Revenue

Earnings

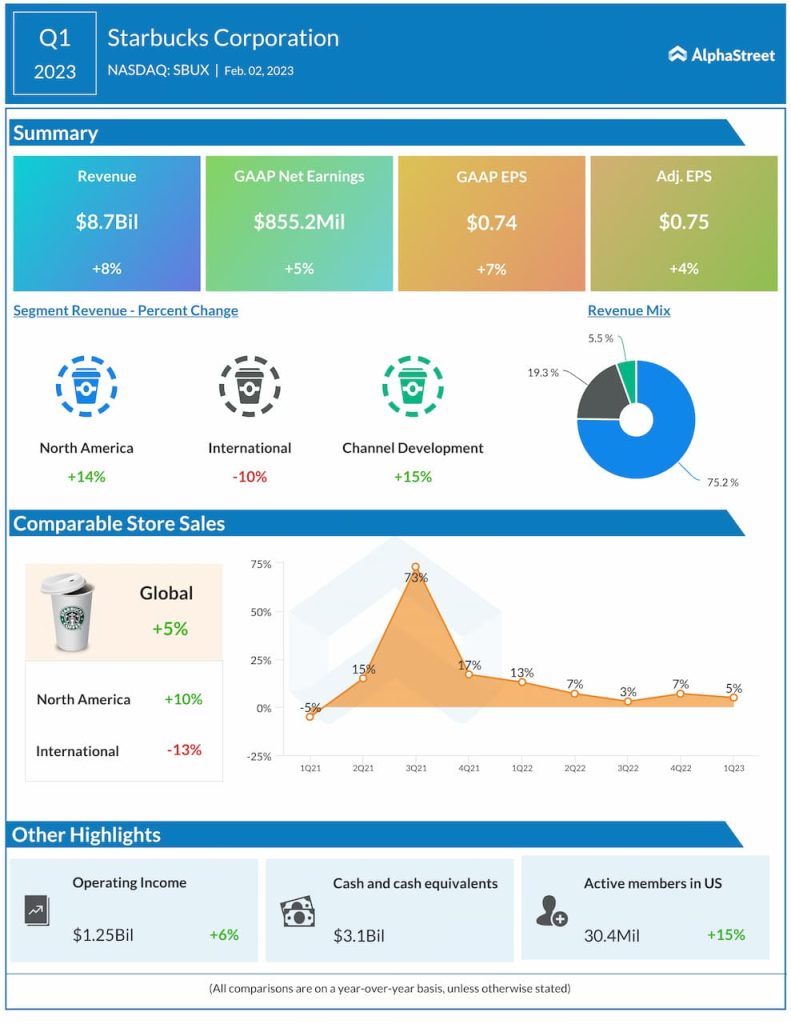

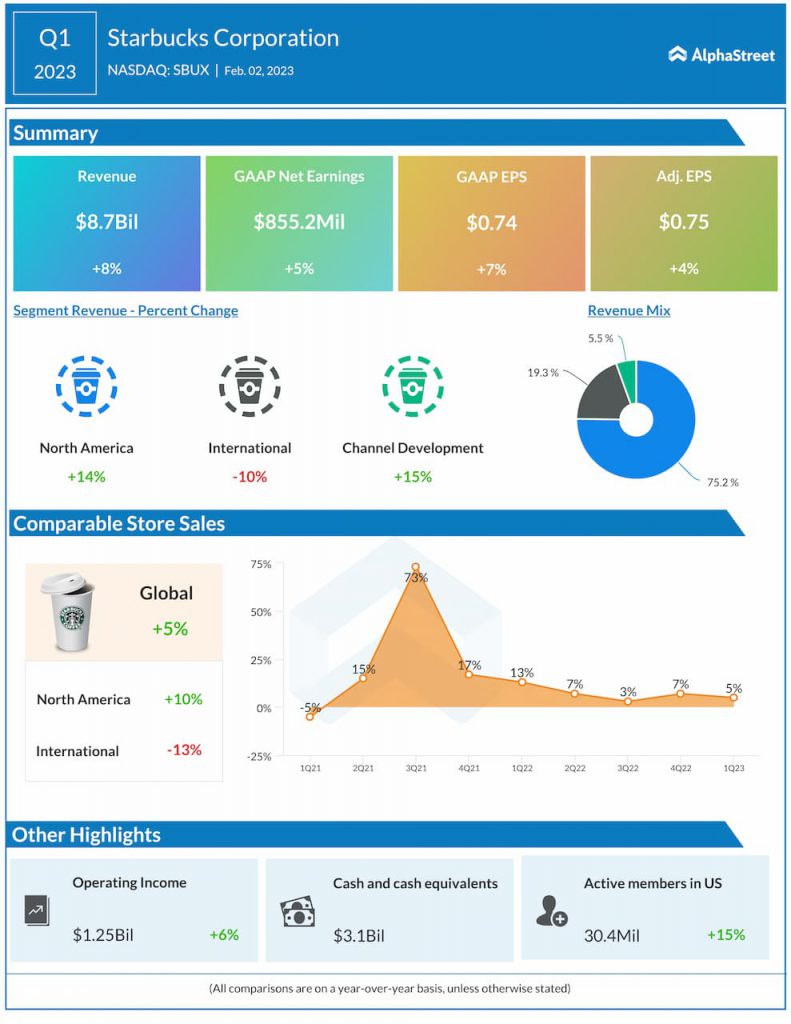

The consensus estimate is for EPS of $0.65 which is up from EPS of $0.59 reported in the year-ago quarter. In Q1 2023, adjusted EPS grew 4% YoY to $0.75.

Points to note

In the first quarter of 2023, Starbucks’ top line benefited from growth in comparable sales and net new stores. Global comparable store sales grew 5%, driven by an increase in average ticket but were offset by a drop in comparable transactions.

The company saw revenues grow across most of its segments in the first quarter, except International due to pandemic-related headwinds in China. Revenues in North America grew 14% helped by double-digit growth in comparable store sales, with increases in average ticket, transactions and new stores. The momentum seen in North America is likely to have continued in Q2.

International revenues fell 10% in Q1 but excluding China and FX impacts, revenues were up 25%. On its Q1 earnings call, Starbucks said that although comparable sales were improving in China, the headwinds continued to persist and were expected to impact the whole of the second quarter. This in turn is likely to impact the company’s operating income in Q2 as well.

In Q1, Starbucks’ operating margin decreased to 14.4% from 14.6% in the year-ago period, mainly due to labor investments such as higher store partner wages and benefits, as well as inflationary pressures, and sales deleverage in China. The company anticipates a sequential decline in operating margin in Q2, mainly driven by pandemic-related headwinds in China.

On its Q1 call, Starbucks said it expects operating margins to improve during the second half of 2023 with sequential improvements in the third and fourth quarters, helped by pricing, productivity gains and a recovery in China. The company expects EPS to follow a similar trend with a sequential decline in Q2 and a meaningful improvement in the second half of the year.