Revenue

Earnings

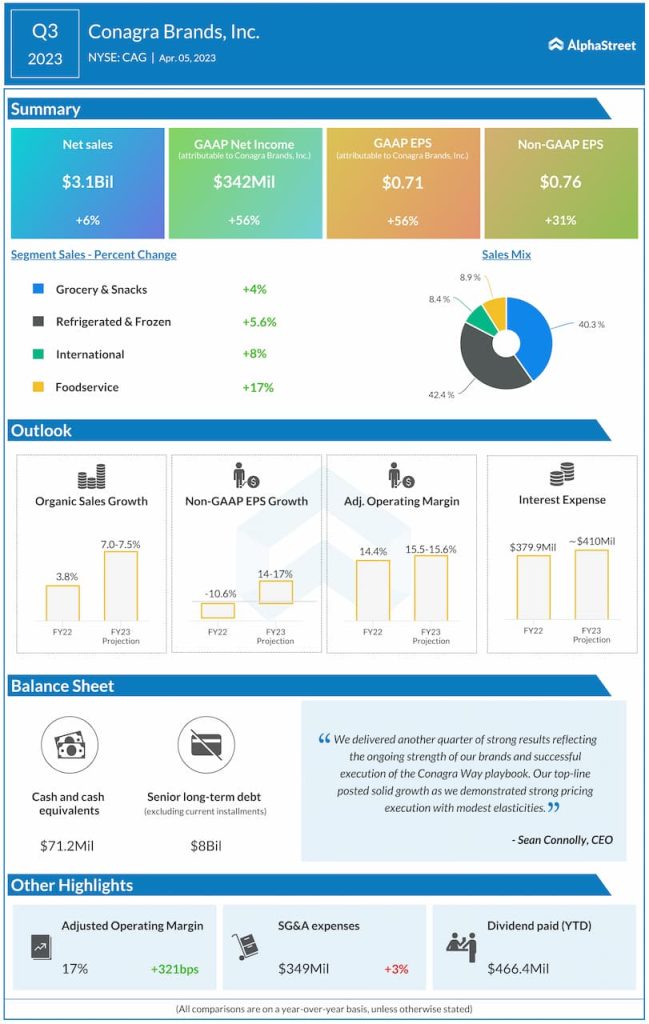

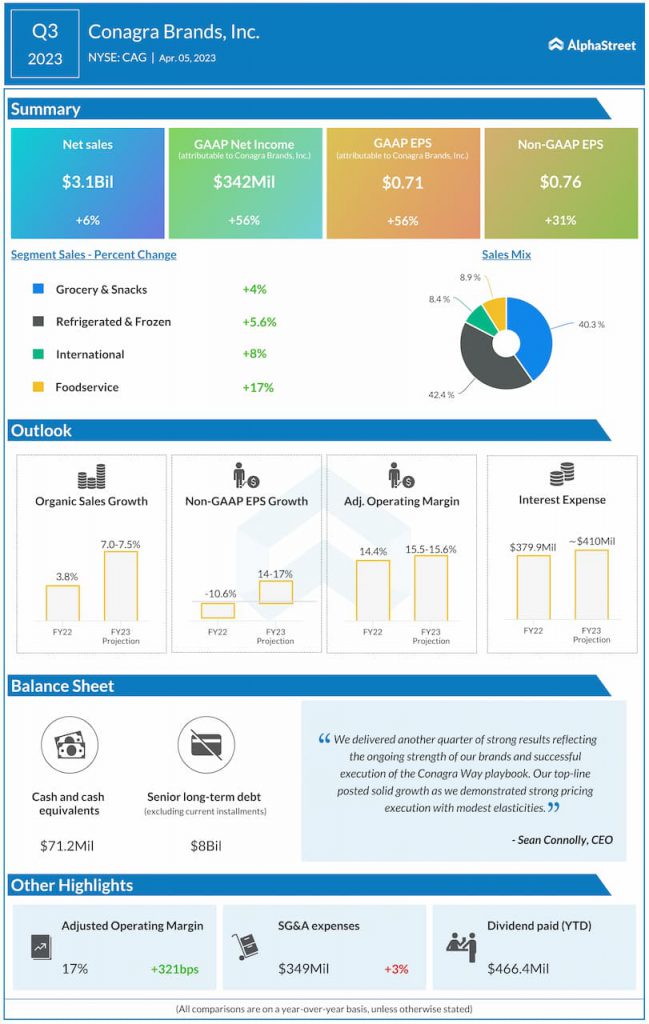

The consensus estimate is for EPS of $0.59 for Q4 2023, which is down compared to EPS of $0.65 reported in the year-ago quarter. In Q3 2023, adjusted EPS increased 31% to $0.76.

Points to note

In Q3, Conagra’s sales benefited from a favorable price/mix, fueled by its inflation-driven pricing actions. However, the elasticity impact from these pricing actions negatively impacted volume which fell 9% in the quarter. The fourth quarter could see a similar trend.

The company saw sales growth across all its segments with an improvement in price/mix offset by volume declines. Conagra saw strength in its snacks and staples categories with gains in meat snacks and microwave popcorn as well as sauces and marinades. Gains in frozen sides, breakfast sausage, and single-serve meals drove strength in the frozen segment. The company also gained share in plant-based protein. A continuation of these trends could benefit results in the fourth quarter.

Strong growth in the Foodservice segment is another positive point for the company. In Q3, sales in Foodservice grew over 17% year-over-year. This momentum is likely to have continued in the fourth quarter benefiting overall results.

Conagra’s favorable price-mix and supply chain productivity initiatives helped drive margin improvement during the third quarter but these benefits were partly offset by inflationary pressures. The company expects gross inflation of approx. 10% for FY2023.