JPMorgan

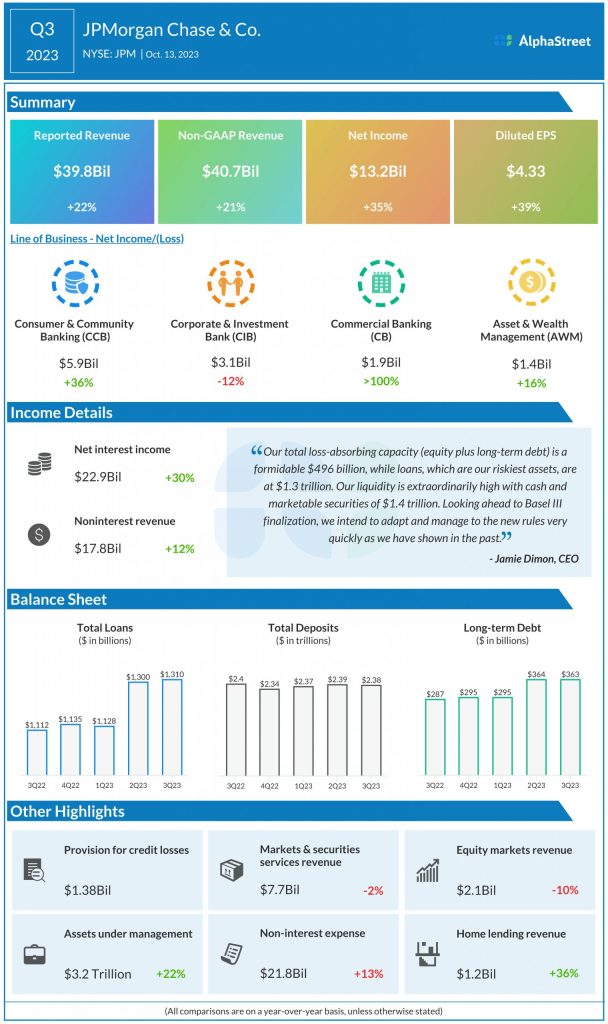

The quarterly results benefited from higher interest rates. Net interest income rose 30% to $22.9 billion while non-interest revenue grew 12% to $17.8 billion compared to last year. In Q3, First Republic contributed $2.2 billion of revenue and $1.1 billion of net income.

CEO Jamie Dimon said that US consumers and businesses remain healthy although consumers are spending down their excess cash buffers. He added that interest rates could continue to rise due to inflation and that with the wars in Ukraine and Israel, this may be the most dangerous time the world has seen in decades.

Wells Fargo

Wells Fargo & Company (NYSE: WFC) reported total revenue of $20.8 billion for the third quarter of 2023, up 7% from the same period a year ago. Net income grew 61% to $5.76 billion while EPS rose 72% to $1.48. Analysts had projected earnings of $1.22 per share on revenue of $20.1 billion.

Net interest income increased 8% in Q3, mainly due to the impact of higher interest rates but was partly offset by lower deposit balances. Non-interest income grew 4%.

“Our revenue growth from a year ago included both higher net interest income and noninterest income as we benefited from higher rates and the investments we are making in our businesses. Expenses declined from a year ago due to lower operating losses. While the economy has continued to be resilient, we are seeing the impact of the slowing economy with loan balances declining and charge-offs continuing to deteriorate modestly.” – Charlie Scharf, CEO

Citigroup

Citigroup Inc. (NYSE: C) posted revenue of $20.1 billion for the third quarter of 2023, which was up 9% year-over-year and ahead of market estimates. EPS remained flat at $1.63 but surpassed expectations.

The top line benefited from strength across Services and Markets, and US Personal Banking, but this was partly offset by a revenue reduction from the closed exits and wind-downs within Legacy Franchises.

Shares of JPMorgan and Wells Fargo were up 2% on Friday while Citigroup’s stock gained over 1%.