Revenue

Earnings

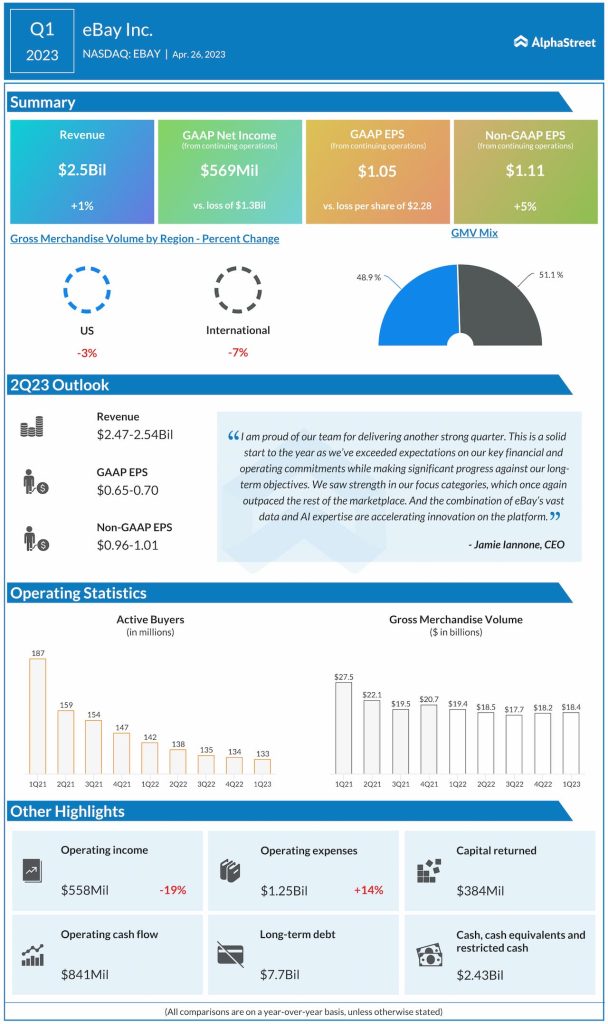

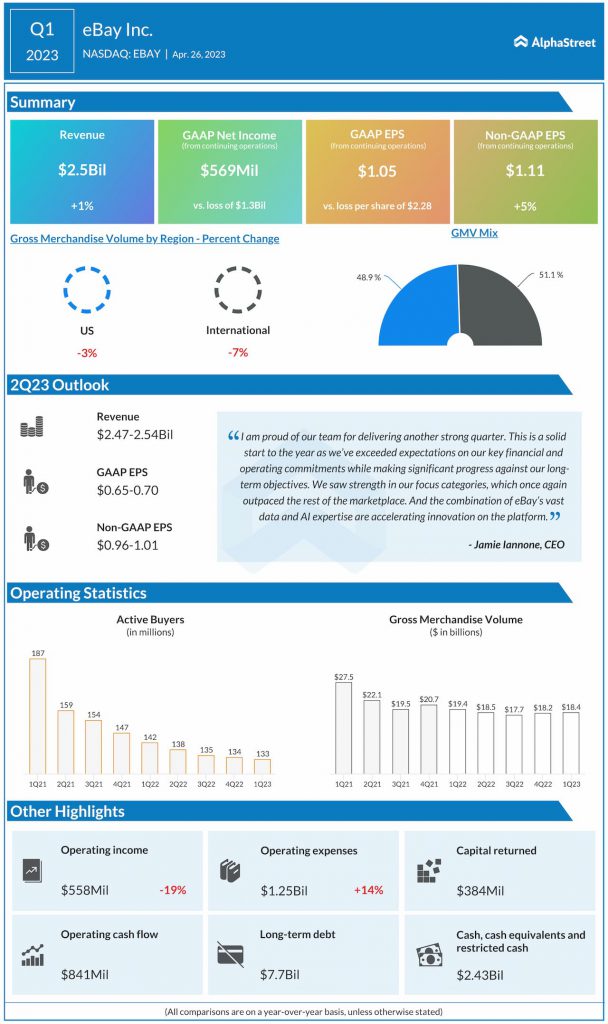

eBay guided for GAAP EPS to range between $0.65-0.70 and adjusted EPS to range between $0.96-1.01 in Q2 2023. Analysts are projecting EPS of $0.99 for Q2, which is unchanged from the year-ago period. In Q1, adjusted EPS rose 5% YoY to $1.11.

Points to note

eBay’s strategy of focusing on used and refurbished goods on its platform could continue to pay off. In a tough economic environment, these goods tend to have more demand among cash-strapped customers than new goods. The company’s efforts in bringing on more small business sellers to its Refurbished program is also likely to prove beneficial. In Q1, eBay saw double-digit growth in its Refurbished gross merchandise volume (GMV).

The company’s advertising business also appears to be healthy. In Q1, strong demand for Promoted Listings drove a 31% YoY growth in first-party advertising revenue. Total advertising revenue grew 23% to $317 million.

Earlier this month, eBay acquired Certilogo, a provider of AI-powered apparel and fashion goods digital IDs and authentication. Certilogo uses digital technology to help brands and designers manage the lifecycle of their garments. It also provides access to reliable product information and helps confirm authenticity. This acquisition is expected to help eBay protect customers from counterfeits, which will be a huge advantage.

In Q1, GMV was down 5% on a reported basis and 2% on an FX-neutral basis to $18.4 billion. This pressure on GMV is expected to continue in the second quarter. The company has guided for GMV of $17.8-18.2 billion, which represents a decline of 2-5% on an organic FX-neutral basis.