Revenue

Earnings

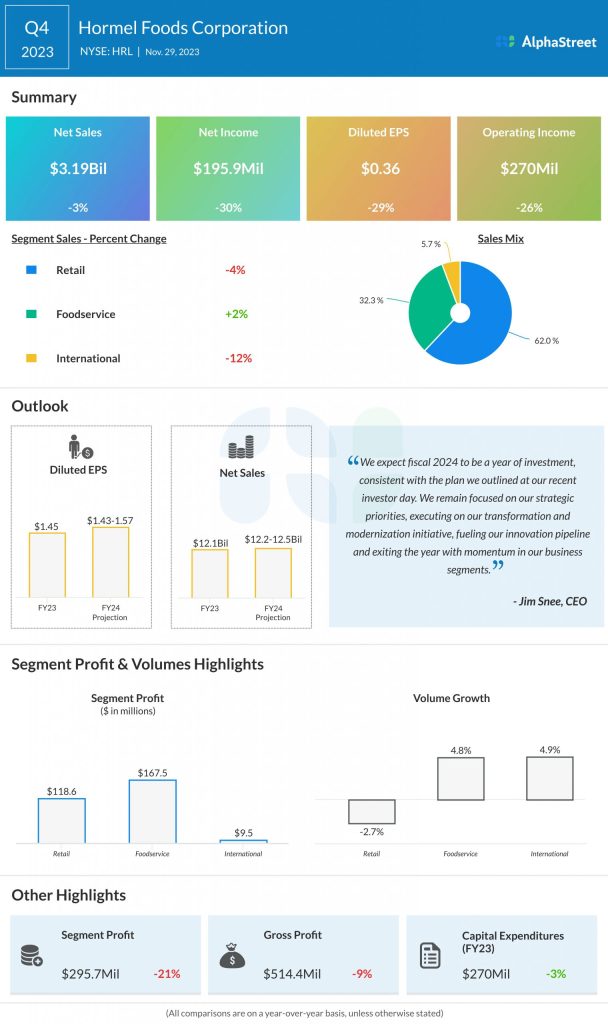

The consensus estimate for EPS in Q1 2024 is $0.34, which compares to EPS of $0.40 reported in Q1 2023. In Q4 2023, adjusted EPS amounted to $0.42.

Points to note

Hormel faced a challenging year in 2023, with pressure in its Retail and International businesses offsetting momentum in the Foodservice segment. The company has been navigating an environment with challenges like slowing consumer demand, inflationary pressures, and headwinds in the turkey business.

In fiscal year 2024, Hormel expects its Foodservice business to see continued growth. It expects to gain traction in key categories such as bacon, pepperoni, prepared proteins, and turkey. This bodes well for the first quarter.

The Retail business is anticipated to see sales growth in categories like bacon, convenient meals and proteins, and snacking, in the coming fiscal year and this could benefit the first quarter as well.

Last year, the company’s International business was impacted by softness in China, weak commodity markets, and higher-than-expected elasticities on its branded export business. Hormel expects these challenges to persist in the first quarter of 2024, with a steady recovery anticipated from the second quarter.

With regards to the bottom line, Hormel expects the impacts from lower turkey markets, lower retail volumes, and softness in China to cause a drop in earnings during the first half of 2024, with the pressures most pronounced in Q1.