Revenue

Earnings

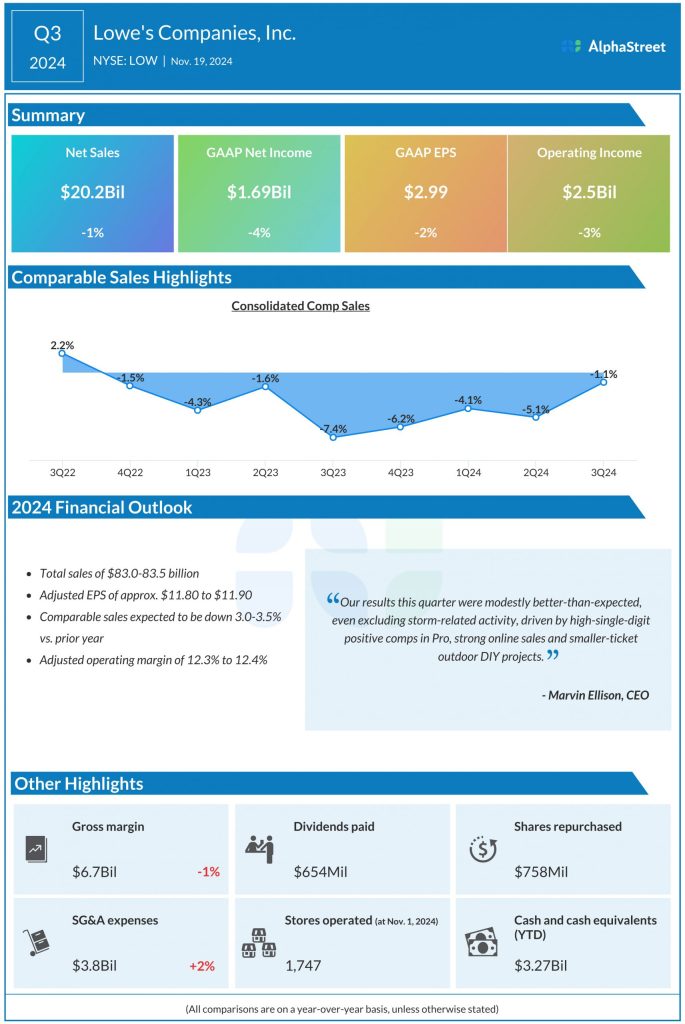

The consensus target for earnings per share in Q4 2024 is $1.83, which compares to EPS of $1.77 reported in Q4 2023. In Q3 2024, EPS dropped 2% YoY to $2.99.

Points to note

Lowe’s is likely to continue to face pressure from softness in demand for bigger-ticket discretionary projects, particularly in the do-it-yourself, or DIY customer segment. A large part of the company’s sales come from the DIY customer, so weakness in this area can have a meaningful impact on its performance. Last quarter, storm-related sales managed to offset some of the pressure on the top line. The company anticipates modest storm-related demand in the fourth quarter of 2024.

Lowe’s is anticipated to benefit from strength in Pro and online sales. In Q3, the Pro segment recorded high single-digit positive comps. The investments being made to serve the small to medium-sized Pro customer, which is the company’s core Pro customer, are yielding benefits.

In Q3, LOW continued to grow its online sales, with a 6% comparable sales growth. It saw an increase in online conversion and traffic, including a double-digit increase in traffic on its mobile app. The retailer’s efforts in offering product information online as well as increasing convenience with regards to order and delivery are expected to continue to pay off. The company is also seeing momentum in its loyalty program with encouraging trends in metrics like repeat purchases and average order value. These trends may have continued into the fourth quarter, benefiting its performance.