“Market conditions have generally been consistent with our expectations, and while the business environment remains soft, there are initial indications of improving trends,” said CEO Steve Milligan, He also added, “Our expectation for the demand environment to further improve for both flash and hard drive products for the balance of calendar 2019 is largely unchanged.”

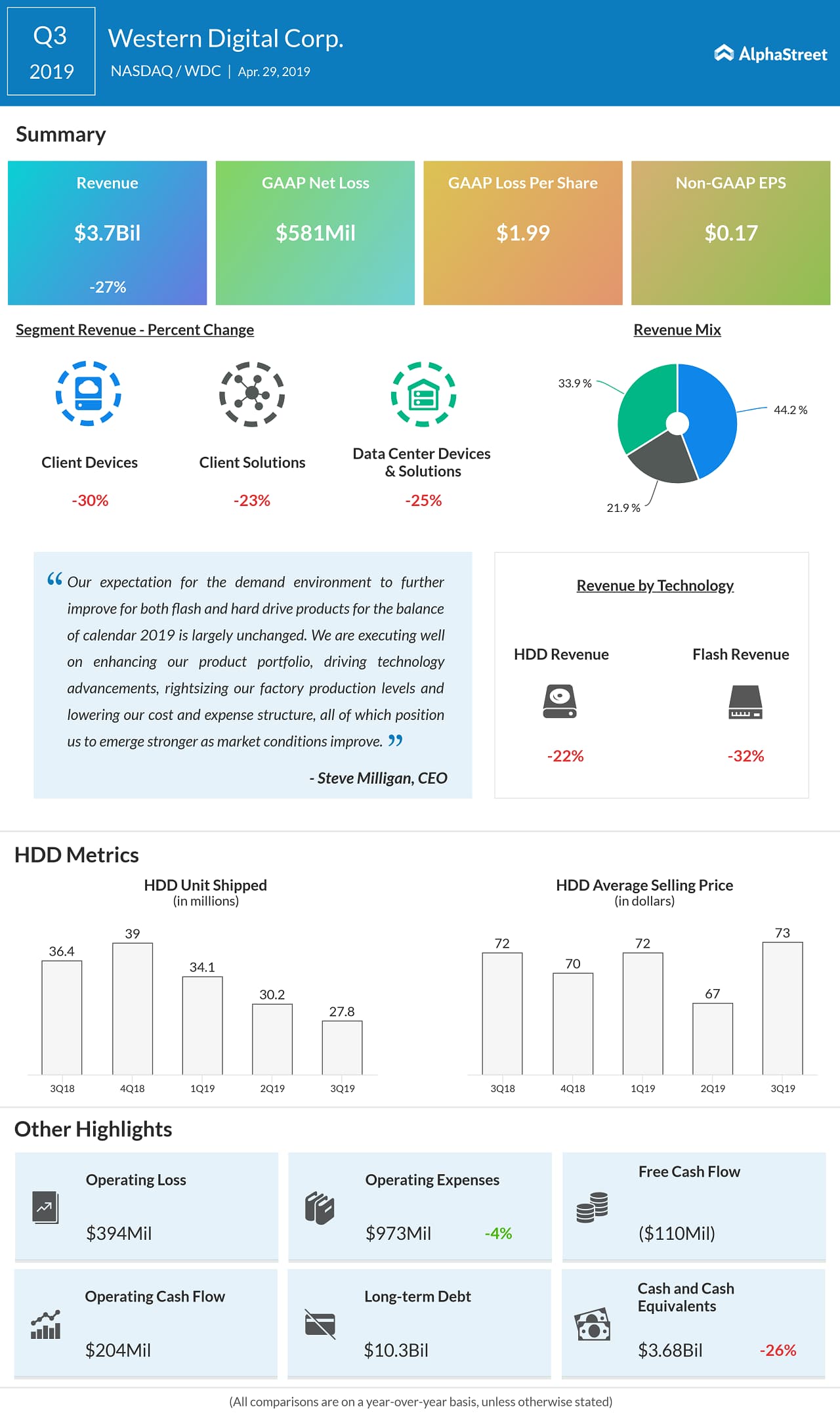

Total HDD units dropped to 27.8 million from 36.4 million in the previous year quarter. HDD average selling price increased modestly year-over-year to $73 from $72 in the year ago.

Western Digital stock had gained 37% so far this year and declined 37% in the past 52 weeks. The stock dropped 4% last Friday as RW Baird downdgraded the stock to “Underperform” from “Neutral” with a price target of $40.

The San Jose, California-based data storage firm returned $146 million to shareholders through dividends. On February 14, 2019, Western Digital declared a cash dividend of $0.50 per share of its common stock, which was paid to shareholders on April 15, 2019.