Revenue

Earnings

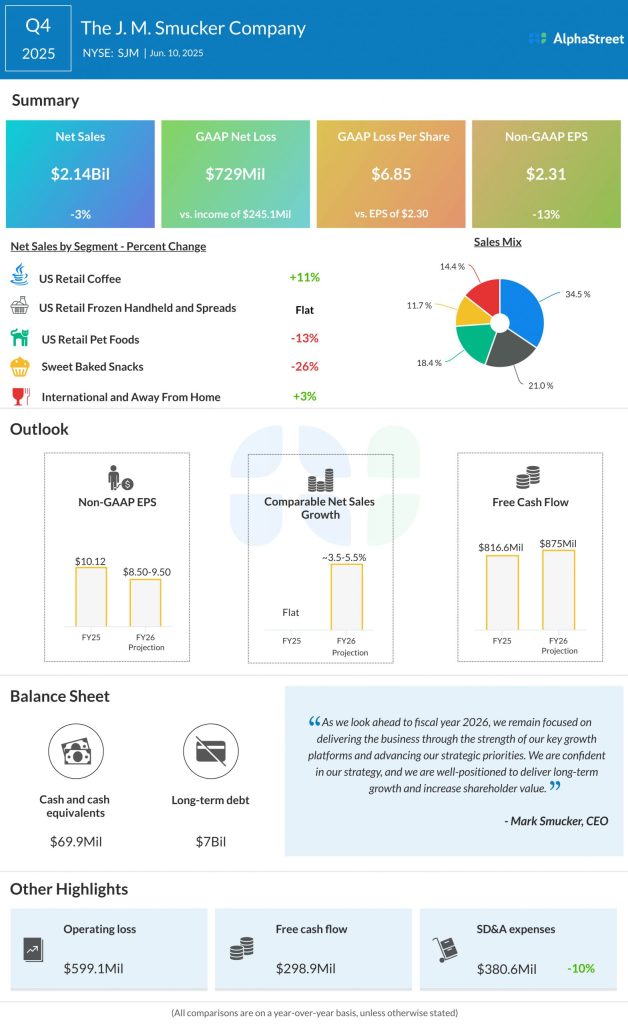

SJM expects adjusted earnings per share to decline approx. 25% in Q1 2026. Analysts are estimating EPS of $1.90, which indicates a decrease of 22% from the prior-year period. In Q4 2025, adjusted EPS decreased 13% YoY to $2.31.

Points to note

JM Smucker expects comparable net sales in Q1 2026 to be flat, reflecting a mid-single-digit increase in net price realization, offset by unfavorable volume/mix. The company’s top line is also expected to reflect a $10 million decline in contract manufacturing sales related to divested pet food brands.

The decline in adjusted EPS is expected to be driven primarily by a decrease in adjusted gross profit in the US Retail Coffee and Sweet Baked Snacks segments. Adjusted EPS is expected to improve sequentially throughout the fiscal year.

SJM expects the operating environment to remain dynamic in fiscal year 2026. The company anticipates strength in its leading brands such as Uncrustables, Café Bustelo, Milk-Bone, and Meow-Mix, which bodes well for the first quarter.

The company continues to deal with high commodity costs in its coffee segment, which it is tackling through price increases. The sweet baked snacks business is likely to remain pressured by lower discretionary income and shifts in consumer preferences. While the pet segment is likely to benefit from the pet humanization trend and gains in the cat foods category, the dog snacks category might face headwinds from inflationary pressures.

SJM can be expected to benefit from its efforts in product innovation, brand-building, distribution expansion and cost management. These measures could have benefited its performance in Q1.