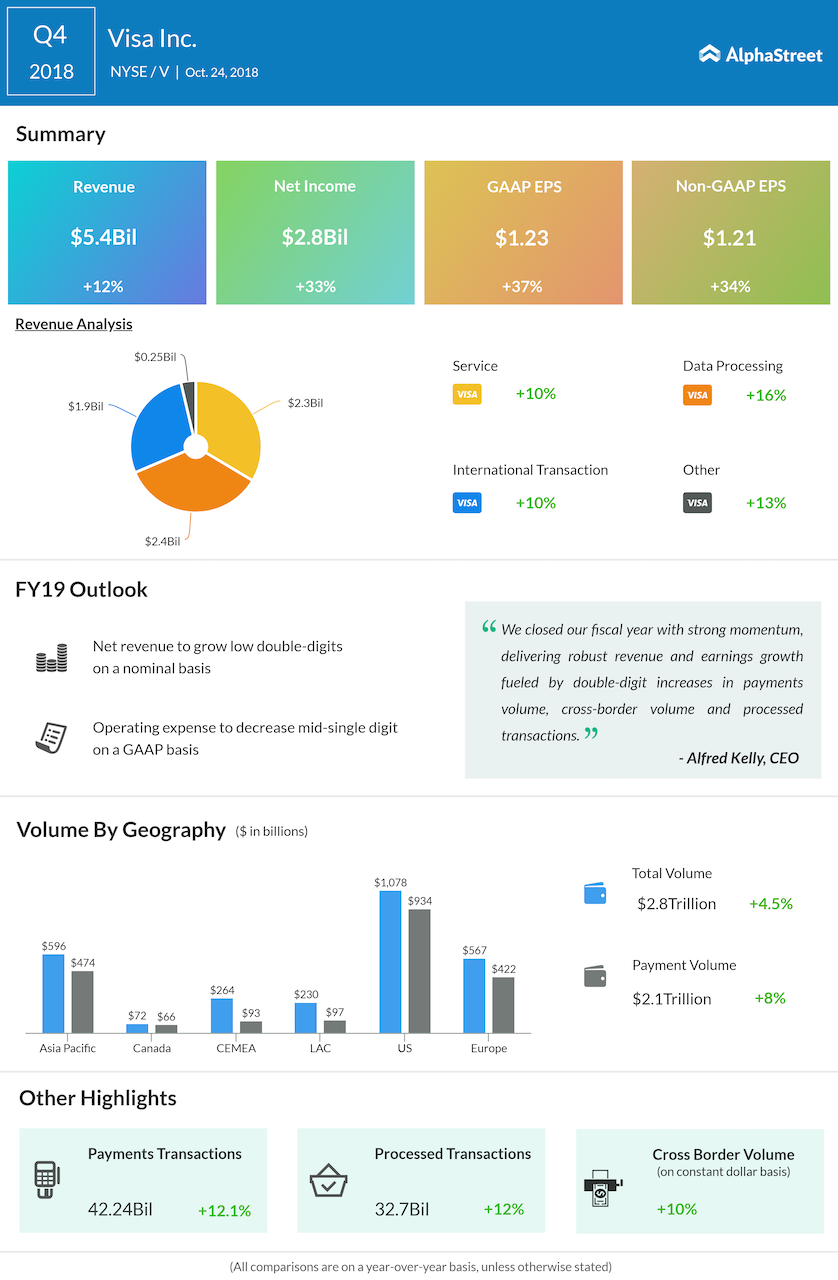

In the fourth quarter of 2018, higher transaction volume drove up operating revenues by 12% to $5.4 billion. Supported by the strong top line growth, adjusted earnings surged 34% to $1.21 per share, beating market expectations.

The company’s robust cash flow gives it sufficient backup to pursue asset purchases even while returning capital to shareholders through stock-buyback. In the longer term, the ultimate beneficiaries of the steady adoption of electronic payment services will be credit card companies, and Visa’s robust customer base gives it an advantage over others.

Visa’s robust cash flow helps it pursue asset purchases even while returning capital to shareholders through stock-buyback

Probably, payments companies are the only businesses that benefit from inflation. The current trend shows high inflation is going to stay in the global economy. Meanwhile, the chances of new players entering the payment sector are rare, due to the huge initial investment required and the challenging task of establishing the network.

Also see: Visa Q4 2018 Earnings Conference Call Transcript

Visa’s margins might face pressure from the incentives paid to clients and the increasing volatility in foreign exchange. Also, high operating expense weighs on profitability though it is partially offset by the relatively low capital expenditure.

Among competitors, Mastercard (MA) will be reporting its December-quarter results Thursday before the market opens. The consensus earnings estimate is $1.53 per share, which represents a 34% increase year-over-year. Earlier this month, American Express (AXP) reported fourth-quarter earnings of $2.32 per share on an 8% revenue growth.

Over the past twelve months, Visa shares gained about 12% and also hit a record high in September 2018. Though the stock had a muted start to 2019, it gathered momentum and stabilized after the initial slump.