For the first quarter ended September 28, 2018, Western Digital reported earnings of $3.04 per share on revenue of $5 billion. Both the bottom line and topline dropped from the year-ago quarter. The weaker-than-expected quarterly results were hurt by the reduction flash average selling prices.

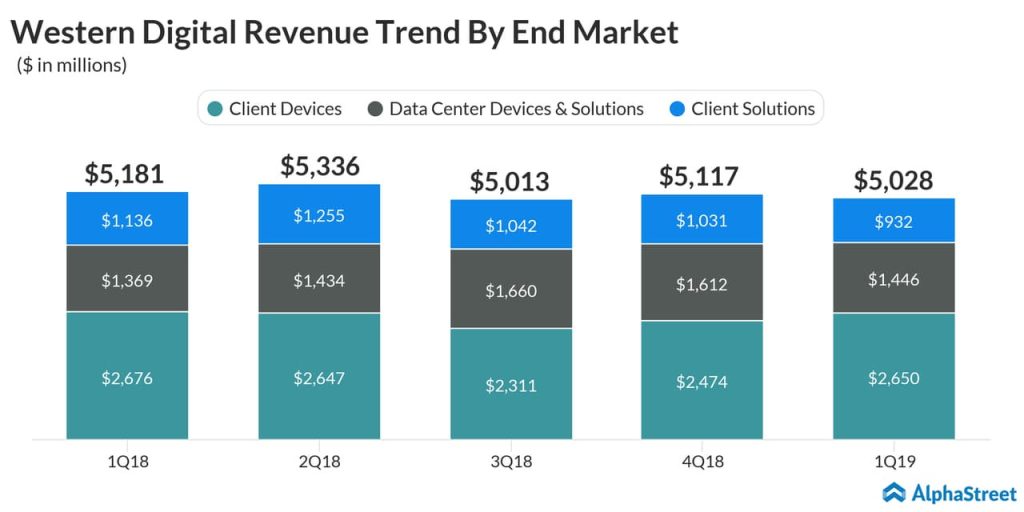

In Q1, Data Center Devices and Solutions division revenue increased 6%, driven by the growth in cloud-related storage. Client Devices revenue was flat year-over-year and revenue from Client Solutions unit dropped 18%, driven by the normalization trends in flash market pricing.

Related: Western Digital Q1 2019 earnings call transcript

The San Jose, California-based company paid a cash dividend of $0.50 per share for Q2 on January 14 to stockholders of record as of December 28, 2018.

Current geopolitical and industry dynamics have created a more challenging global business environment for the semiconductor stocks. Trade tensions with China and foreign exchange volatility had resulted in softening demand for the semiconductor industry and this has delayed the deployment of capital equipment by the chipmakers. How the company reacts to these macroeconomic conditions will be closely watched by investors during Western Digital’s earnings report tomorrow.

Shares of Western Digital opened at $37.93 and were trading flat during the afternoon session on Wednesday. The stock, which plunged to a 52-week low ($33.83) on December 26, had dropped 57% in the past 12 months period.

We’re on Flipboard! Follow us to receive the latest stock market, earnings, and financial news at your fingertips