For the fourth quarter ended December 31, 2018, non-GAAP net income attributable to Vipshop’s shareholders increased by 2.9% year-over-year to RMB913.6 million (US$132.9 million). Revenue rose 8% annually to RMB26.1 billion (US$3.8 billion).

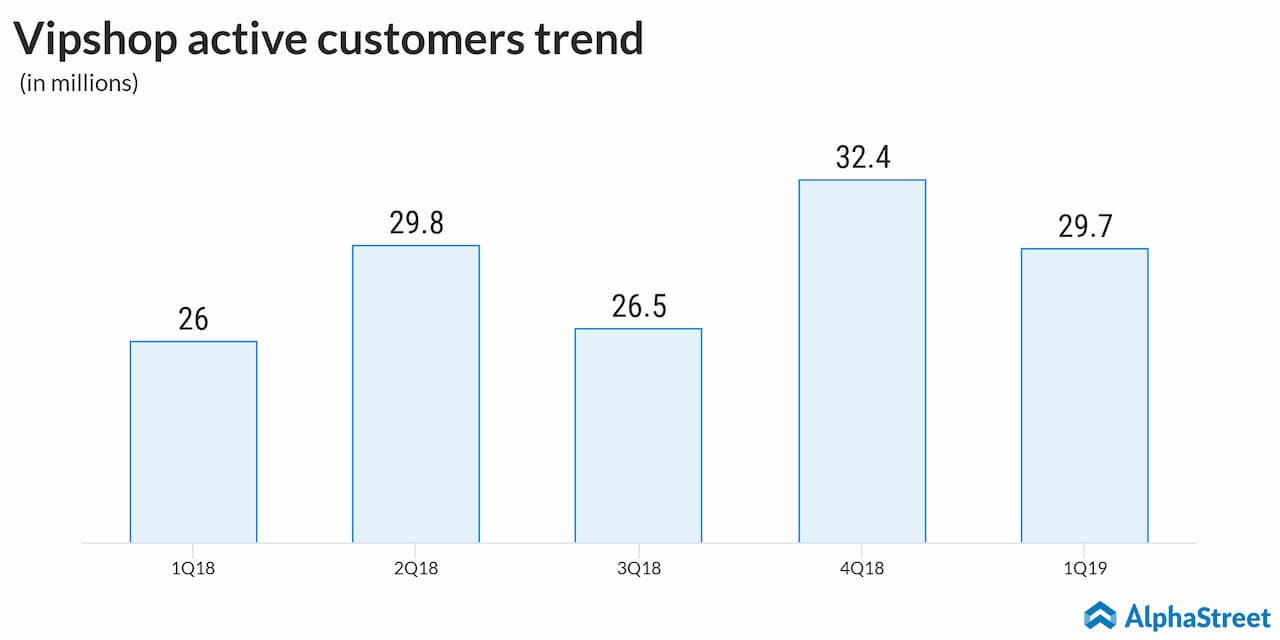

Gross merchandise volume grew by 11% to RMB33.8 billion in Q4 2018, while the number of active customers increased 14% to 29.7 million. Total orders surged 29% to 116.5 million from 90.2 million in the prior year period.

For the second quarter of 2019, Vipshop expects its revenue to be between RMB20.7 billion and RMB21.7 billion, representing a year-over-year growth rate of approximately 0% to 5%.

Also read: L Brands stock surges on Q1 earnings beat, raises outlook

“During this quarter, our total active customers grew by 14% year over year, which was the result of enhanced loyalty from existing customers and accelerated growth in the number of new customers. Going forward, we will continue to expand our market share in the discount apparel segment, further strengthening our leading position in China,” said CEO Eric Shen.

Shares of the Chinese e-commerce company have gained 34% since the beginning of 2019 and slided 40% in the past 12 months.