Recent performance

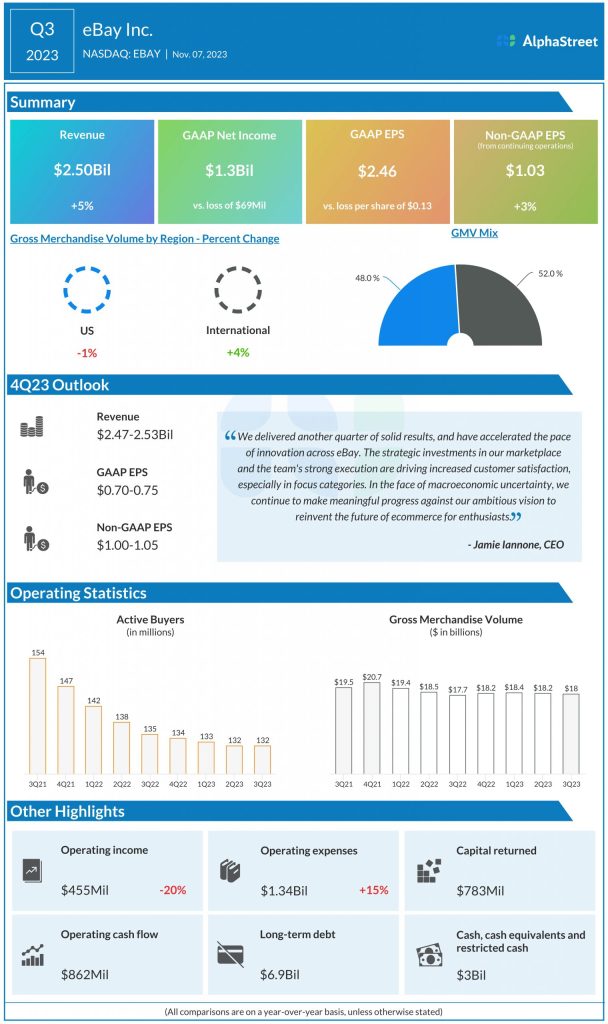

Gross Merchandise Volume (GMV) rose 2% on a reported basis to $18 billion but remained flat on an FX-neutral basis. Active buyers, on the other hand, decreased 3% to 132 million in Q3.

The company’s focus categories drove momentum in the business, with Refurbished growing the fastest on a percentage basis. Another category that is doing well is collectibles. On its quarterly call, eBay said it generated over $10 billion in GMV from collectibles over the last 12 months and more than one in four eBay buyers purchased at least one collectibles item over the past year.

eBay is also seeing strength in advertising. The company generated approx. $366 million in revenue from its total advertising offerings in Q3, with revenue from first-party advertising products growing 39% year-over-year.

Outlook

On its Q3 call, eBay said it was seeing softening consumer demand in its US and international markets, with the softness most pronounced in Europe, particularly the UK and Germany. Therefore, the company expects the pressure on discretionary demand to lead to a relatively muted seasonal uptick in volumes during the holiday season.

For the fourth quarter of 2023, eBay expects GMV of $17.9-18.3 billion, which represents an organic FX-neutral decline of between 2-4% YoY. Revenue is expected to be $2.47-2.53 billion, reflecting organic FX-neutral growth of negative 1% to positive 2% YoY. GAAP EPS is expected to range between $0.70-0.75 while adjusted EPS is expected to range between $1.00-1.05.

For the full year of 2023, revenue is expected to grow 3-4% YoY on an FX-neutral basis to $10.02-10.08 billion. GAAP EPS is expected to be $4.53-4.58 while adjusted EPS is expected to be $4.17-4.22.