Shares of United Parcel Service Inc. (NYSE: UPS) were down slightly on Thursday. The stock has gained 12% year-to-date. The logistics company is scheduled to report its first quarter 2023 earnings results on Tuesday, April 5, before market open. Here’s a look at what to expect from the earnings report:

Revenue

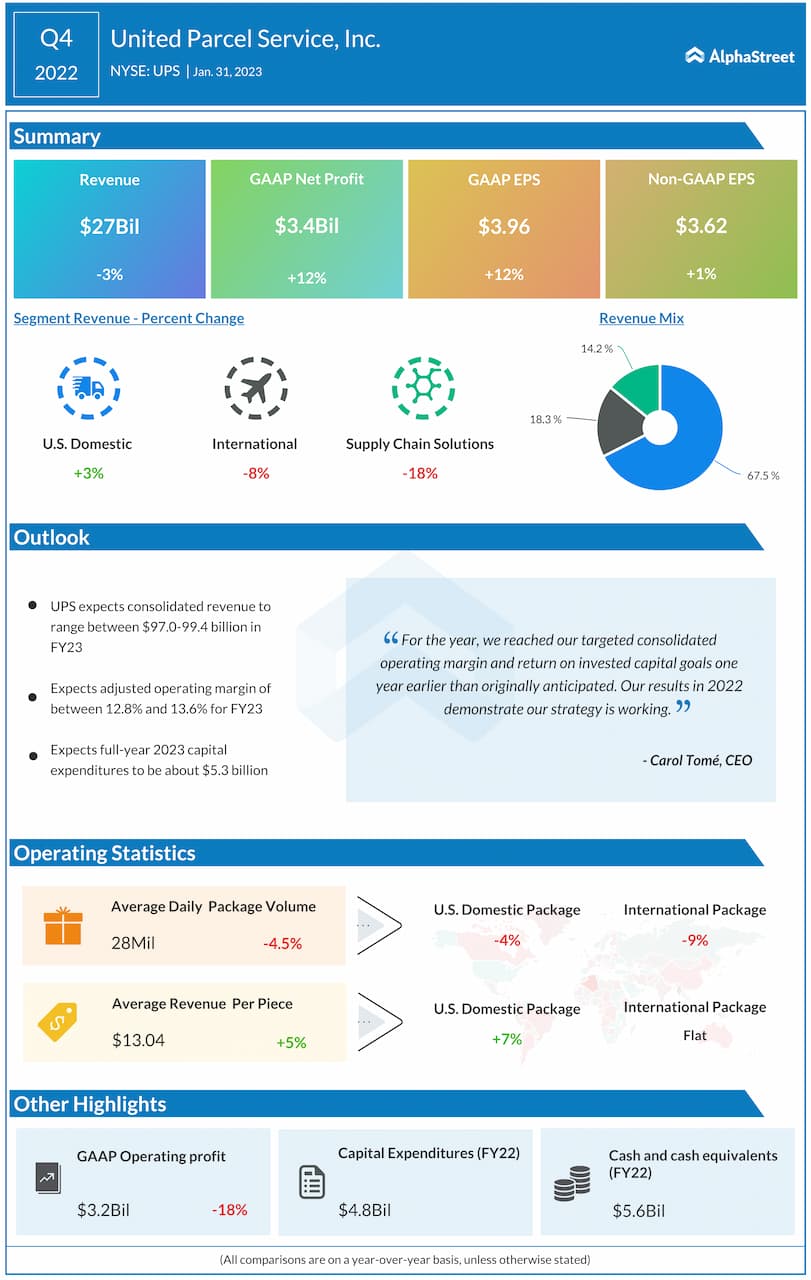

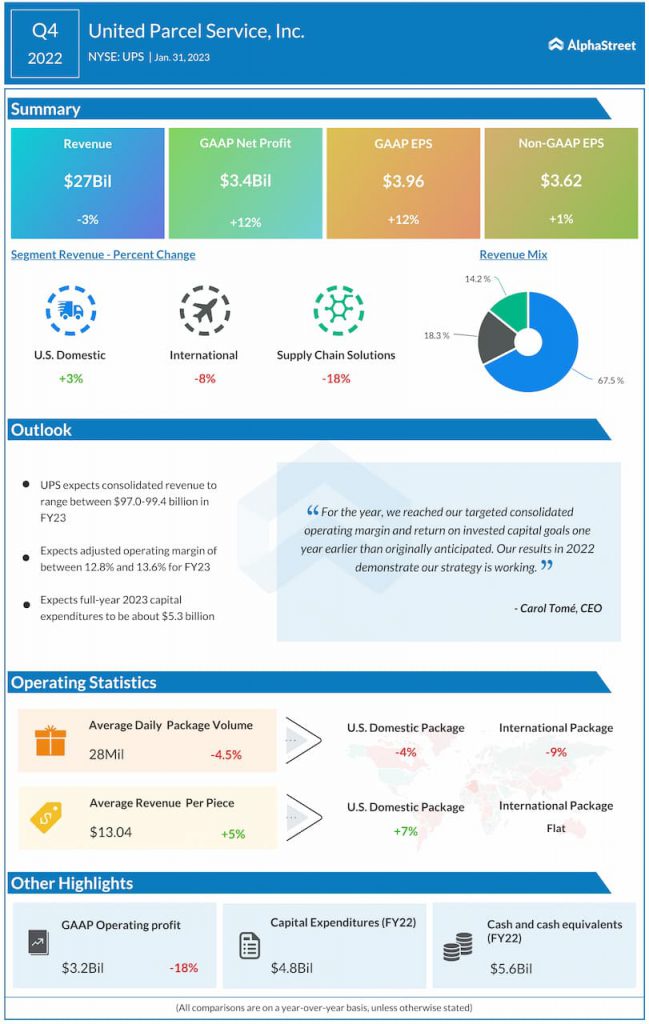

Analysts are projecting revenue of $23 billion for UPS in Q1 2023. This represents a decline of over 5% from the year-ago period. In the fourth quarter of 2022, UPS’ consolidated revenues dropped nearly 3% year-over-year to $27 billion.

Earnings

The consensus estimate is for EPS of $2.22 which represents a decline from adjusted EPS of $3.05 reported in Q1 2022. UPS delivered adjusted EPS of $3.62 in Q4 2022.

Points to note

During the fourth quarter of 2022, UPS saw volumes decline due to a drop in demand and a challenging macro environment. In the US, while battling inflation, consumers returned to stores for shopping post-pandemic and retail sales during the holiday season were lower than expected. Internationally, demand remained pressured in Europe while exports out of Asia worsened due to the pandemic in China.

UPS expects 2023 to be a challenging year due to rising interest rates, high inflation, recession concerns, geopolitical factors, and labor negotiations in the US. On its Q4 call, the company said it anticipates a mild recession in the US during the first half of the year with a moderate recovery in the latter half.

Volumes are expected to drop in the US domestic segment while revenue growth rate is expected to be in the low single digits during the first half. Although volume growth is expected to pick up in the second half, it means that Q1 results are likely to be pressured.

Within the International segment, UPS expects to see a recession in Europe during the first half of the year. Demand in China is expected to be weak in the first quarter with a recovery from the second quarter. The company expects volumes and revenues to decline in the low single digits in International during the first half of 2023, which does not bode well for Q1 results for this segment. International volume growth is expected to improve during the back half of the year.