Revenue

Earnings

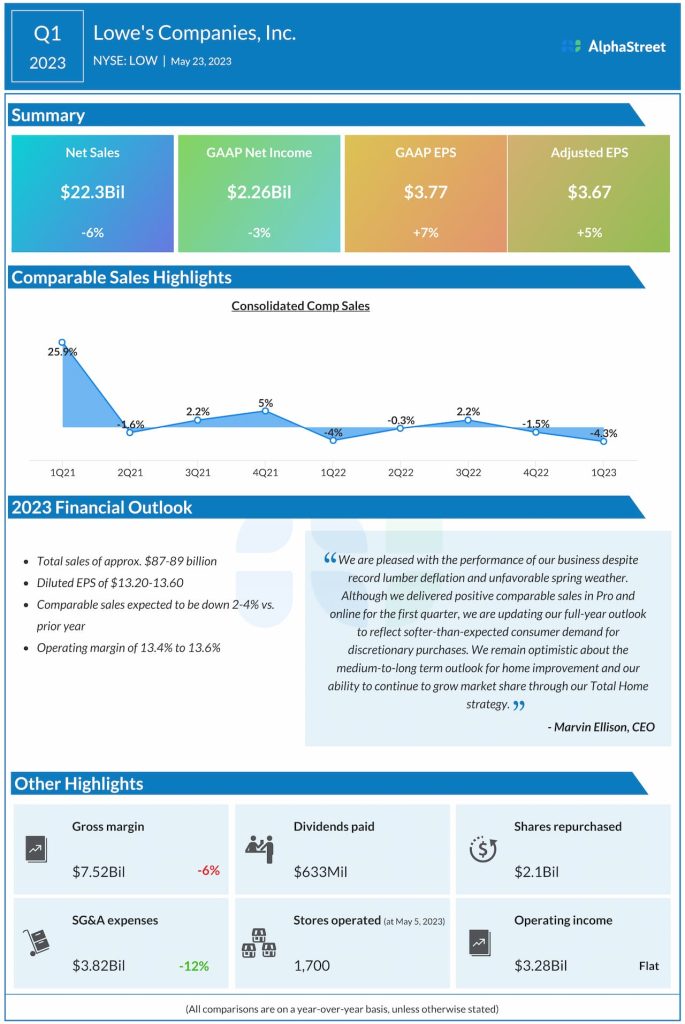

The consensus estimate for Q2 2023 EPS is $4.49, which compares to EPS of $4.67 reported in the year-ago quarter. In Q1 2023, adjusted EPS rose 5% YoY to $3.67.

Points to note

Lowe’s is likely to see some of the trends from the first quarter continue into the second quarter, as the pullback in home improvement spending continues to impact business. The company is likely to see lower demand for DIY discretionary categories with lumber deflation also taking a toll on performance.

Last quarter, Lowe’s forecast a headwind of approx. $400 million to sales in Q2 due to the timing shift in its fiscal calendar. It expects lumber deflation to pressure sales by around 150 basis points in the second quarter. The company also expects a $250 million benefit to sales from the delayed spring. Lowe’s expects adjusted operating margins to be slightly above last year’s levels, due to the shift in the fiscal calendar and the timing of several productivity initiatives it has undertaken.

Earlier this week, Lowe’s competitor Home Depot (NYSE: HD) reported its second quarter 2023 earnings results, which saw both revenue and earnings decline year-over-year but surpass expectations. Home Depot saw softness in big-ticket discretionary purchases along with a shift towards smaller-scale projects in its Pro customer segment. It also witnessed a rebound in spring-related categories.