Revenue

Earnings

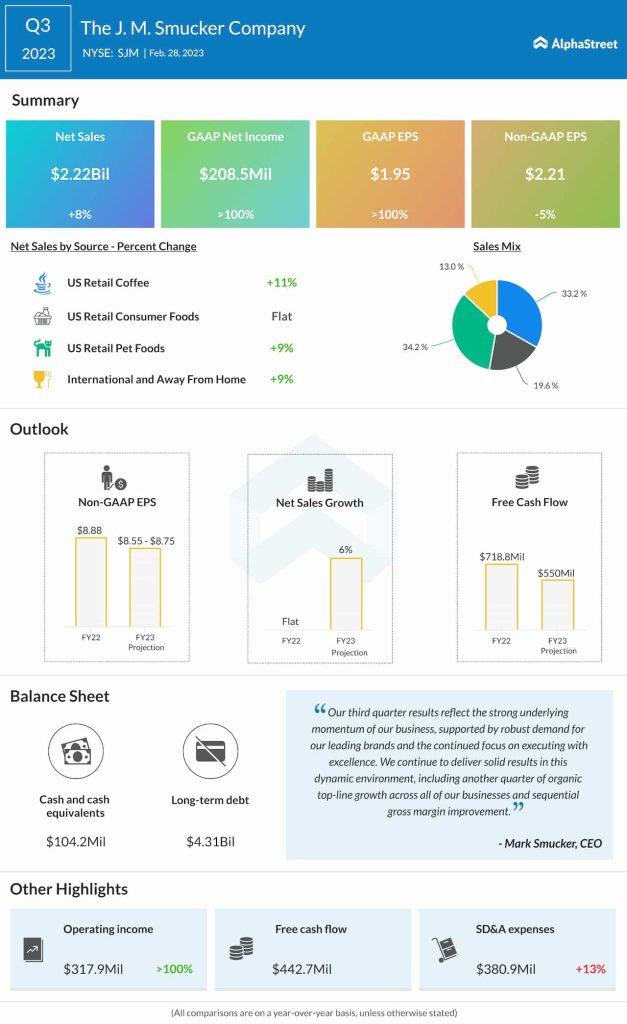

The consensus estimate is for EPS of $2.37 in Q4 2023, which would reflect a growth of 6% from the year-ago period. In Q3 2023, adjusted EPS fell 5% to $2.21.

Points to note

In the third quarter, J.M. Smucker’s top line benefited from price increases across its segments and this trend is likely to have continued in the fourth quarter. Its comparable sales rose 11% as the company saw momentum in its Coffee and Pet businesses along with growth for its Uncrustables brand.

SJM expects the pet, coffee and snacking categories to continue to drive meaningful growth for its business. Within the Pet Foods segment, the company is seeing strength in the dog snacks and cat food categories, driven by the Milk-Bone and Meow Mix brands. SJM expects to see double-digit sales growth for Meow Mix in FY2023, with continued growth in Q4.

In April, J.M. Smucker completed the divestiture of several of its pet food brands including Nutrish, 9Lives, Kibbles ‘n Bits, as well as its private label pet food business. This transaction will allow the company to focus more on the dog snacks and cat food categories. It will bring the business to approx. 60% pet snacks and 40% cat food, which will help improve profit margin and product mix. In its Q4 report, SJM is expected to give more details on the impact of this transaction on its outlook for FY2024.

Within Coffee, the company expects its at-home coffee category to remain resilient despite macroeconomic conditions and changes in consumer habits. In Q3, this business saw an 11% growth in sales.

Factors like cost inflation, supply chain volatility, and macroeconomic headwinds continue to pose a challenge to SJM’s business and these may have impacted Q4 results.