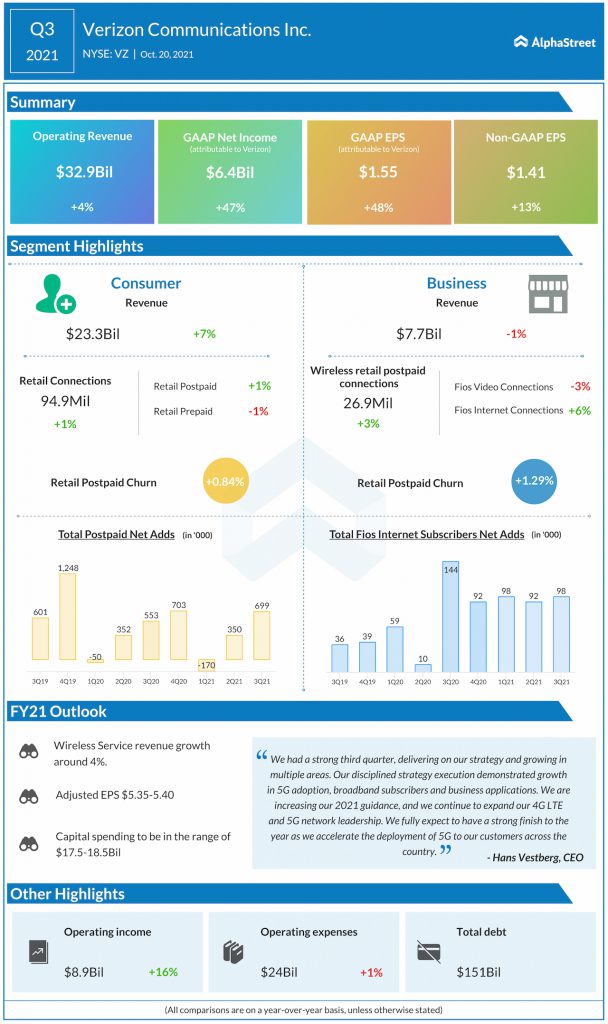

For the third quarter of 2021, Verizon reported operating revenue of $32.9 billion, which was up 4.3% from the prior-year quarter. These results included two months of revenue from Verizon Media. Excluding Verizon Media revenue, consolidated revenue rose 5.5%. Adjusted EPS totaled $1.41. The bottom line surpassed projections but the top line missed expectations.

Trends

During the quarter, Consumer revenues grew over 7% to $23.3 billion driven by strong demand for connectivity and products. The Mix and Match pricing strategy and partnerships helped fuel the momentum in this segment. The segment reported 423,000 wireless retail postpaid net additions and saw a 4% growth in wireless service revenue in the quarter.

Verizon is seeing strong momentum in the adoption of 5G with over 25% of its consumer phone base using a 5G capable device. In terms of broadband expansion, the company is on track to meet its fixed wireless access household coverage targets with an expected 15 million homes passed by the end of the year between 4G and 5G. 5G Home is currently available in 57 markets and 4G LTE Home is available in over 200 markets spanning all 50 states.

Business segment revenues dipped 0.8% year-over-year to $7.7 billion. This segment continues to see strong demand for wireless services with wireless revenue growth offsetting legacy wireline declines. Business reported 276,000 wireless retail postpaid net additions during the quarter.

Outlook

For the full year of 2021, Verizon expects total wireless service revenue to grow around 4%. The company raised its outlook for adjusted EPS, which is now expected to come between $5.35-5.40 versus the prior range of $5.25-5.35.

Click here to read the full transcript of Verizon’s Q3 2021 earnings conference call