Guidance update

Comparable currency-neutral EPS is expected to grow 13-15% in FY2024. The outlook for comparable net revenues includes a currency headwind of 5-6% based on current rates and hedged positions. Comparable EPS growth is expected to include a currency headwind of 8-9%.

Comparable net revenues are expected to include a 4-5% headwind from acquisitions, divestitures and structural changes while comparable EPS is expected to include a headwind of 1-2% from the same.

Better-than-expected Q2 results

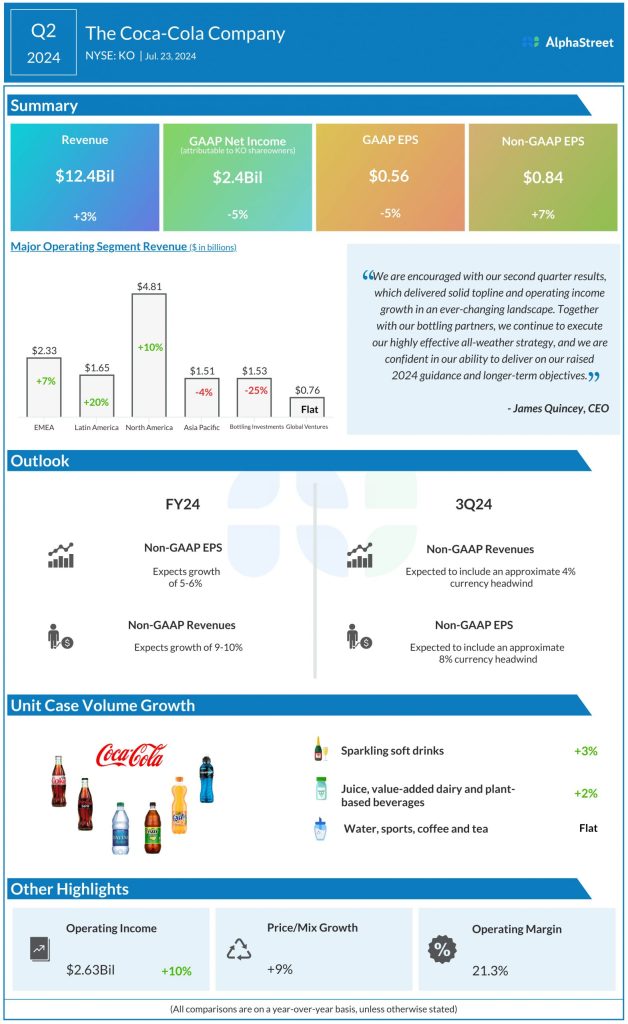

In Q2 2024, Coca-Cola’s net revenues increased 3% year-over-year to $12.4 billion, beating estimates of $11.7 billion. Organic revenues grew 15%. The top line benefited from a 9% growth in price/mix and 6% growth in concentrate sales. Adjusted EPS grew 7% YoY to $0.84, surpassing projections of $0.80.

Business performance

In Q2, Coca-Cola saw revenues increase across all its segments, except Asia-Pacific and Bottling Investments. Latin America reported the highest growth of 20% followed by North America at 10%. Europe, Middle East & Africa (EMEA) saw revenue growth of 7% while revenue from Global Ventures remained flat. Revenues fell 4% in Asia-Pacific and 25% in Bottling Investments.

Unit case volume grew 2% in the quarter, helped by mid-single-digit growth in developing and emerging markets. Unit case volume for sparkling soft drinks grew 3%, driven by strong performance in Asia Pacific and Latin America. Trademark Coca-Cola grew 2% while Coca-Cola Zero Sugar grew 6%. Sparkling flavors grew 3%.

Unit case volume for juice, value-added dairy and plant-based beverages grew 2% in the quarter, led by North America and Asia Pacific. Unit case volume for water, sports, coffee and tea remained flat. Water declined 1% while sports drinks grew 3%. Coffee decreased 4% while tea grew 1%.