Revenue

Earnings

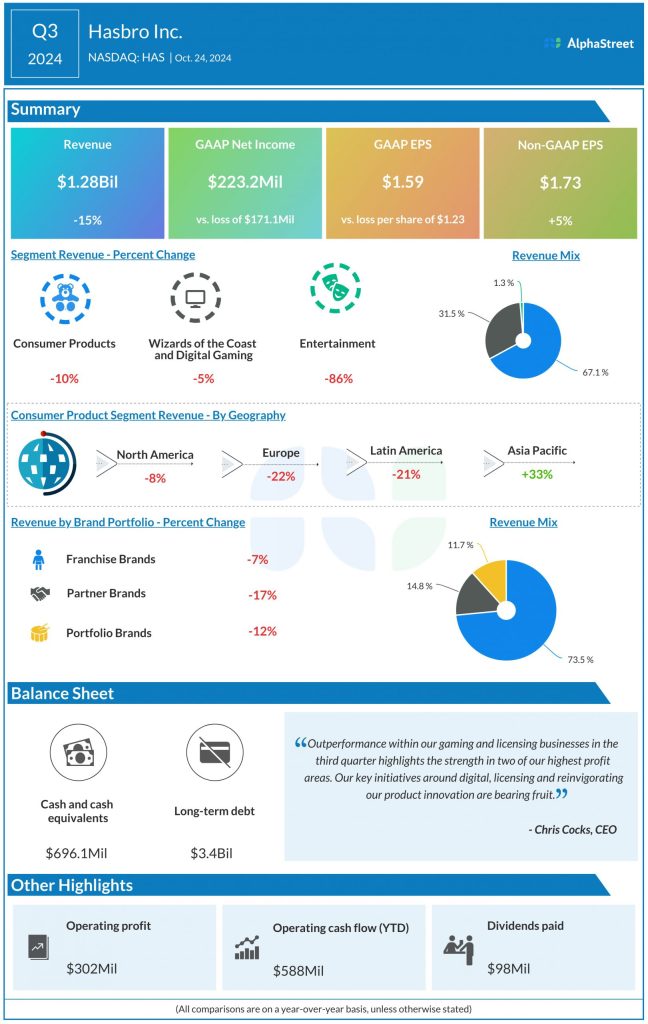

The consensus target for earnings per share in Q4 2024 is $0.33, which represents a decline from adjusted EPS of $0.38 reported in Q4 2023. In Q3 2024, adjusted EPS rose 5% YoY to $1.73.

Points to note

Hasbro has been seeing a continued decline in revenues, driven by declines in its segments. In Q3, revenues in the Consumer Products segment were impacted by lower volume from exited brands and reduced closeouts, which offset growth in licensed consumer products and volume increases in brands like TRANSFORMERS and FURBY. Softness in NERF and action figures also hurt revenue.

While lower closeout volume negatively impacted revenue in the CP segment, it helped drive a gross margin benefit last quarter. For the fourth quarter, Hasbro expects to see a moderation in the pace of revenue decline for the CP business. It has forecast a quarterly step down in Q4 margin but it anticipates year-over-year margin expansion at it laps last year’s inventory clean-up efforts.

In Q3, revenues in the Wizards of the Coast and Digital Gaming segment fell 5%, as growth in MAGIC: THE GATHERING and contributions from Monopoly Go! were offset by lower revenue for Baldur’s Gate 3. Hasbro anticipates lower revenue and margin for this segment in Q4, due to the timing of MAGIC set releases and revenue deleverage.

Hasbro has been strategically shifting its mix towards games, digital, and IP licensing, which it believes will help in diversification and growth. Licensing is a strong point for the company, with Monopoly Go! bringing in around $10 million in licensing revenue per month. HAS is also seeing gains from brands like FURREAL FRIENDS, LITTLEST PET SHOP, and MY LITTLE PONY. Despite near-term softness, the company remains optimistic about action figures as this category has a large customer base spanning various age groups.