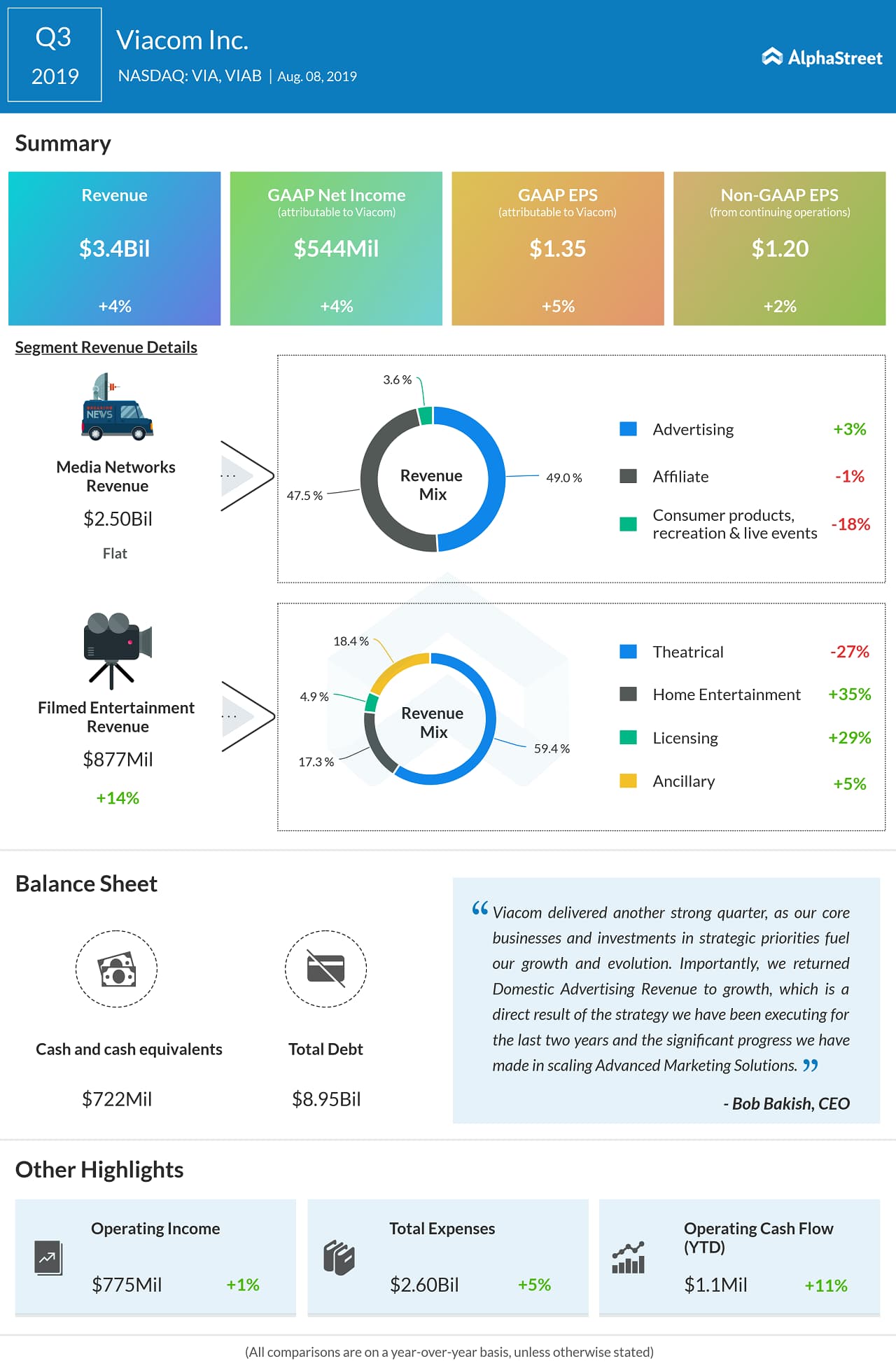

Revenues moved up 4% annually to $3.36 billion, beating Wall Street’s estimates. The company’s core segments performed well during the quarter. Aided by strategic investments and marketing initiatives, domestic advertising returned to the positive territory, registering 6% annual revenue growth.

Paramount, the key operating division, recorded a 14% revenue growth helped by strong licensing and home entertainment results. The segment benefitted from the successful release of films Rocketman and Pet Sematary. The number of monthly active users at Pluto TV rose sharply to about 18 million.

Also see: Walt Disney Q3 results miss estimates despite box office success

“Viacom delivered another strong quarter, as our core businesses and investments in strategic priorities fuel our growth and evolution. Importantly, we returned Domestic Advertising Revenue to growth, which is a direct result of the strategy we have been executing for the last two years and the significant progress we have made in scaling Advanced Marketing Solutions,” said CEO Bob Bakish.

Earlier this week, Walt Disney Company (DIS) reported double-digit growth in third-quarter revenues to $20.3 billion. However, adjusted earnings declined 28% and missed Wall Street’s prediction, hurt by higher costs and expenses.

Viacom’s stock is currently trading at the levels seen a year ago. The stock has gained 11% since the beginning of the year. It gained during Thursday’s premarket trading.

Listen to on-demand earnings calls and hear how management responds to analysts’ questions