GAAP net income dropped to $103 million, or $0.46 per share, from $140.9 million, or $0.62 per share, in the prior-year period. Adjusted net income stayed flat at $156.4 million, or $0.68 per share, versus last year but surpassed forecasts of $0.56 per share.

Advertising and marketing revenues remained

relatively unchanged year-over-year at $370.7 million. Advertising revenues

from small and medium-sized enterprises and key accounts increased 2% to $346.5

million.

Value-added service revenues increased 8% year-over-year to $61.2 million, mainly driven by revenues from the live streaming business, partially offset by a decline in gaming revenues.

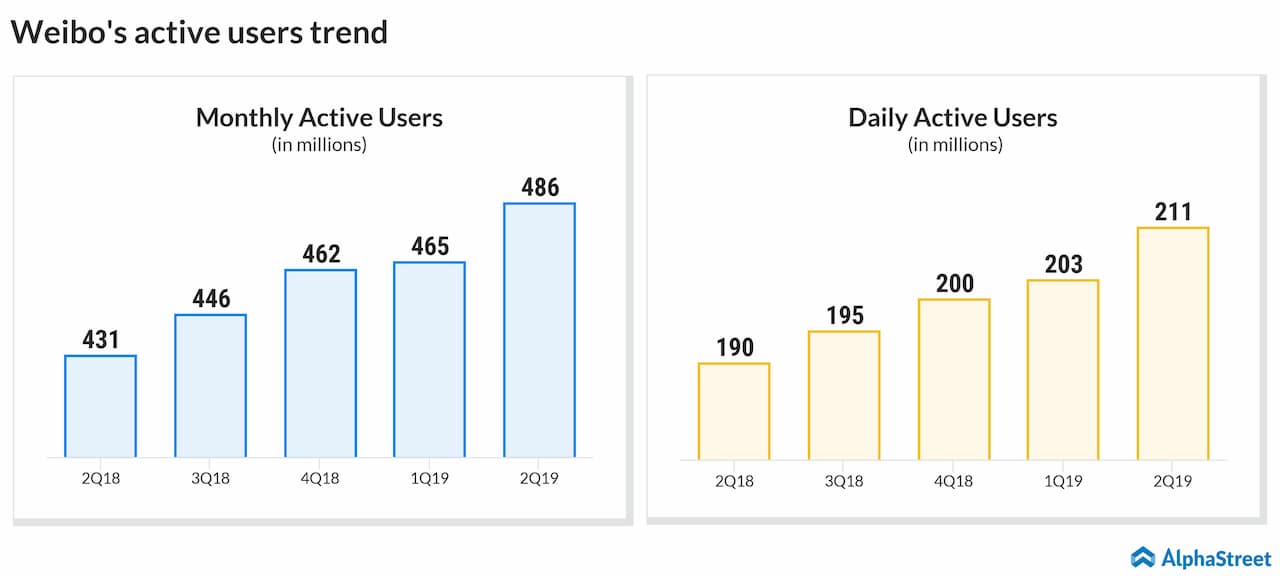

Monthly active users (MAUs) totaled 486 million in June, a net addition of approx. 55 million users year-over-year. Mobile MAUs represented approx. 94% of MAUs. Average daily active users (DAUs) were 211 million in June, a net addition of approx. 21 million users year-over-year.

Gaofei Wang, CEO, said, “Weibo delivered strong user performance this quarter. We are delighted to see a notable acceleration in user

growth from prior quarter and robust user engagement trends, underpinned by our

strengthened social network effect as well as the consistent efforts in user

product upgrade and optimization. On monetization, we continued to showcase

unique value proposition to advertisers, leveraging the ongoing ad product

evolution to mobile, social and video.”

Costs and expenses increased to $280.6

million, from $271.7

million in the same

period last year. As of June

30, 2019, Weibo

had cash, cash equivalents and

short-term investments of $1.56 billion.

For the third quarter of 2019, Weibo estimates net revenues to increase 6-9% year-over-year on a constant currency basis.

Get access to timely and accurate verbatim transcripts that are published within hours of the event.