Revenue

Earnings

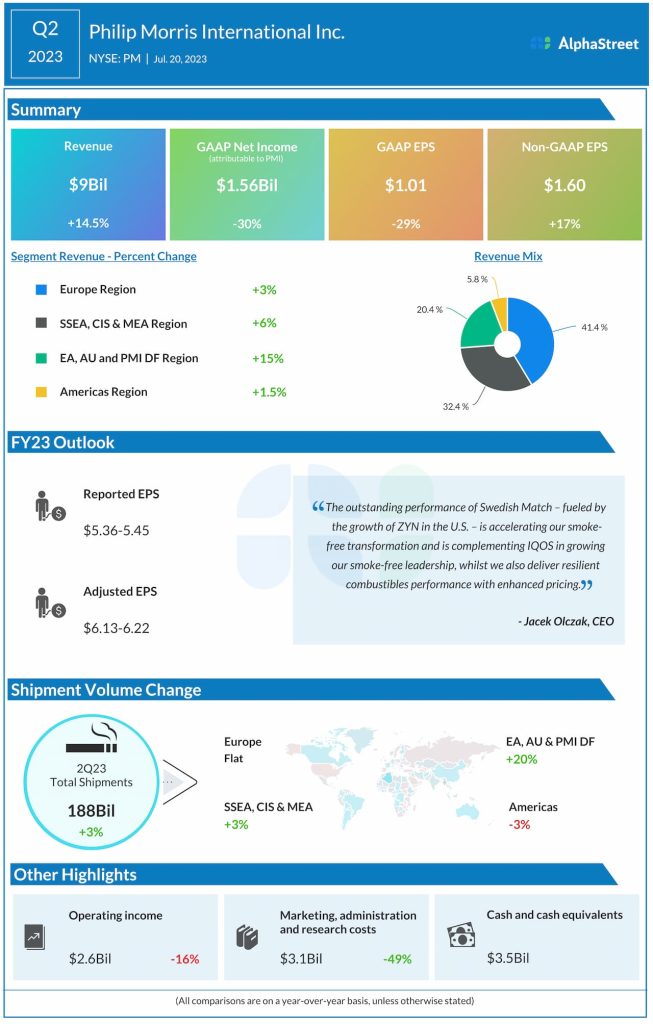

Philip Morris has guided for adjusted EPS to range between $1.60-1.65 in Q3 2023. Analysts are predicting EPS of $1.61, which compares to adjusted EPS of $1.53 reported in the prior-year period. In Q2 2023, adjusted EPS increased 17% to $1.60.

Points to note

In the second quarter, PMI’s top line benefited from higher pricing and heated tobacco unit (HTU) shipment volume growth. HTU shipments increased 26.6% in Q2. However, cigarette shipments continue to decline with the company seeing a drop of 0.4% last quarter. The company has forecasted HTU shipment volume of around 31-33 billion units in the third quarter of 2023.

The momentum in HTUs is led by strength in IQOS, which was estimated to have 27.2 million users at the end of the second quarter. Philip Morris is seeing strong gains for IQOS in developed countries along with encouraging growth in low and middle-income markets.

The Swedish Match acquisition has helped boost PMI’s oral product shipment volume. In Q2, oral product shipment volume jumped over 100%, reflecting growth in nicotine pouches. ZYN nicotine pouches saw volume growth of over 50% in the US in Q2.

Philip Morris is making strong progress on its smoke-free transformation. Led by IQOS and ZYN, smoke-free products made up 35% of its adjusted net revenues in the first half of 2023. This momentum is likely to continue in the second half as well, benefiting Q3 results.