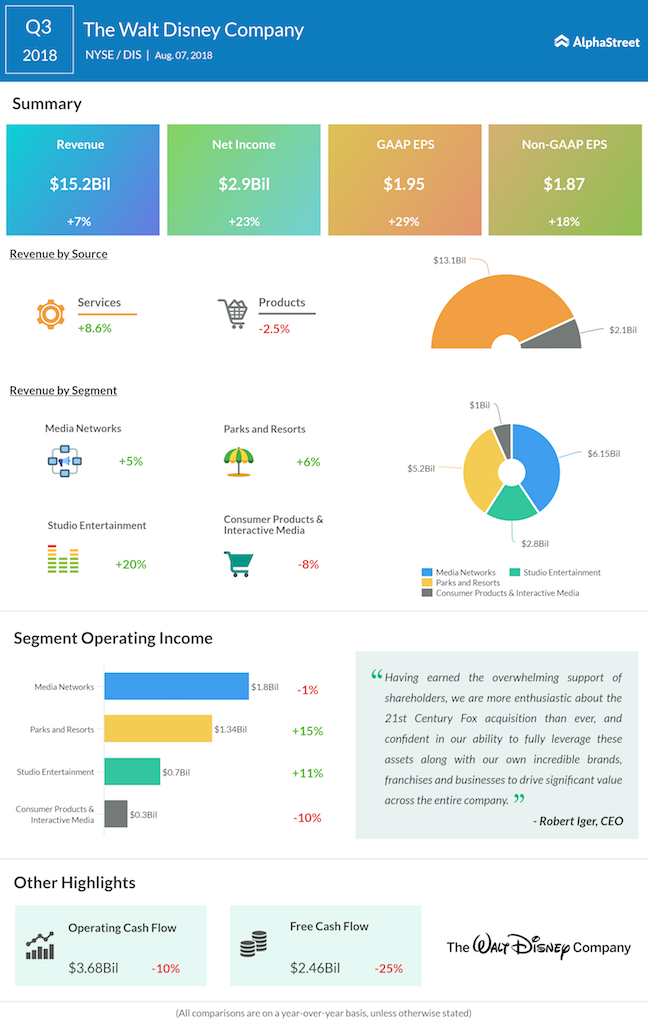

With strong contributions from all the major business segments, net revenues advanced 7% annually to $15.23 billion in the June quarter, but came in below the street view.

With contributions from all the major business segments, net revenues advanced to $15.23 billion

“Having earned the overwhelming support of shareholders, we are more enthusiastic about the 21st Century Fox acquisition than ever, and confident in our ability to fully leverage these assets along with our own incredible brands, franchises and businesses to drive significant value across the entire company,” said Disney CEO Robert Iger.

Riding on the box office success of new movie releases like Avengers: Infinity War and Incredibles-2, the Studio Entertainment segment registered a 20% revenue growth, as expected. Revenues of the Parks and Resorts division rose 6%, helped by an increase in average ticket prices and the management’s initiatives to revamp the facilities.

RELATED: Disney-Fox deal gets shareholder nod

Consumer products witnessed an 8% decline, while Media Networks revenue moved up 5%. Though ESPN, which comes under the Media Networks division, recovered from the recent slump, the improvement was mainly due to seasonal factors. Higher programming costs and muted advertising revenues at ESPN continued to drag operating income.

Disney’s shares witnessed several ups and downs during the past twelve months as the company fiercely fought with rival bidder Comcast to clinch a deal with Fox. The stock ended Tuesday’s regular session slightly higher, but declined in the after-hours following the announcement.