Revenue

Earnings

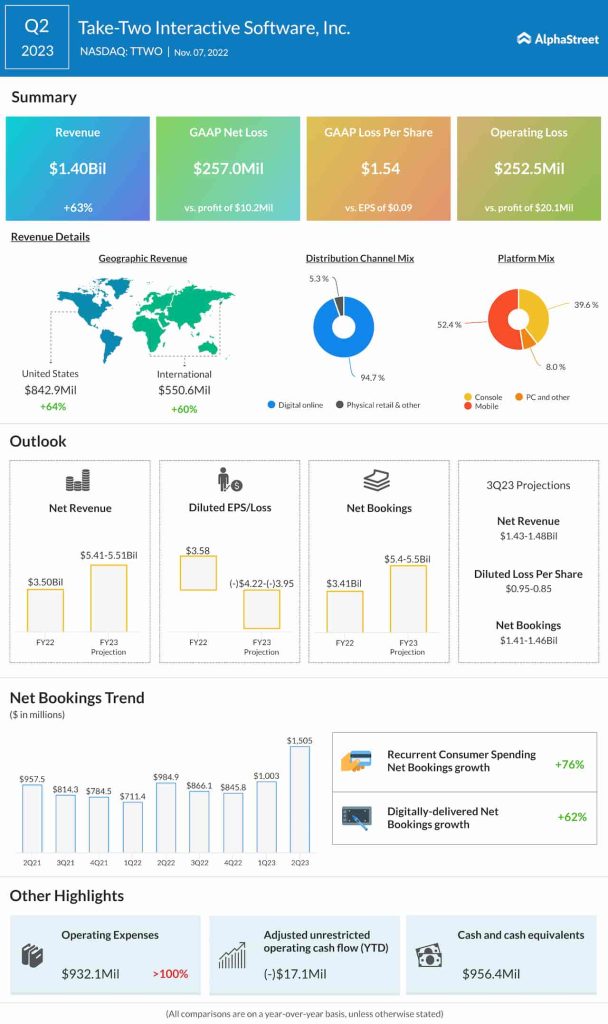

For Q3 2023, Take-Two expects a net loss of $160-142 million and loss per share of $0.95-0.85. In the year-ago quarter, the company reported net income of $144.5 million, or $1.24 per share. In Q2 2023, net loss was $257 million, or $1.54 per share. Analysts are projecting EPS of $0.87 for Q3.

Net bookings

Take-Two expects net bookings for the third quarter of 2023 to range between $1.41-1.46 billion. This compares to net bookings of $866.1 million in Q3 2022 and $1.5 billion in Q2 2023.

Points to note

During the second quarter of 2023, the popularity of Take-Two’s major franchises like NBA2K22 and NBA2K23, Grand Theft Auto, and Red Dead Redemption helped drive a 62% growth in revenue. Toon Blast, Toy Blast, and Rollic’s hyper-casual portfolio which came with Zynga also contributed to the top line growth. Recurrent consumer spending, which is generated from ongoing consumer engagement and includes virtual currency and in-game purchases, was up 95% in Q2.

Net bookings grew 53% in Q2, driven by the aforementioned franchises. NBA 2K and Rollic’s hyper-casual mobile portfolio performed better than expected even though there was softness across other parts of the portfolio. The biggest concern on the Street is the impact of the challenging macroeconomic environment on the video game industry.

Take-Two expects recurrent consumer spending to grow approx. 125% and digitally-delivered net bookings to increase around 80% in Q3 2023. The company’s forecast assumes that 72% of console game sales will be delivered digitally, up from 63% last year.

Despite the economic uncertainty, Take-Two remains optimistic on its long-term development pipeline and its new releases, which are expected to drive growth. It remains to be seen how the recent releases have performed in the current economic environment.