Vertex Q4 2025 Earnings: Financial Results

Net income was $824 million with a net margin of 24%. This compares to $618 million in Q4 2024. Operating income rose 33% year-over-year. Yet the company faced higher R&D spending of $687 million.

Full Year 2025 Vertex Q4 2025 Earnings: Annual Performance

For the full year 2025, total revenue hit $11.27 billion. This rose 8% from $10.43 billion in 2024. Also, net income was $2.95 billion. The company did 41.3 million CF patient visits. Plus, adjusted net income was $3.42 billion.

The full-year gross margin was 84.5%. Yet the company faced cost pressures. Operating margin was 38%. So costs exceeded margins for a time. Yet adjusted operating margin hit 42%, showing core momentum. The SG&A ratio improved to 18% from 19%.

Read the full Vertex Q4 2025 earnings press release for complete details.

Quarterly Revenue: Vertex Q4 2025 Earnings Momentum

The chart shows Vertex Q4 2025 earnings revenue acceleration. Q1 2025 was $2.72 billion. Then Q2 rose to $2.98 billion. Then Q3 hit $3.16 billion. Finally, Q4 reached $3.42 billion, ending solid.

Cystic Fibrosis Market: Vertex Q4 2025 Earnings Driver

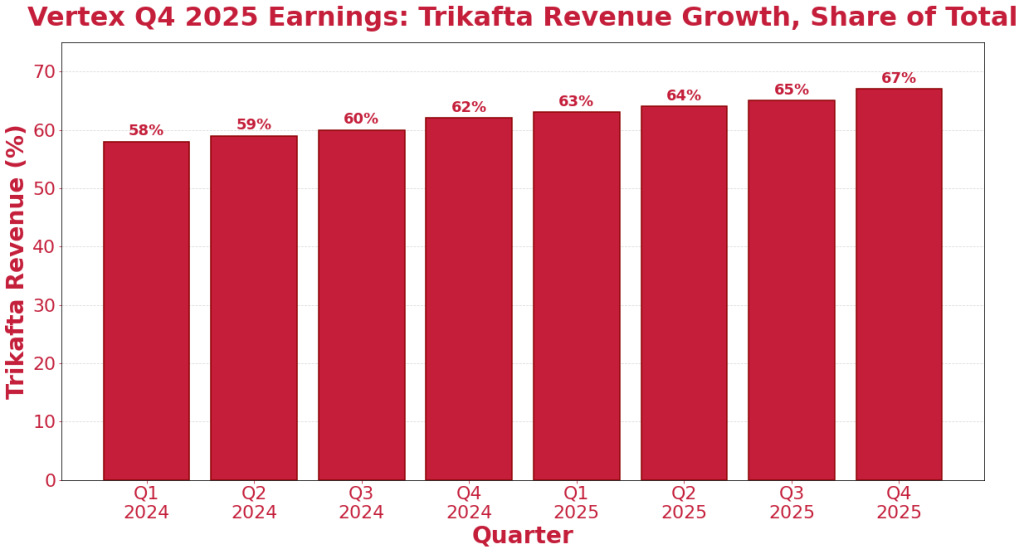

Trikafta sales drove Q4 results. So the CF therapy dominated all profit. The drug treats the F508del mutation in CF patients. In fact, Trikafta now represents 67% of total revenue. Also, patient adoption continues to rise. Plus, geographic expansion helps growth.

International markets show momentum. So Europe contributed 38% of Trikafta sales. Yet the US remains the base at 62%. Also, pediatric use expanded in Q4. So new patient initiation rose 12%. Plus, label expansions occurred in Japan and Canada.

Product Mix: Vertex Q4 2025 Earnings Concentration

Vertex Q4 2025 earnings show revenue concentration. Trikafta was 58% in Q1 2024. It rose to 62% by Q4 2024. Yet 2025 saw rapid growth. Q1 2025 hit 63%. Then Q2 jumped to 64%. Q3 rose to 65%. Finally, Q4 reached 67% of total sales.

Key Catalysts: Vertex Q4 2025 Earnings Highlights

Pipeline progress added upside. So VX-880 gene therapy advanced. This treats CF mutations. Management expects FDA approval in 2025. Also, the triple combination drug Trikafta continued expansion. Plus, next-gen CF medicines advance in trials.

Operational gains drove profitability. So a gross margin of 85% beat guidance. Also, manufacturing efficiencies helped costs. Yet R&D spending rose for innovation. So investments in new programs were substantial. Plus, sales force hiring accelerated globally.

2026 Vertex Q4 2025 Earnings Guidance & Outlook

Management raised 2026 guidance. So full-year revenue is $11.8 billion to $12.0 billion. Also, operating margin guidance is 40%-42%. Plus, net income guidance is $3.70-$3.95 billion. So the company sees continued momentum in 2026.

Trikafta sales are forecast to grow 5%-8% in 2026. So CF market expansion continues. Also, the new market launch in Asia gains traction. Yet competition from other CF drugs exists. So Vertex maintains its market position.

Key Takeaways: Vertex Q4 2025 Earnings Summary

Vertex Q4 2025 earnings delivered solid results. So revenue rose 7% year-over-year. Yet margins improved substantially. Also, cash generation was exceptional. Plus, forward guidance confirms 2026 growth.

The Trikafta franchise remains robust. So CF market demand continues. Also, pipeline innovation aids future revenue. Yet patent expiration risks exist. So investors should monitor competitive dynamics.

Click Here to visit the AlphaStreet website.