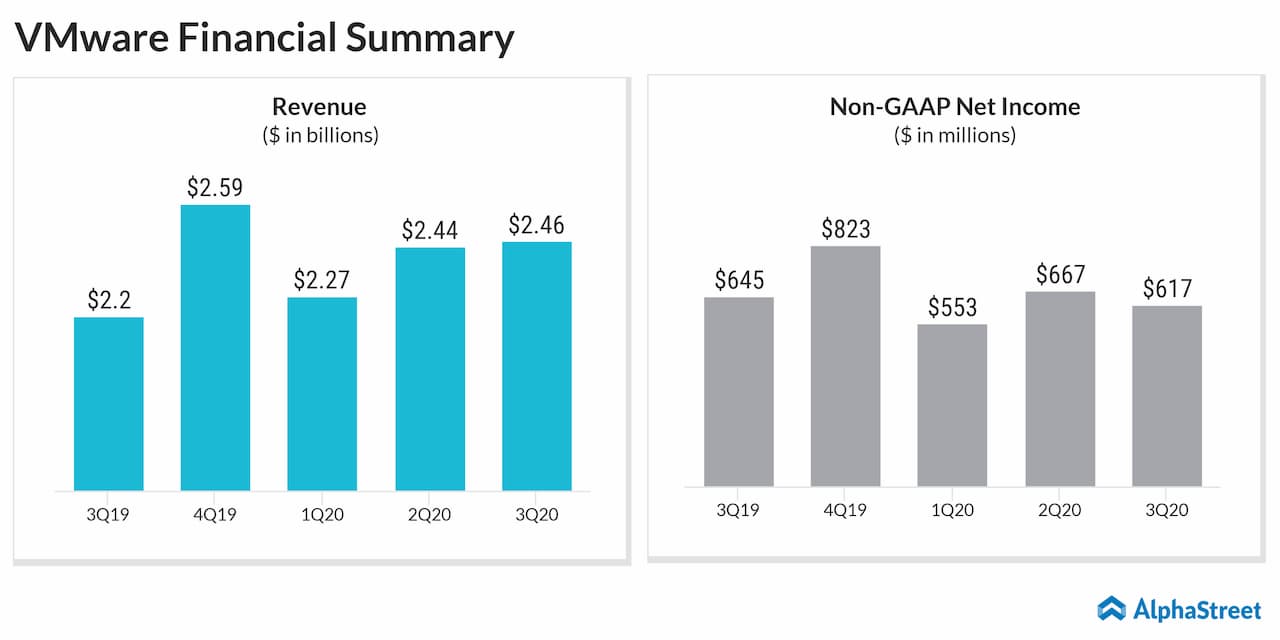

Revenue grew by 12% to $2.46 billion. License revenue increased by 10% to $974 million. The results reflected broad-based strength across its product and solutions portfolio.

Hybrid Cloud Subscription and SaaS revenue grew to over 13% of total revenue in Q3, and the company expects this category to continue to grow significantly next year, including the contributions of Carbon Black and Pivotal.

For the third quarter, the company continued to see traction and customer momentum in support of VMware’s vision to deliver a software architecture that enables any app, on any cloud, delivered to any device. The company remained on track to close the acquisition of Pivotal Software by the end of the fiscal year.

For the quarter, software maintenance services revenue increased by 12.5% year-over-year to $1.28 billion. Professional services revenue grew by 13.5% to $202 million. Services accounted for 60% of the total revenue while license accounted for just 40%.

Cloud computing continues to be a rapidly growing market for VMware. And the company has been betting huge with several big acquisitions for driving product and market growth.