Continuing the expansion spree, enterprise software firm VMware (NYSE: VMW) on Monday completed the acquisition of cloud services provider Pivotal Software. Pursuant to the $2.7-billion transaction, Pivotal will become a wholly-owned subsidiary of VMware.

The deal also complements VMware’s efforts to enhance its Tanzu brand, which is designed to help customers manage their software applications effectively. After integration, VMWare senior executive Ray O’Farrell will be heading the combined cloud applications unit, titled Modern Applications Platform.

Related: Pivotal Software Q2 loss narrows on top-line growth

The combination, touted as a win-win deal for VMWare and Pivotal, is expected to be beneficial to their mutual clients also, including high-value customers like Raytheon Company (RTN).

“It’s my pleasure to announce Ray O’Farrell as the leader of VMware’s new Modern Applications Platform business unit—uniting the Pivotal and VMware Cloud Native Applications teams. And as Pivotal is now part of VMware, I want to thank the Pivotal leadership team for building a great company. Together, we’re poised to be the leading enabler of Kubernetes with a deep understanding of both operators and developers,” said VMWare CEO Pat Gelsinger.

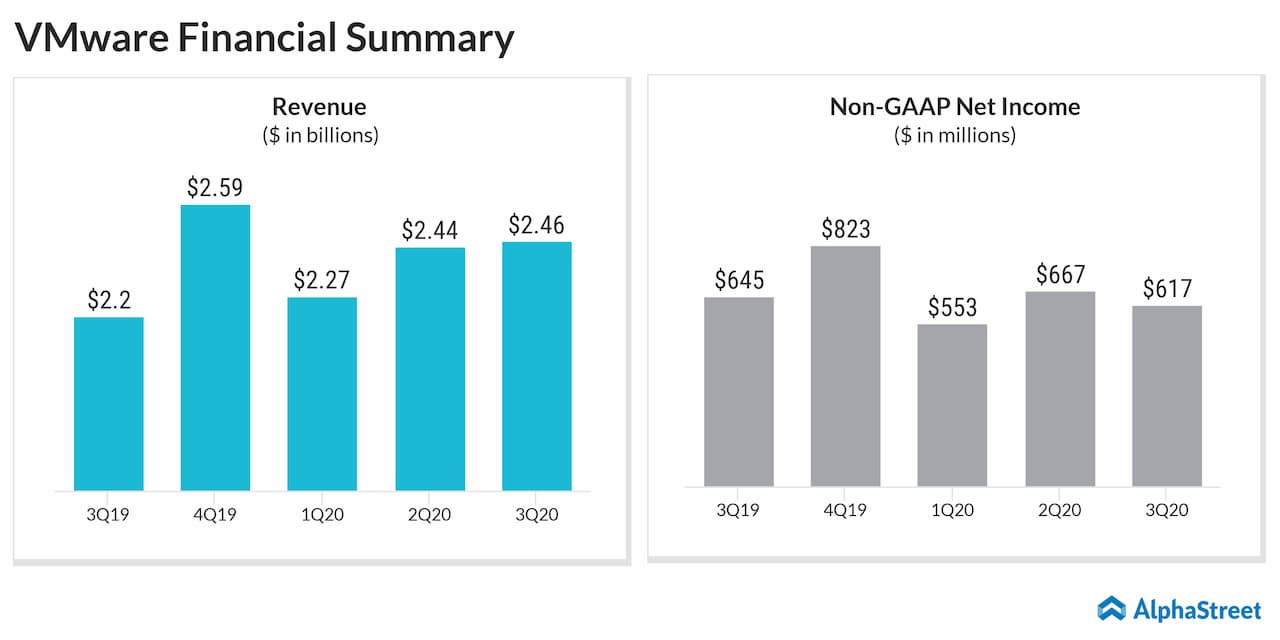

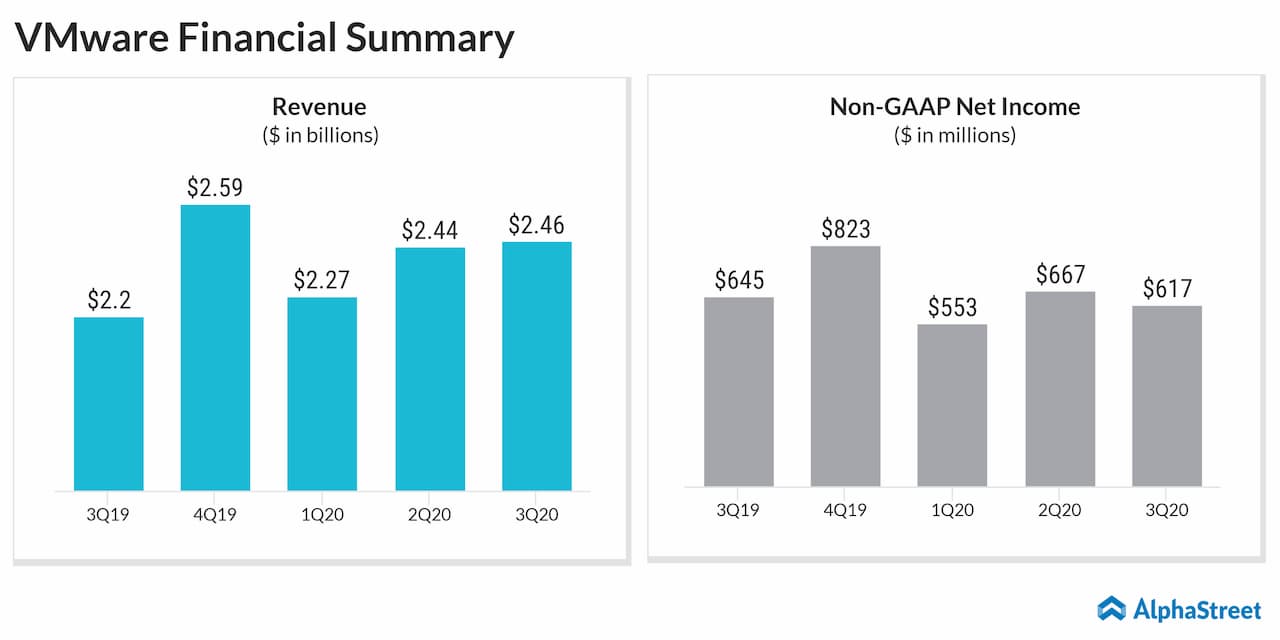

In the third quarter, VMWare’s adjusted earnings dropped 4% annually to $1.49 per share, reflecting a buyout-related investment. Revenues, meanwhile, climbed 12% annually to $2.46 billion.

VMWare shares traded higher during Monday’s early trading hours. The stock has declined 9% in the past six months, after climbing to a record high mid-year and crossing the $200-mark for the brief period. Meanwhile, Pivotal closed at $15 after trading in the stock was suspended before the opening bell.