Revenue

Earnings

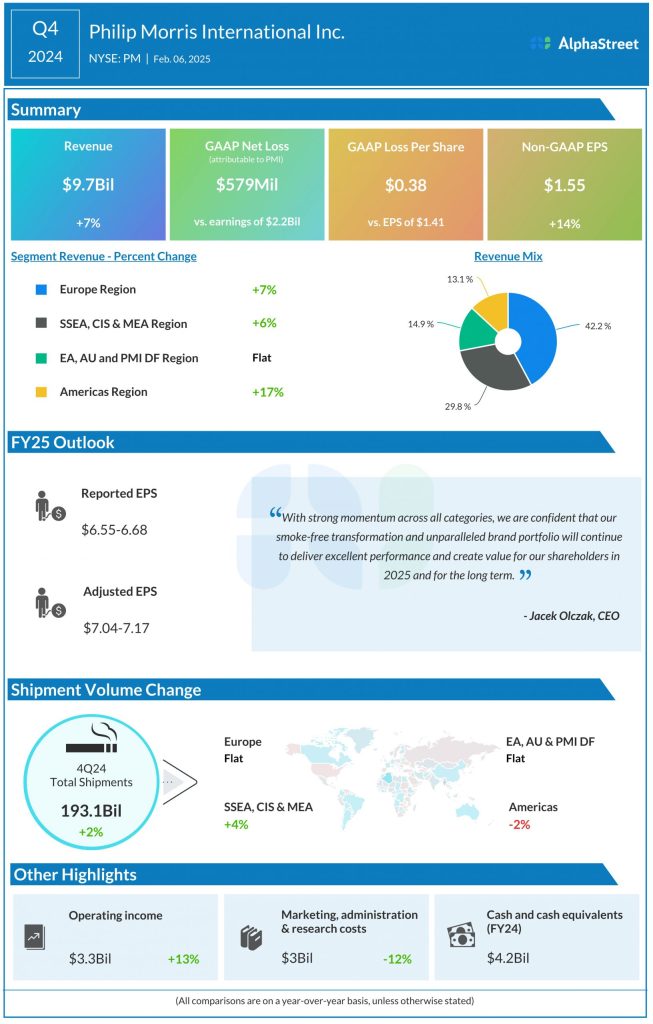

Philip Morris has guided for adjusted earnings per share to range between $1.58-1.63 in Q1 2025. Analysts are predicting EPS of $1.61. This compares to adjusted EPS of $1.50 reported in Q1 2024. In Q4 2024, adjusted EPS rose 14% YoY to $1.55.

Points to note

Philip Morris can be expected to benefit from the continued momentum in its smoke-free business, which accounted for 40% of its total revenues and 42% of its gross profit in Q4 2024. Last quarter, the smoke-free business saw a 9% growth in revenues and a 15% growth in gross profit. The company’s smoke-free products are currently available in 95 markets.

The strength in the smoke-free business is being driven by IQOS and ZYN. IQOS continued to gain market share in Japan and Europe and saw double-digit growth in regions like Spain and Germany last quarter while ZYN grew shipment volume by 42% to 165 million cans. In Q4, PM saw 13% growth in heated tobacco units (HTU) adjusted in-market sales (IMS) volume.

For the first quarter, PM has forecast HTU adjusted IMS growth of around 10% along with shipment volumes of 35-36 billion for HTUs and 170-180 million cans for US ZYN.

Philip Morris is also expected to benefit from the resilience of its combustibles business, which is being fueled by high pricing, as well as volume growth in markets where smoke-free products are not permitted. In Q4, combustibles revenue grew 6% YoY while cigarette shipment volume rose 1.1%.