Revenue

Earnings

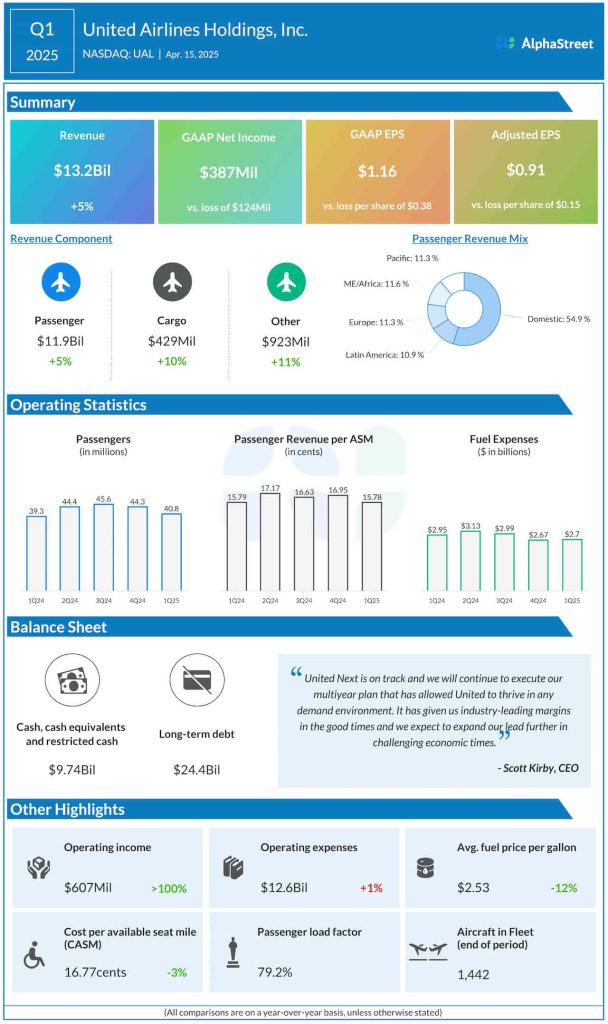

United expects its earnings per share for Q2 2025 to range between $3.25-4.25. Analysts are predicting EPS of $3.88, which implies a decline of 6% from the year-ago period. In Q1 2025, adjusted EPS amounted to $0.91.

Points to note

United Airlines has remained resilient in an uncertain macroeconomic environment that has caused market volatility and soft demand for travel. The company’s performance was helped by brand loyalty and growth across its diversified revenue streams. In Q1, passenger revenue increased nearly 5% year-over-year. Total revenue per available seat mile, or TRASM, was up 0.5%.

United continued to see momentum in its premium segment and loyalty programs. Premium cabin revenue grew 9% while international premium-plus RASMs were up over 5% in Q1. As alluded to in its earnings call, the company did not see a dent in customers’ willingness to purchase a premium experience. The economic uncertainty appears to have more of an impact on budget-conscious discretionary travelers than on premium customers.

Loyalty revenue was up 9.4% in Q1. The company’s MileagePlus loyalty program remains popular. Co-brand spending also remained strong and was up 9%. The momentum in these segments can be expected to continue in Q2.

Business travel revenue was up over 7% last quarter but traffic trends saw a moderation. Since UAL’s top line is comparatively less reliant on this revenue source, it should provide a cushion against any potential economic headwinds on business traffic. In addition, the company’s cost-saving efforts are expected to help offset declines in overall revenue.