Revenue

Earnings

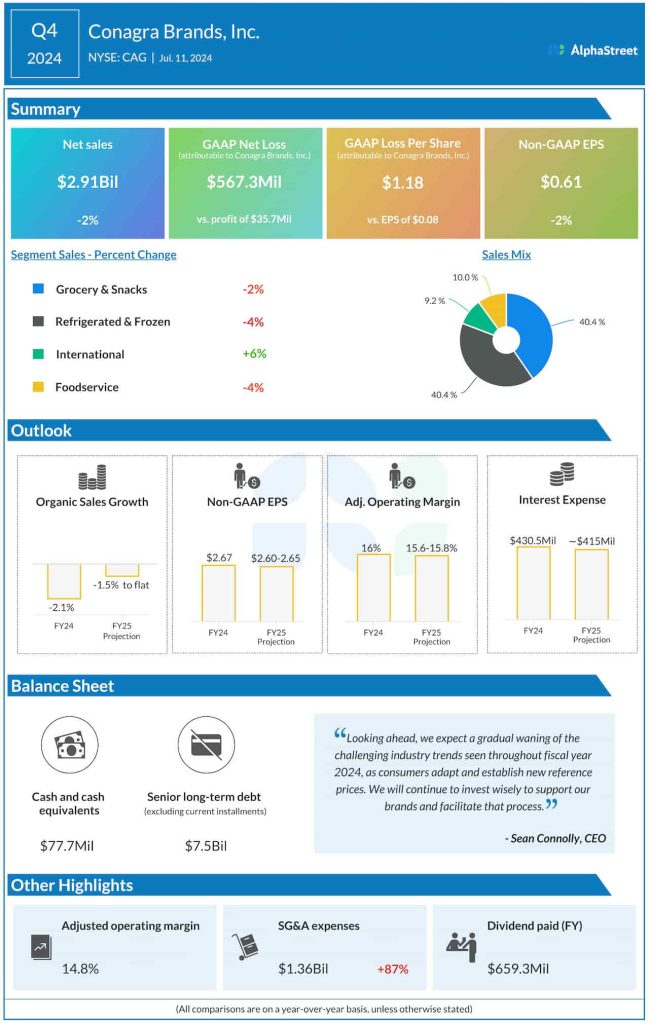

The consensus estimate for Q1 2025 EPS is $0.59. This compares to adjusted EPS of $0.66 reported in Q1 2024. In Q4 2024, adjusted EPS decreased 2% YoY to $0.61.

Points to note

Conagra faced a challenging consumer environment during fiscal year 2024. The company saw organic sales and volumes decrease in the fourth quarter of 2024, driven by lower consumption trends. Although Conagra expects these challenges to continue into fiscal year 2025, it expects them to gradually wane through the year thereby allowing for a normalization in the operating environment.

Last quarter, Conagra saw sales decrease across all its segments, except International. The Grocery & Snacks segment was impacted by volume decreases due to inflation-driven price hikes, and lower consumption trends. The Foodservice segment faced challenges due to softness in restaurant traffic.

However, volume consumption trends are picking up in categories like snacks and frozen. The company has been seeing volumes rise in frozen single-serve meals and frozen vegetables. It is also seeing strong momentum in snacks. The frozen category is benefiting from at-home meal consumption trends.

Conagra expects its brand-building investments to help drive volume growth in FY2025. It expects adjusted gross margins to remain stable despite these investments. The company expects Q1 2025 to see the lowest volume, top line, and adjusted gross margin of any quarter, as it will be impacted by continued brand-building investments. It anticipates volumes to improve sequentially each quarter after Q1.