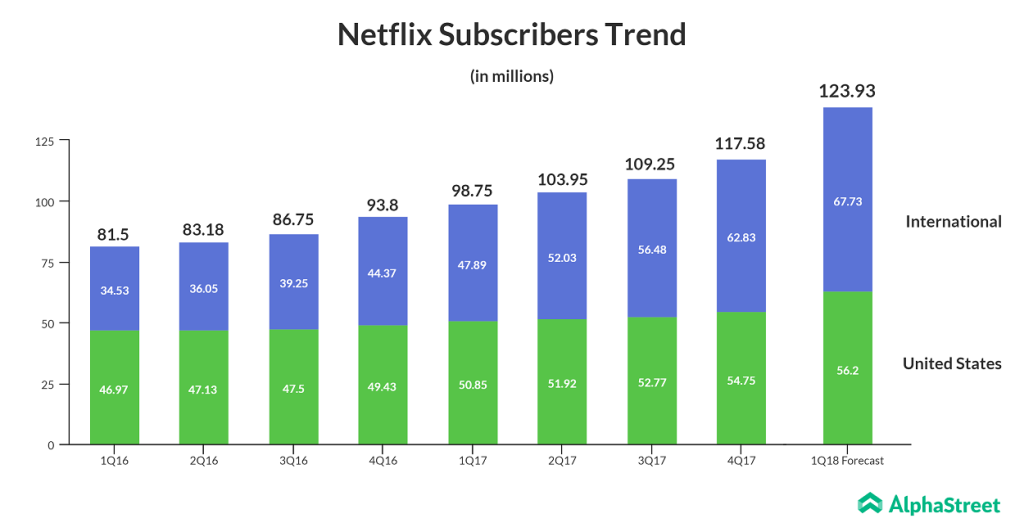

One of the key metrics to look for is the total number of subscribers it has garnered in the Domestic and International segments. Historically, first quarter subscriber numbers tend to be good for the company as more people buy web-enabled devices during the holiday season.

Last quarter, Netflix reported that it expects to add 6.35 million members in the first quarter compared to 5 million in prior year quarter. Net adds from the US segment is expected to be 1.45 million and the rest coming from International segment. Since, subscriber adds has a direct impact on the company’s top line, it would be interesting to see whether there is any surprise in store in the upcoming quarter.

Content is king

Netflix has evolved a lot from being a streaming service provider. To put things in perspective, the company plans to release 80 movies this year. Last year, all the six big studios in Hollywood totally released 94 movies. In addition, it’s worth noting that Netflix is expected to spend around $8 billion this year on original content.

If the company continues to produce content at this pace, it won’t be long before it becomes the largest content producer. Having more proprietary content in the kitty would help Netflix monetize it for perpetuity.

On the flip side, licensing content from other providers is for a particular time period. It’s worth noting that its rival Hulu has inked exclusive content deals with Fox (FOXA), Comcast (CMCSA) and Time Warner (TWX); not to forget that Disney (DIS) will end its distribution deal by end of 2018.

Wedbush in its recent research note stated that with increased competition for content, it would be tough for Netflix to maintain the subscriber growth rate.

Cash Flow Concerns

Netflix has its task cut out for future. In order to grow its library and offer fresh content, it has to spend billions of dollars every year to grow its subscriber base. It’s going to be an uphill task for the company to spend around $6 billion to $8 billion every year on content given its negative free cash flow. The company reported negative free cash flow of $2 billion last year.

In 2018, the company expects its negative free cash flow to be between $3 billion to $4 billion as it intends to spend more on own content. Due to increased competition and pressure from creditors, the company needs to do a tough balancing act to maintain growth and becoming free cash flow positive in the near future.

Rigged Bonus Lawsuit

City of Birmingham Relief and Retirement System, one of the shareholders, filed a lawsuit against Netflix for rigging its compensation process to pay bonuses to its key executives. Last December, post the tax reforms, the streaming giant took off cash bonus payments and hiking the salary and stock options as the new law doesn’t offer any tax deductions for performance-based bonuses. It would be interesting to see whether the management comments on this issue in the upcoming earnings call.

Future Tense

With increased competition in the domestic market, the company needs to beef up its efforts on marketing and content spending in order to maintain its growth momentum. Investors will be looking for cues on Monday whether the streaming giant justifies the valuation it is enjoying now. Stay tuned!