Best Buy Co. Inc. (NYSE: BBY) has experienced a sales slowdown so far this year, after generating record sales in 2021 helped by the COVID-driven spike in demand for electronic gadgets and technology products. With most of those tailwinds waning after the market reopening, the company’s sales are expected to remain under pressure in the near future.

The Richfield-based electronics retailer tackled the pandemic-era shutdown by making timely investments in e-commerce, thereby shifting to multichannel retail from the traditional store-based model. Before that, Best Buy had undergone a major transformation that helped it achieve steady growth, through initiatives like enhancing the merchandise mix and optimizing the use of floor space. The healthy inventory levels, unlike some of its peers that suffer excess inventory, show that the efforts are paying off.

Best Buy Co. Q2 2023 Earnings Call Transcript

Since peaking more than a year ago, Best Buy’s shares have experienced persistent weakness — in line with the slowdown in the broad market. The stock, which slipped to a two-year low early this year, has regained some strength ahead of next week’s earnings. It suffered a fresh jolt this week when retail shares tumbled after leading players like Walmart Inc. (NYSE: WMT) and Target Corporation (NYSE: TGT) reported weak results and issued cautious guidance.

A Risky Bet?

Over the past decade, the company has raised dividends regularly, and now offers a decent yield of 4.8%. But, since the business conditions are not in its favor, the stock will likely continue to decline until normalcy returns. A combination of the post-shutdown slump and the impact of macroeconomic uncertainties on consumer sentiment –– aggravated by the high inflation — make the stock a risky investment.

Market watchers estimate that the company’s earnings nearly halved to $1.03 per share in the third quarter that ended October 2022, due to a double-digit drop in sales to $10.31 billion. The earnings report is expected to be released on November 22, before regular trading begins. It is worth noting that the management had lowered its full-year guidance a couple of times, signaling weak sales during the holiday season, and cautioned that the slowdown would persist in 2023.

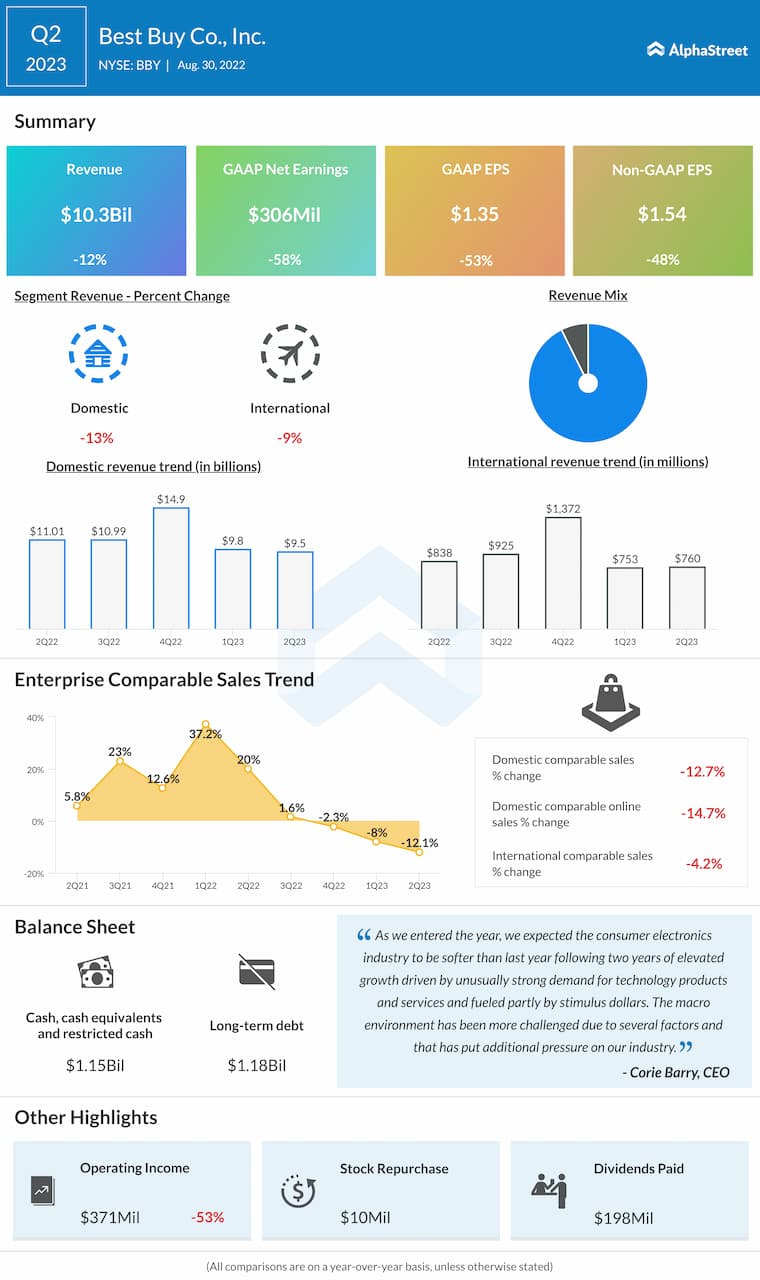

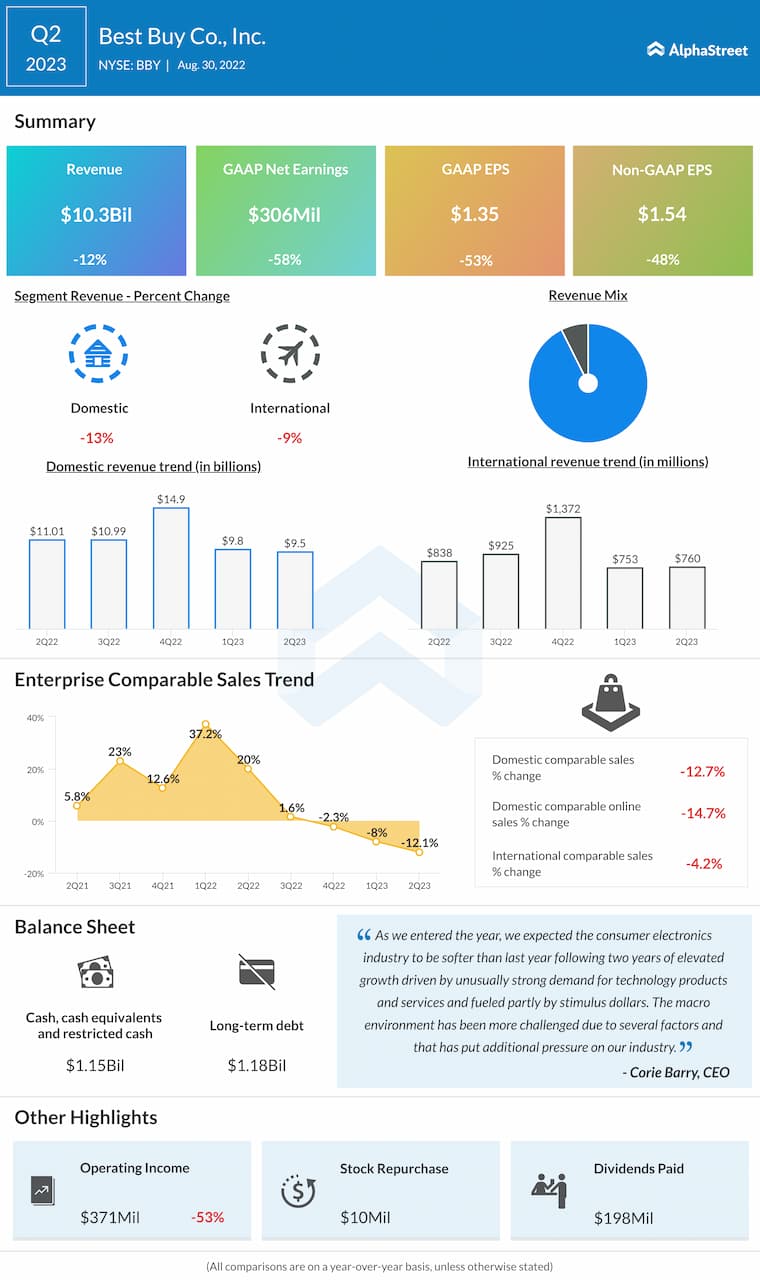

Key Numbers

There has been a steady decline in Best Buy’s profit for more than a year, hurt by a dip in sales during that period. In the most recent quarter, which ended in July 2022, the top line declined 12% from the prior-year period to $10.3 billion. The weak performance translated into a 48% drop in adjusted earnings to $1.54 per share. Comparable sales decreased a dismal 12.1% year-over-year, after registering negative growth in each of the trailing two quarters.

AMZN Earnings: All you need to know about Amazon’s Q3 2022 earnings results

“We continue to invest in our people and our stores, with an eye toward the best possible customer experience, leveraging our unique differentiators. Through all the changes, overarching store NPS is substantially higher than pre-pandemic, including more stores than we have ever seen at what we consider to be best-in-class level. This is entirely due to our amazing store associates’ hard work and dedication to always being there for our customers,” said Best Buy’s CEO Corie Barry in a recent statement.

Best Buy’s stock opened sharply lower on Wednesday, matching the industry-wide selloff that hit most retail stocks in the previous session. BBY has lost 17% in the past six months.