Revenue

Earnings

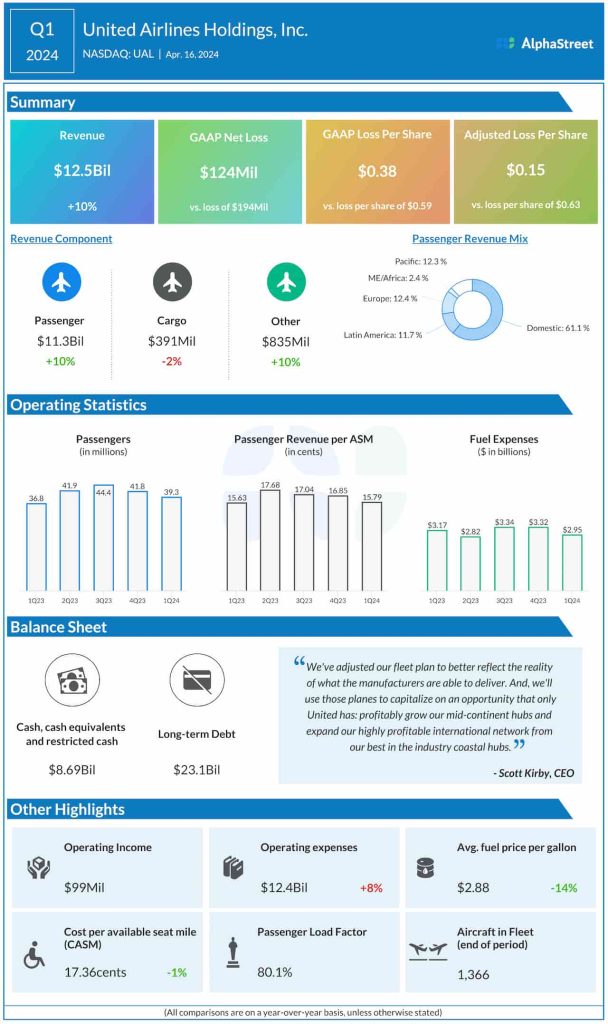

United has guided for adjusted EPS of $3.75-4.25 in Q2 2024. The consensus estimate is $3.99, which compares to adjusted EPS of $5.03 reported in the same period a year ago. In Q1 2024, the company reported an adjusted loss of $0.15 per share.

Points to note

United’s second quarter results are expected to benefit from strong demand for air travel, particularly strong summer travel as well as continued improvement in business travel. In Q1, United’s passenger revenue grew 10% YoY while unit revenue was up 0.6%. Passenger revenue per available seat mile (PRASM) was up 1%. Managed corporate travel was up 14%.

Last quarter, the company saw a rise in domestic PRASM while international PRASM saw a decline. Latin American PRASM was down nearly 13%. The Atlantic region saw growth in PRASM while the Pacific region saw a drop.

On its last quarterly call, United said that for the second quarter, it was seeing strong domestic and Atlantic demand with positive PRASM results, tempered by the Pacific where it expects a negative result YoY. The company also expects Latin America to have a materially negative PRASM result YoY in Q2.

The challenges caused by the Boeing fleet weighed on United’s profitability last quarter. The uncertainty created by the Boeing MAX grounding and the delays to United’s aircraft deliveries have been pressuring expenses, and the continued reduction in capacity from delivery delays are expected to temporarily pressure costs through the year. The impact of this could likely be seen in the second quarter as well.

At the same time, United’s efforts in improving the travel experience for customers by providing assistance through AI tools and such capabilities as well as its plans to expand its routes are likely to prove beneficial.