Q4 Report on Tap

After hitting an all-time high in May, Deere’s stock has dropped around 10%. The average stock price for the past twelve months is $476.67. Recently, the stock rebounded and has maintained the momentum ahead of next week’s earnings.

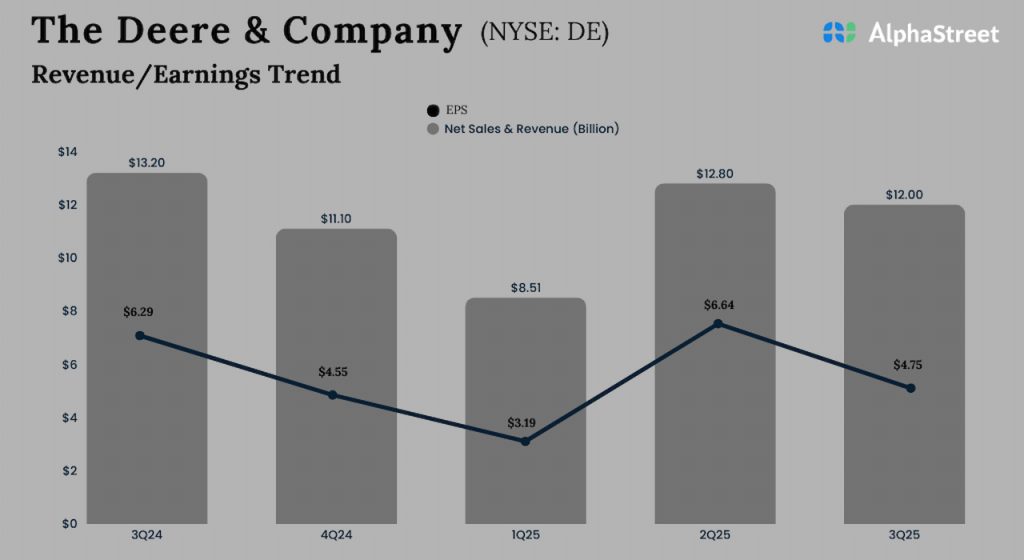

Weak Q3

In the third quarter, net income declined to $1.29 billion or $4.75 per share from $1.73 billion or $6.29 per share in the corresponding quarter of FY24. The weak bottom-line performance reflects a 9% decline in Q3 sales to $12.01 billion. Both sales and profit exceeded Wall Street’s expectations, continuing the long-term trend of outperformance. The management said it expects net income for fiscal 2025 to be in the range of $4.75 billion to $5.25 billion.

From Deere & Company’s Q3 2025 Earnings Call:

“After a slow start to the year, turf and compact utility tractor shipments in North America were better than expected, reflecting improvement in consumer confidence and favorable weather conditions. Year-over-year retail sales also increased for both tractors in Europe and Earthmoving and Forestry equipment in North America, reversing several quarters of flat or declining sales. Amidst this backdrop, Deere’s performance continues to demonstrate strong financial results.”

Strategy

As part of its efforts to empower customers, Deere is using advanced technologies such as See & Spray and Harvest Settings Automation in its products, thereby significantly reducing input costs and boosting efficiency for users. Meanwhile, the management has cautioned of a $600 million pre-tax impact from new import tariffs in the current fiscal year. It has incurred around $300 million in tariff expenses in the first nine months of the year.

On Wednesday, the stock opened at $474.36 and traded slightly higher throughout the session. DE has gained 3.6% in the past 30 days, signaling a recovery from the downturn it experienced earlier.